Toncoin’s (TON) price recently failed to breach the crucial resistance level of $6.00, a key psychological barrier. Although the altcoin reached $5.96, it could not sustain the momentum needed to flip this level into support.

Despite this setback, the possibility of recovery remains, with Toncoin still holding the potential for upward movement.

Toncoin Has a Chance

The macro momentum for Toncoin has started to show signs of weakness. Moving Average Convergence Divergence (MACD) indicator, widely used to gauge momentum, suggests that bullish momentum is dissipating. The receding green bars on the histogram point to this loss of momentum, indicating a weakening bullish trend.

However, this does not signal a complete reversal. As long as the MACD stays above the neutral line, there’s no definitive sign of bearishness. A drop below the neutral zone would confirm a bearish shift, but for now, Toncoin remains in a vulnerable yet undecided state.

Read more: What Are Telegram Bot Coins?

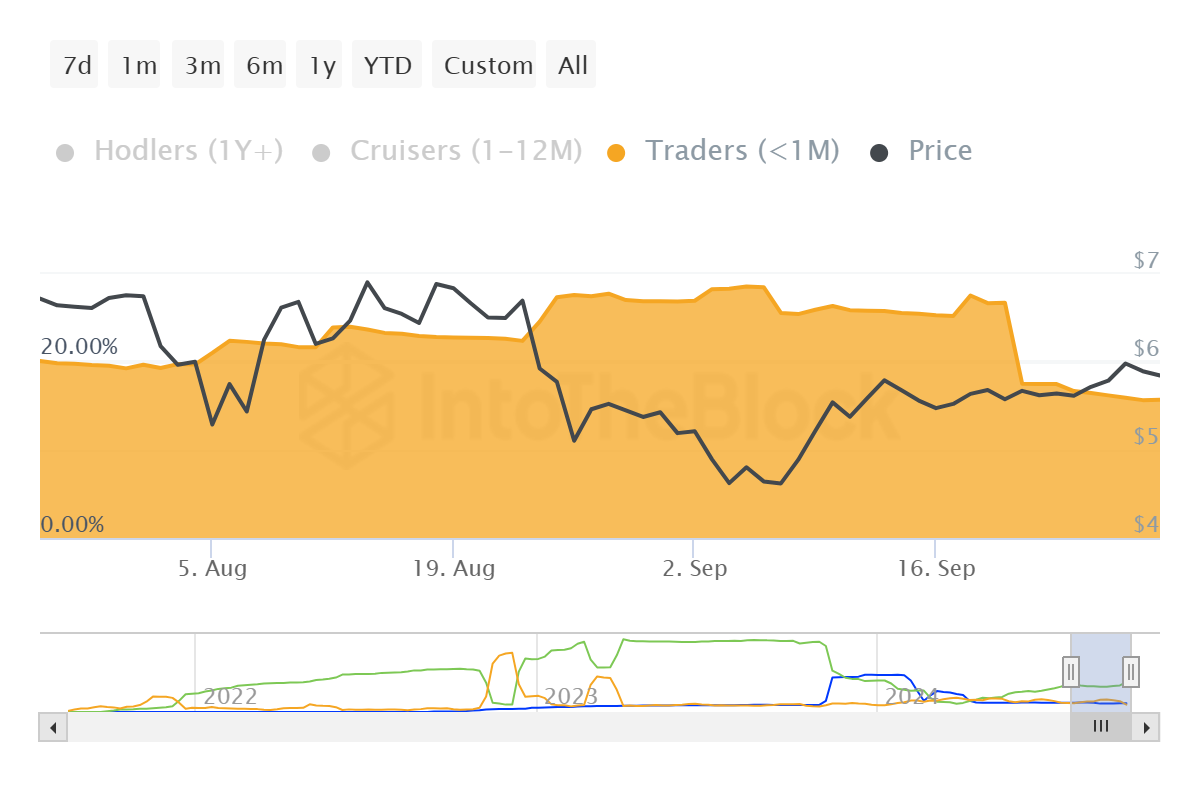

Nevertheless, Toncoin’s market sentiment has improved, particularly with the decline in short-term investors’ domination. These investors, typically holding assets for less than a month, are prone to selling quickly, often adding volatility to the price. Over the last ten days, the share of such investors has dropped from 26% to 15%, a considerable 11% decline.

This shift is crucial, as values above 25% usually signal potential bearish pressure. With fewer short-term holders, the risk of a sharp sell-off decreases, stabilizing Toncoin’s price and reducing the likelihood of immediate bearishness.

TON Price Prediction: Barrier Ahead

Toncoin is currently trading at $5.81, having recently failed to breach the resistance at $5.96. This resistance is pivotal for the cryptocurrency, as breaking past it would pave the way for an attempt to cross the $6.00 mark, a level that remains elusive.

Despite the failed breach, Toncoin still has a chance at flipping $5.96 into support. If successful, this could trigger a rally that would push the altcoin higher, with $6.36 being the next target for bullish investors.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, if Toncoin fails to break $5.96 again and bullish momentum continues to wane, the asset may enter a consolidation phase. This could result in Toncoin trading between $5.37 and $5.96, potentially invalidating the current bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/toncoin-price-rise-delayed-not-stopped/

2024-09-30 07:40:50