Cardano (ADA) has bucked the general market trend with an 11% price surge over the past week. Amid rising prices, transactions involving the altcoin have become profitable, prompting long-term holders to sell some of their coins.

Although profit-taking activity is underway, the 11th altcoin by market capitalization seeks to maintain its uptrend.

Cardano Long Holders Lock in Gains

Transactions involving Cardano have returned significant profits over the past week, driven by a double-digit price rally despite broader market downturns.

On Thursday alone, the ratio of daily on-chain transactions in profit to loss has reached 1.53. This indicates that for every ADA transaction resulting in a loss, 1.53 transactions have generated profits.

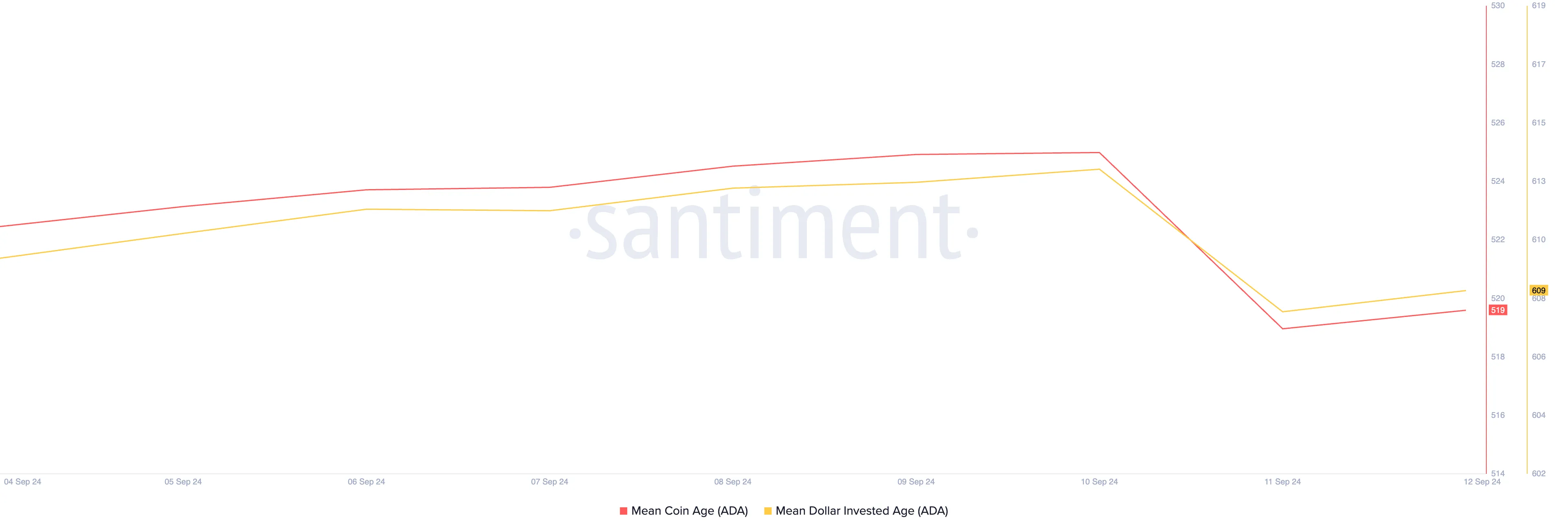

This has prompted ADA’s long-term holders to sell some of their coins for profit, as evidenced by the slight decline in Cardano’s Mean Coin Age and Mean Dollar Invested Age.

According to Santiment, these metrics tracking the behavior of long-term holders saw a decline on September 11. A drop in suggests that long-term holders, who typically buy at lower prices, are selling to take profits. This selling reduces the average age of the coins in their possession.

ADA Price Prediction: A Break Above Resistance Is Key

Although profit-taking activity is underway, Cardano price is poised to extend its gains. The coin is attempting to break above the descending trend line, which it has been trading under since July 15.

This bearish line emerges when an asset faces significant selling pressure and struggles to break above a price level, which forms strong resistance. With strong demand backing its price rally, ADA’s attempt to break above this resistance line might be successful.

If Cardano’s price breaks above the trend line, its value may surge by another 34% to trade at a two-month high of $0.47.

Read more: How To Stake Cardano (ADA)

However, if profit-taking intensifies and buying pressure weakens in comparison, the attempt to break above the resistance level will likely fail. Cardano’s price could drop to $0.27 in this scenario, invalidating the bullish outlook above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-long-term-holders-offload-coins/

2024-09-12 15:01:08