Toncoin (TON) price is up more than 7% in the last 24 hours, showing signs of recovery as it approaches a $16 billion market cap. After touching oversold levels with an RSI as low as 18, TON has rebounded to 47, suggesting potential for continued growth.

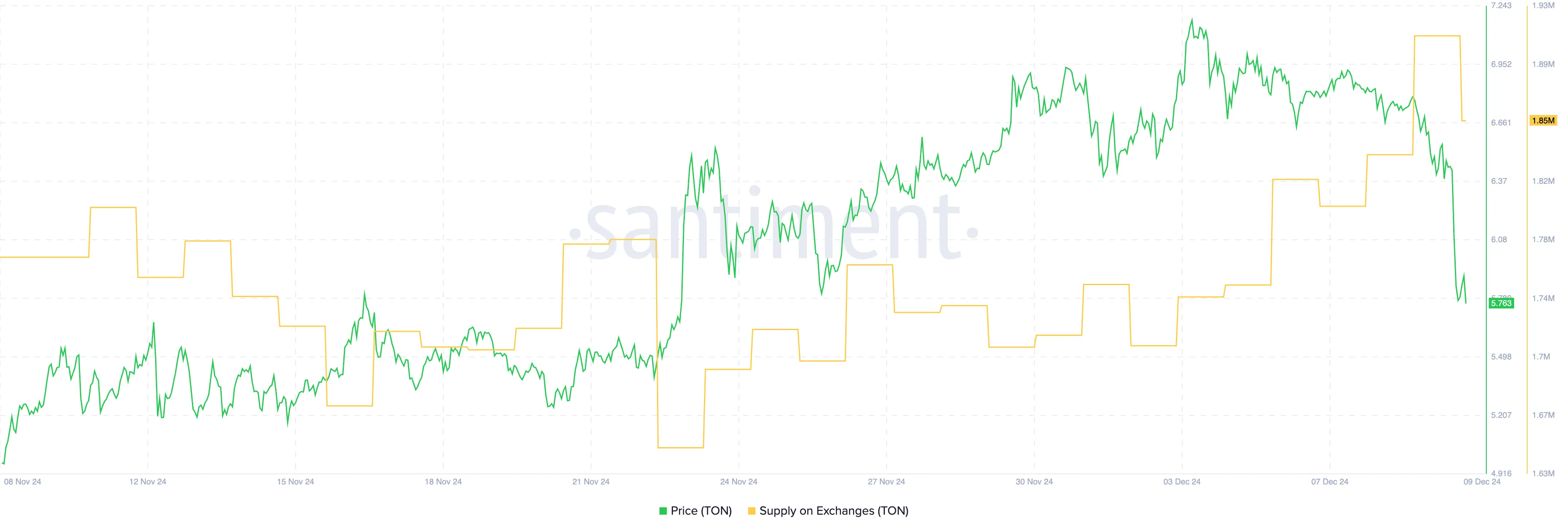

Additionally, TON’s supply on exchanges decreased from 1.91 million to 1.85 million on the last day, signaling reduced selling pressure. While EMA lines recently formed a death cross, short-term indicators hint at a possible reversal if momentum sustains, positioning TON to test key resistance levels near $6.3 and beyond.

TON RSI Recovered From The Oversold Zone

Toncoin Relative Strength Index (RSI) has recovered significantly, currently sitting at 47 after dropping as low as 18 between December 9 and December 10. This move marks a recovery from extreme oversold conditions, which often precede a rebound in price.

TON price is up more than 7% in the last 24 hours, reflecting renewed buying interest as the RSI approaches the neutral zone. This upward momentum suggests that TON’s price could continue rising, provided buying pressure sustains.

The RSI is a momentum oscillator that ranges from 0 to 100, measuring the speed and magnitude of price movements. Readings below 30 indicate oversold conditions, signaling potential for a reversal, while readings above 70 suggest overbought conditions and the likelihood of a pullback.

With TON’s RSI now at 47, it has exited the oversold zone and moved closer to neutral territory. This level suggests that the current rally could have more room to grow, as TON still has space before hitting overbought levels.

Toncoin Supply On Exchanges Decreased to 1.85 Million

Toncoin supply on exchanges has been steadily increasing since December 3, when it stood at 1.71 million, now sitting at 1.85 million. This trend suggests growing selling pressure as more tokens move to exchanges, typically a bearish signal indicating that holders might be preparing to sell.

However, in the last 24 hours, TON’s supply on exchanges has decreased from 1.91 million to 1.85 million, signaling a potential shift in sentiment. This decline could indicate that users are withdrawing tokens from exchanges, possibly for long-term holding or staking.

The movement of a coin’s supply on and off exchanges is a key indicator of market sentiment. An increasing supply on exchanges often precedes selling activity, exerting downward pressure on the price. Conversely, a declining supply on exchanges suggests users are moving coins to private wallets, which can reduce immediate selling pressure and support bullish momentum.

Although the recent drop in TON supply in exchanges is promising, it’s essential to monitor whether this trend continues, as sustained decreases could indicate stronger confidence in the coin’s price recovery.

TON Price Prediction: Can It Break Into $7 Again In December?

Toncoin Exponential Moving Average (EMA) lines formed a death cross yesterday, with short-term EMAs crossing below long-term EMAs, signaling a bearish trend.

Despite this, TON’s price has since shown signs of recovery, with short-term EMAs beginning to turn upward. This suggests that while the bearish signal is present, the possibility of a reversal remains if momentum continues to build, making Toncoin one of the best altcoins to invest in December.

If the downtrend persists, TON price could test support at $5.68. A break below this level might lead to further declines, potentially targeting $5.19. However, as indicated by the RSI, there is still room for growth.

TON could capitalize on this recovery to challenge resistance at $6.3. If it successfully breaks above this level, further targets include $6.6 and $6.99, the latter of which has acted as a strong barrier in recent days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ton-price-eyes-key-resistance/

2024-12-11 23:00:00