Ethereum (ETH) co-founder Vitalik Buterin has sparked curiosity among community members by promoting the largest altcoin by market cap.

Known for his philosophical insights, the Russo-Canadian innovator recently noted that his followers have been asking him to cut back on the “philosophizing” and do more “Ethereum bull posting.”

ETH Fundamentals ‘Crazy Strong’ — Vitalik Buterin

After publishing his blog titled “Plurality philosophy in an incredibly oversized nutshell,” Buterin mentioned that many of his followers want “less philosophizing and more Ethereum bull posting.” This change in tone sparked speculation, with one user jokingly suggesting Buterin had sold his X (formerly Twitter) account. They noted the difference in his usual content style.

“Vitalik 100% sold their account comparing their early posts to their posts now completely different in almost every way, the language, the nomenclature, the phrasing, practically everything. People don’t change that radically that quickly, regardless of personal situation,” one user expressed.

In a recent development, Vitalik Buterin strongly defended Ethereum after a user questioned its strength in the current market cycle. The critic argued that Layer-1s and Layer-2s are nearing bankruptcy, with investors losing up to 80% of their value.

“Hey Vitalik, Ethereum has weakened a lot in this cycle, layer-1 and layer-2 projects in the ecosystem are almost going bankrupt, and investors have already lost up to 80%, what will happen?” the trader wrote.

Read more: How to Invest in Ethereum ETFs?

Challenging the bearish outlook, Buterin stated that “Ethereum has gotten stronger.” He highlighted key factors such as transaction fees on Layer-2 solutions dropping to less than $0.01 and pointed to Arbitrum and Optimism as Ethereum Virtual Machines (EVMs) now in Stage 1. Buterin further said that the “fundamentals for Ethereum are crazy strong right now.”

While Buterin highlights Ethereum’s strong fundamentals, Ignas, co-founder of DeFi studio Pink Brains, argues that it’s easy to be bearish on ETH. He cites Ethereum’s underperformance relative to Solana (SOL) and Bitcoin (BTC), noting that bearish sentiment is widespread.

However, Ignas remains optimistic, suggesting that Ethereum’s upcoming Pectra Upgrade could act as a bullish catalyst. This upgrade might renew investor confidence and shift market sentiment in favor of ETH.

Ethereum Plans Changes With Pectra Upgrade

The Ethereum blockchain has scheduled the Pectra Upgrade for the first quarter of 2025. This hard fork combines the Prague and Electra upgrades, aimed at enhancing the execution and consensus layers of the network, respectively.

Key features of the Pectra Upgrade include an increased staking limit, PeerDAS/rollup improvements, and enhancements to the EVM. Ethereum developers chose to delay the upgrade’s release until after Devcon in November 2024, prioritizing thorough testing and monitoring based on lessons learned from previous upgrades.

Although Pectra is considered a relatively minor update, Ethereum Foundation protocol support lead Tim Beiko and Vitalik Buterin have also highlighted the upcoming Verkle tree development, another significant upgrade planned for 2025.

“I’m looking forward to Verkle trees. They will enable stateless validator clients, which can allow staking nodes to run with near-zero hard disk space and sync nearly instantly – far better solo staking UX. Also good for user-facing light clients,” Buterin shared.

The Pectra Upgrade follows Ethereum’s Dencun hard fork, which occurred in March 2024. Dencun, which combined Deneb and Cancun upgrades, was intended to lower transaction fees for L2 solutions while improving Ethereum scalability.

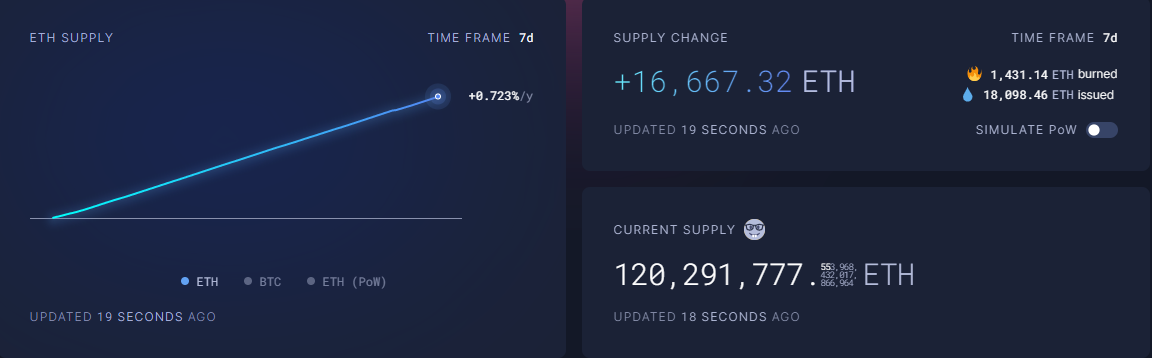

While Ethereum’s upcoming upgrades are generating optimism, the network’s deflationary status has been fading since the Dencun Upgrade. According to recent data, Ethereum has experienced a notable increase in ETH supply since mid-April, leading to concerns about its inflationary trend. Despite initial expectations for Ethereum to maintain its deflationary stance following its shift to Proof-of-Stake (PoS), it is now experiencing its longest inflationary period since the transition.

The current inflation rate is around 0.72% per year, according to ultrasound.money. This means that Ethereum is now issuing more units than it is burning, weakening the “ultra-sound money” narrative that has been a key selling point for the network.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

While the upgrade successfully lowered transaction fees, it inadvertently decreased the total amount of ETH burned on the mainnet. This reduction has resulted in a slower burn rate, pushing Ethereum back into inflationary territory.

“Due to the decrease in on-chain activity, ETH Gas has been below 2 Gwei for a long time since early April this year. In the past four and a half months, the total amount of ETH has increased from 120,063,605 to 120,291,622, and inflation has increased by 228,000. Based on this, the annual inflation will be 600k, with an inflation rate of 0.5%,” blockchain sleuth EmberCN wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/vitalik-buterin-ethereum-gets-stronger/

2024-08-22 16:00:00