Toncoin (TON) price has been on a four-month downtrend, showing no sign of reversal as it struggles to hold above $5.0. Recent price action has underscored the ongoing weakness, raising concerns among investors.

Despite intermittent rallies, TON has been unable to escape the bearish trajectory that began in June, pushing the price below critical support levels and possibly priming it for further declines.

New Investors Lose Interest in Toncoin

Toncoin’s network growth has seen a significant dip, with adoption hitting an eight-month low. This indicator, which gauges the number of new addresses created, is vital in assessing whether a cryptocurrency is gaining or losing market interest. The current decline implies that fewer new investors and users are joining the TON ecosystem, suggesting diminishing confidence.

When fewer new addresses appear, it generally signals waning adoption, which could contribute to downward price pressure. As long as this trend persists, TON may struggle to find a strong base, leaving its price susceptible to further depreciation.

Read more: What Are Telegram Bot Coins?

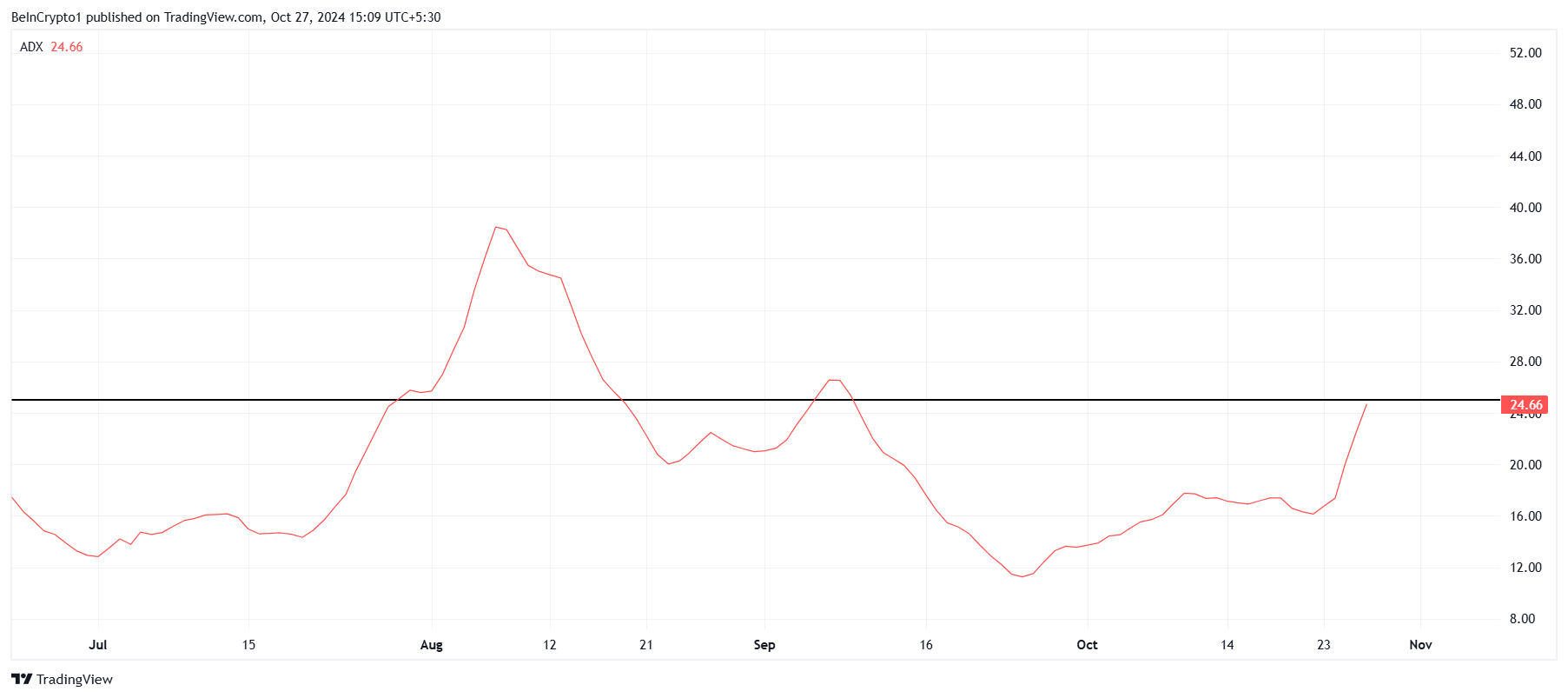

Analyzing the macro trend reveals that Toncoin’s overall momentum remains bearish. The Average Directional Index (ADX) currently sits just below the 25.0 mark, a critical threshold that indicates trend strength. If the ADX breaches above 25.0, it signals a strengthening active trend. For Toncoin, this would mean intensifying bearish momentum.

The ADX has yet to confirm an uptick, but if it does, the active downtrend could accelerate. A strong ADX reading over 25.0 would indicate that the ongoing sell-off might deepen, potentially pushing Toncoin’s price to new lows. As a result, unless a reversal is triggered, the cryptocurrency may continue to face bearish pressures in the short term.

TON Price Prediction: Steady Downtrend

Toncoin’s price fell approximately 11% this past week as it battles to recover from its latest lows. Despite attempts to break free from its current downtrend, TON has been unable to establish a lasting upward momentum. The ongoing macro downtrend, lasting four months, has made it challenging for the cryptocurrency to regain lost ground.

Attempts to breach the downtrend line have so far been unsuccessful, raising concerns about TON’s sustainability at current levels. With the price already below $5.0, a continued decline could push Toncoin down to around $4.6 or even lower if selling pressure persists.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, a reversal is possible if Toncoin can break above the downtrend line in the coming weeks. For this bullish scenario to unfold, TON would need to push through the $5.3 resistance and establish it as new support. Achieving this would invalidate the current bearish thesis, potentially sparking a sustained recovery and attracting fresh buying interest.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/toncoin-price-decline-could-worsen/

2024-10-27 13:30:00