In the first week of September, a noticeable decline in trading activity has taken hold, with many market participants opting to stay on the sidelines. This is reflected in a 5% drop in global cryptocurrency market capitalization over the past week.

Meanwhile, large investors, known as crypto whales, are capitalizing on the market dip. This week, they’ve been acquiring altcoins such as Polygon (POL), Ethereum (ETH), and frog-themed meme coin Pepe (PEPE).

Polygon Ecosystem Token (POL)

On September 4, Polygon completed the 1:1 migration of its native token from MATIC to POL. Afterward, the token saw a spike in whale accumulation as the number of wallet addresses holding between 100,000 and 1,000,000 POL skyrocketed by over 90%.

Currently, this group of POL holders comprises 33 addresses and controls 5% of the altcoin’s total circulating supply.

Despite the migration being considered a “sell the news” event, the number of POL whales continues to grow. These large investors have kept accumulating tokens, undeterred by the muted price reaction. As previously reported by BeinCrypto, POL’s value has remained muted since the migration, showing little sign of recovery. At the time of writing, the altcoin is trading at $0.38.

Ethereum (ETH)

Ethereum has faced significant resistance at the $2560 price level this week. However, this has not stopped its large holders’ from accumulating the leading altcoin, as can be gleaned from the 38% uptick in their netflow over the past seven days.

Large holders are whale addresses that hold over 0.1% of an asset’s circulating supply. Their net flow measures the difference between the coins they buy and those they sell over a specific period.

Read more: 9 Best Places To Stake Ethereum in 2024

When the net flow of large holders rises, these whales increase their holdings. This is a bullish signal that may prompt retail investors to do the same, driving up an asset’s value.

If ETH witnesses a surge in market-wide accumulation, it may rally past resistance to trade at $2868.

Pepe (PEPE)

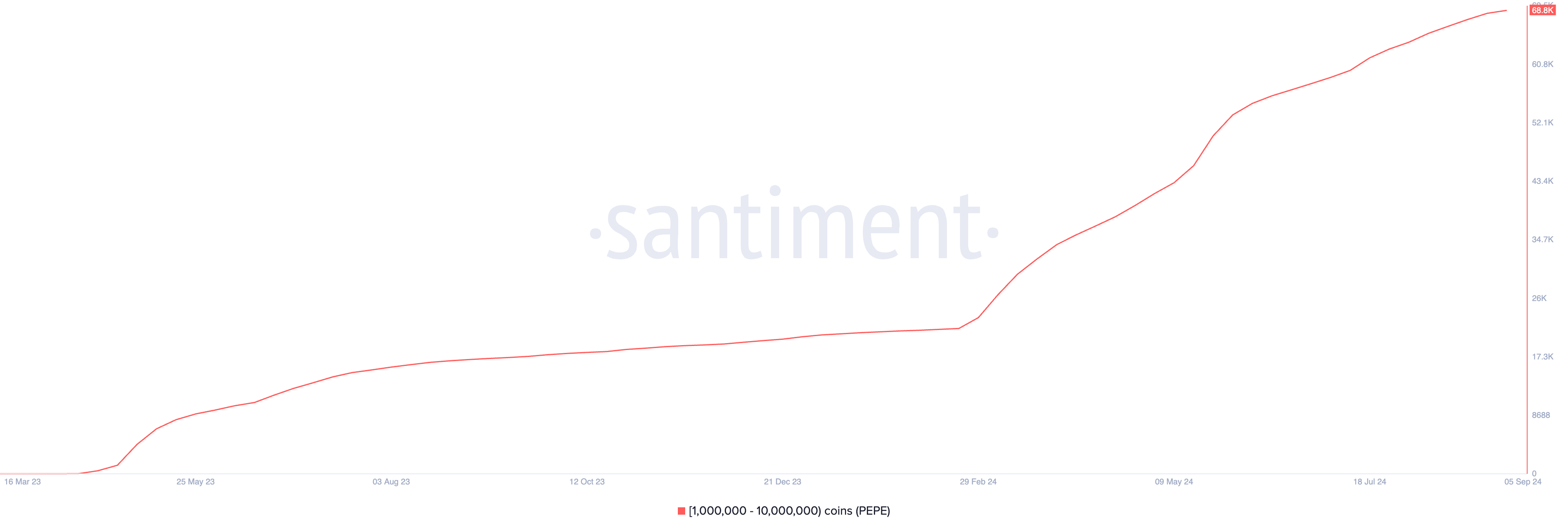

In the past week, demand for the Ethereum-based meme coin PEPE has increased among crypto whales. Data from Santiment shows that the number of addresses holding between 1 million and 10 million PEPE has hit a record high of 69,000.

This is a 1.2% rise over the last seven days, confirming that large investors are buying more PEPE.

These addresses have been encouraged to accumulate the meme coin following a buy signal from its Market Value to Realized Value (MVRV) ratio. This on-chain metric, calculated using a 30-day moving average, stands at -5.67% at the time of writing.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

When an asset’s MVRV ratio is below zero, it indicates the asset is undervalued. In other words, its current price is lower than the average price paid for all tokens in circulation. This often signals a good opportunity for investors aiming to “buy the dip.”

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/crypto-whales-altcoins-first-week-september/

2024-09-07 09:46:55