Toncoin (TON) holders are seeing their investments pay off. The supply of coins held at a profit has reached a new weekly high, following a decline to a seven-month low.

This surge in profitability comes just a week after Telegram CEO Pavel Durov broke his silence regarding his arrest in France.

Toncoin Supply in Profit Skyrockets

Following Pavel Durov’s public condemnation of his arrest on September 5, market sentiment has shifted positively towards Toncoin. The value of the Telegram-linked asset has surged by 15% over the past seven days, bucking the general market downtrend.

As Toncoin’s price climbs, the percentage of its total supply held in profit has also surged. At press time, it sits at a seven-day high of 53%.

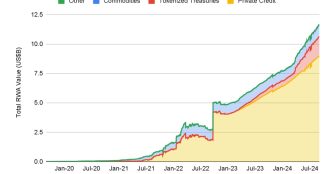

According to Santiment’s data, Toncoin’s supply in profit hit a seven-month low on September 8. However, following Pavel Durov’s statement, trading activity surged, increasing the number of TON coins held in profit to 6.13 million. A spike in an asset’s supply in profit indicates that a significant portion of its circulating supply is now valued higher than when it was originally acquired.

This rise in profit has led to a shift in strategy among TON’s short-term holders. Data from IntoTheBlock reveals that many addresses that purchased the coin in the past month are now holding onto it, resisting the urge to sell.

Read more: 6 Best Toncoin (TON) Wallets in 2024

This is a bullish signal because short-term holders, often known as “paper hands,” typically sell their coins at the first sign of trouble. However, this group of TON holders has held onto their coins, indicating their intention to benefit from the ongoing price rally.

TON Price Prediction: Coin Seeks More Gains

TON’s technical setup confirms that the altcoin is poised to extend its gains. For example, the Moving Average Convergence/Divergence (MACD) indicator — which tracks trend direction, shifts, and potential price reversal points — confirms the growing demand for the altcoin. At press time, TON’s MACD line (blue) rests above its signal line (orange) and is making its way toward the zero line.

When an asset’s MACD line rises above the signal line, short-term momentum is stronger than long-term momentum. A cross above the zero line further confirms the uptrend, reinforcing the likelihood of a continued rally. If TON maintains this uptrend, it will target resistance at $6.8.

Read more: Which Are the Best Altcoins To Invest in September 2024?

However, a spike in profit-taking activity may invalidate this bullish projection. If selling pressure gains momentum, it will pull Toncoin’s price to $4.46.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/toncoin-holders-record-gains/

2024-09-13 10:32:06