Telegram-linked Toncoin (TON) has seen a slight 1% increase in price over the past week. However, this merely mirrors the broader market uptrend, as it has yet to enjoy a significant demand from its whales or retail investors.

The altcoin risks falling by double digits in the near term if demand remains low. This analysis explains why.

Toncoin Investors Stay Away

Toncoin’s market value to realized value (MVRV) ratio, which measures the overall profitability of all its holders, shows that the altcoin has been undervalued in recent weeks. As of this writing, the token’s 30-day and 90-day MVRV ratios are -0.26% and -5.38%, respectively.

Negative MVRV ratios historically represent a buying signal. They signal that the asset is being traded below its historical acquisition cost and may be due for a rebound. However, this has not been enough motivation for Toncoin investors to accumulate the token.

Read more: What Are Telegram Bot Coins?

Over the past week, Toncoin’s large holders’ netflow has plummeted by 115% despite a 1% uptick in its price. Large holders, or addresses holding over 0.1% of an asset’s circulating supply, are critical indicators of market trends. Their netflow, the difference between what they buy and sell over a set period, can offer insight into market sentiment.

When an asset’s large holder netflow declines, it indicates that whales are offloading their holdings — a bearish signal that suggests selling pressure and the potential for a price drop.

Toncoin’s short-term holders (STHs) have also reduced their holding time, amplifying the risk of a downturn. According to IntoTheBlock, their holding period has decreased by 7% over the last month.

STHs, who typically hold assets for less than 30 days, may sell when seeking to lock in profits or avoid losses from a predicted price drop. A reduction in STH holdings often signals decreased demand, adding further downward pressure on the asset’s price.

TON Price Prediction: Double-Digit Price Decline Imminent

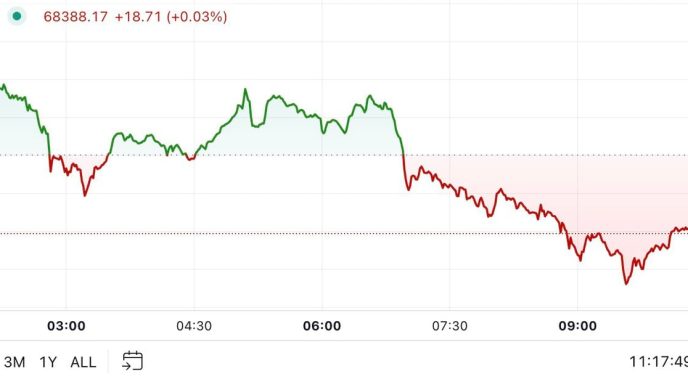

Currently, Toncoin is trading at $5.33, just shy of the $5.35 resistance level. If its whales and STHs continue reducing their positions, a breakout above this resistance will likely be out of reach.

Failure to surpass this level could trigger a 17% drop, bringing Toncoin’s price down to $4.44, a price last seen on September 6.

Read more: 6 Best Toncoin (TON) Wallets in 2024

On the other hand, if market sentiment improves and demand for Toncoin rises, it could break through the $5.35 resistance and rally toward $6.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/toncoin-price-faces-decline/

2024-10-21 11:30:00