LINK, the native token of the leading decentralized oracle network Chainlink, has noted a 5% price surge over the past 24 hours. It currently trades at $11.76, with a 2% hike in trading volume during that period.

On-chain, the altcoin shows signs of renewed bullish momentum, suggesting a potential double-digit rally in the near term. This analysis explores why this is bound to happen.

Chainlink Witnesses Increased Demand

LINK’s Exchange Netflow is the first indicator worthy of note here. The altcoin has recorded consistent negative exchange netflows over the past 30 days. On Thursday, the trading session ended with 667,290 LINK tokens taken out of cryptocurrency exchanges.

An asset’s Exchange Netflow measures the net amount of its tokens flowing into or out of exchanges. Negative netflows occur when more tokens are leaving exchanges than entering them, suggesting that holders are moving their holdings off exchanges.

Such a trend typically signals accumulation by holders. When holders withdraw assets from exchanges, they often transfer them to cold storage or private wallets for long-term holding. This is a bullish signal for the market as it reduces the token’s availability for short-term trading, improving its price action.

Read more: How to Buy Chainlink (LINK) With a Credit Card: A Step-By-Step Guide

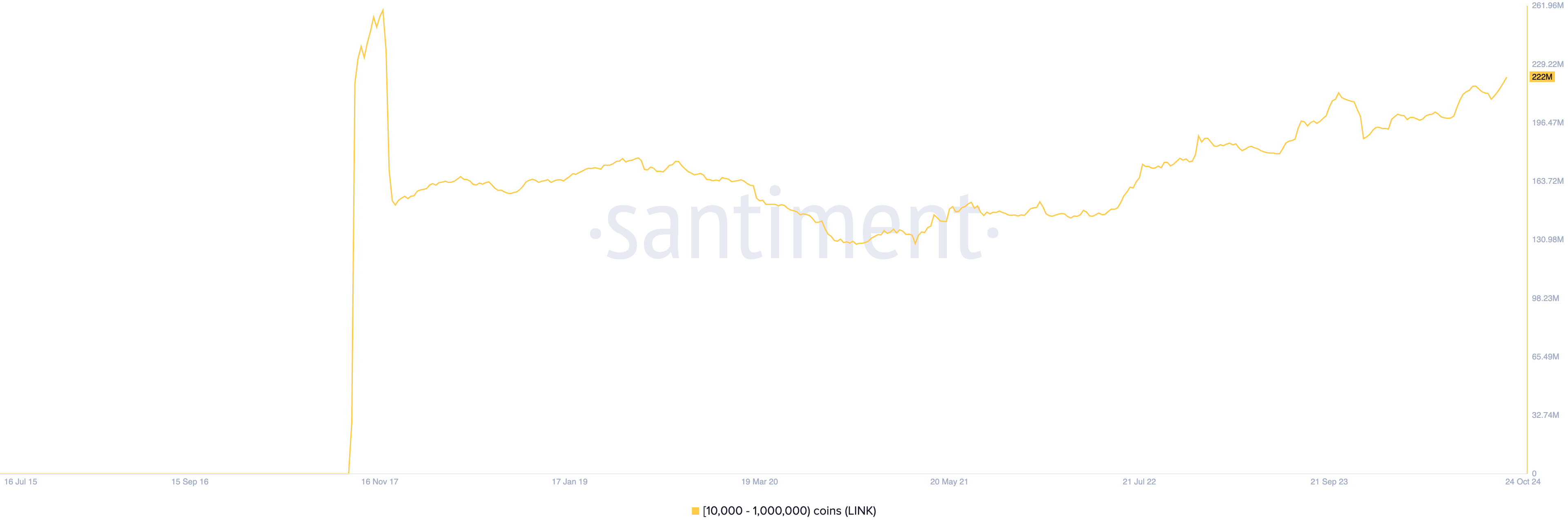

Furthermore, Chainlink’s large investors or whale addresses have increased their holdings, supporting the bullish outlook. According to BeInCrypto’s analysis of LINK’s supply distribution, whale addresses holding between 10,000 and 1,000,000 LINK have accumulated 11 million tokens in just 30 days — an investment exceeding $130 million at current market prices.

This group of holders now collectively holds 221 million LINK tokens, marking their highest balance since December 2017. The uptick in whale accumulation is a bullish signal because it reduces LINK’s available supply, signals confidence, and can also prompt retail investors to buy, all of which can contribute to a price increase.

LINK Price Prediction: Uptrend is Certain If Demand Remains

LINK is trading at $11.76, having rebounded from support at $11.24. Growing demand for the altcoin, highlighted by an increasing Relative Strength Index (RSI), is pushing it toward resistance at $13.73.

The RSI, now at 55 and climbing, indicates that buying interest is outweighing selling pressure, signaling bullish momentum. A successful breakout above this resistance could set LINK on a path to a target of $15.47.

However, should demand weaken and LINK fails to beat resistance, it may trend downward to retest support at $11.24. If this level does not hold, Chainlink’s price could fall further to $9.98.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/chainlink-price-extended-gains/

2024-10-25 20:30:00