Dogecoin (DOGE) has been riding an impressive uptrend over the past month, with its price climbing from $0.108 to $0.209.

This surge has put Dogecoin close to reaching a seven-month high. However, despite this bullish momentum, DOGE may face challenges in surpassing key resistance levels.

Dogecoin Investors’ Intentions Are Bleak

Analyzing market sentiment through active address profitability reveals that approximately 40% of Dogecoin participants are currently in profit. Historically, when a substantial portion of network participants hold profitable positions, they are more likely to sell. This profit-taking tendency can introduce downward pressure on DOGE’s price, especially as the percentage of profitable holders surpasses the 25% threshold, which is typically seen as a bearish indicator.

The elevated level of profitable addresses suggests caution for investors looking for further gains. If a significant number of holders choose to cash out, it could hamper Dogecoin’s upward trajectory, adding selling pressure that might prevent DOGE from achieving its next price milestone.

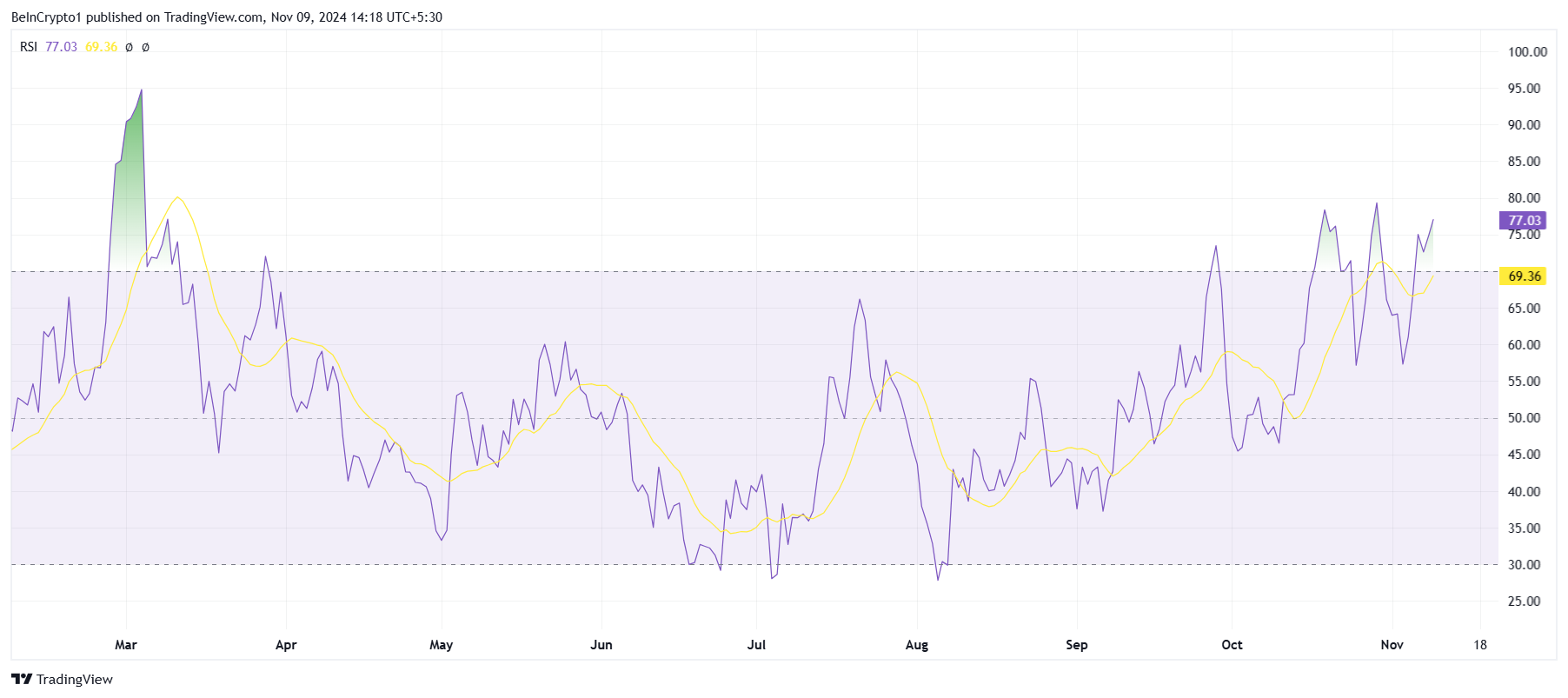

Dogecoin’s macro momentum, as reflected by the Relative Strength Index (RSI), indicates that the asset has been hovering in the overbought zone above 70.0. While this signals strong buying interest, prolonged stays in the overbought zone can sometimes lead to corrections. Although there is currently no immediate threat of reversal, Dogecoin’s RSI level suggests that caution may be warranted.

In the past, Dogecoin has occasionally sustained overbought levels without facing immediate downturns. However, the possibility of a correction remains if buying interest wanes or if sellers begin to capitalize on recent gains.

DOGE Price Prediction: Fighting the Odds

Dogecoin’s price has been up by 8.5% over the past 24 hours, trading at $0.209. If DOGE can breach the critical resistance level of $0.220, it would mark a new seven-month high, reinforcing its strong position in the crypto market. A break past this level would signal renewed bullish strength.

However, given the potential bearish cues from profit-taking and elevated RSI levels, Dogecoin may struggle to hold on to its recent gains. Failing to surpass $0.220 could result in DOGE losing the $0.200 support level, leading to a potential pullback to $0.176. This support loss could shift market sentiment towards caution.

If Dogecoin manages to sustain its current bullish momentum, it could break through the $0.220 resistance, paving the way for a rise toward $0.300. This move would invalidate any bearish outlook, enabling further gains as DOGE capitalizes on its current uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/dogecoin-price-rally-at-risk/

2024-11-09 11:30:00