According to RootData statistics, 111 publicly disclosed crypto VC investment projects took place in August, matching the total from July 2024. This represents a 41% increase compared to August 2023, when 78 projects were recorded.

The total fundraising amount in August reached $785 million, marking a 22% decrease from the $1.01 billion raised in July.

Crypto VC Investments Remain Steady in August

Venture capital activity is a key indicator of major investors’ interest in the crypto market. While the number of publicly disclosed crypto VC projects in August remained unchanged from July, both months now rank as the third-highest for crypto funding rounds in 2024, behind March and May, which saw 190 and 155 rounds, respectively.

Although the total fundraising amount in August dropped by 22% from July’s $1.01 billion, it still represents a 20% increase over the $660 million raised in August 2023.

Read more: Best Investment Apps in 2024

The steady funding volume reflects strong confidence in the crypto sector, even amidst economic uncertainties. Additionally, the distribution of funds across various sectors points to shifting priorities and emerging trends in the industry.

In August, decentralized finance (DeFi) accounted for nearly 25% of total investments, followed by artificial intelligence (AI) at 15%. Tools and wallets saw the smallest share, with only 2.2% of the total.

It is important to note that these figures do not include merger and acquisition deals.

DeFi and AI Take the Spotlight

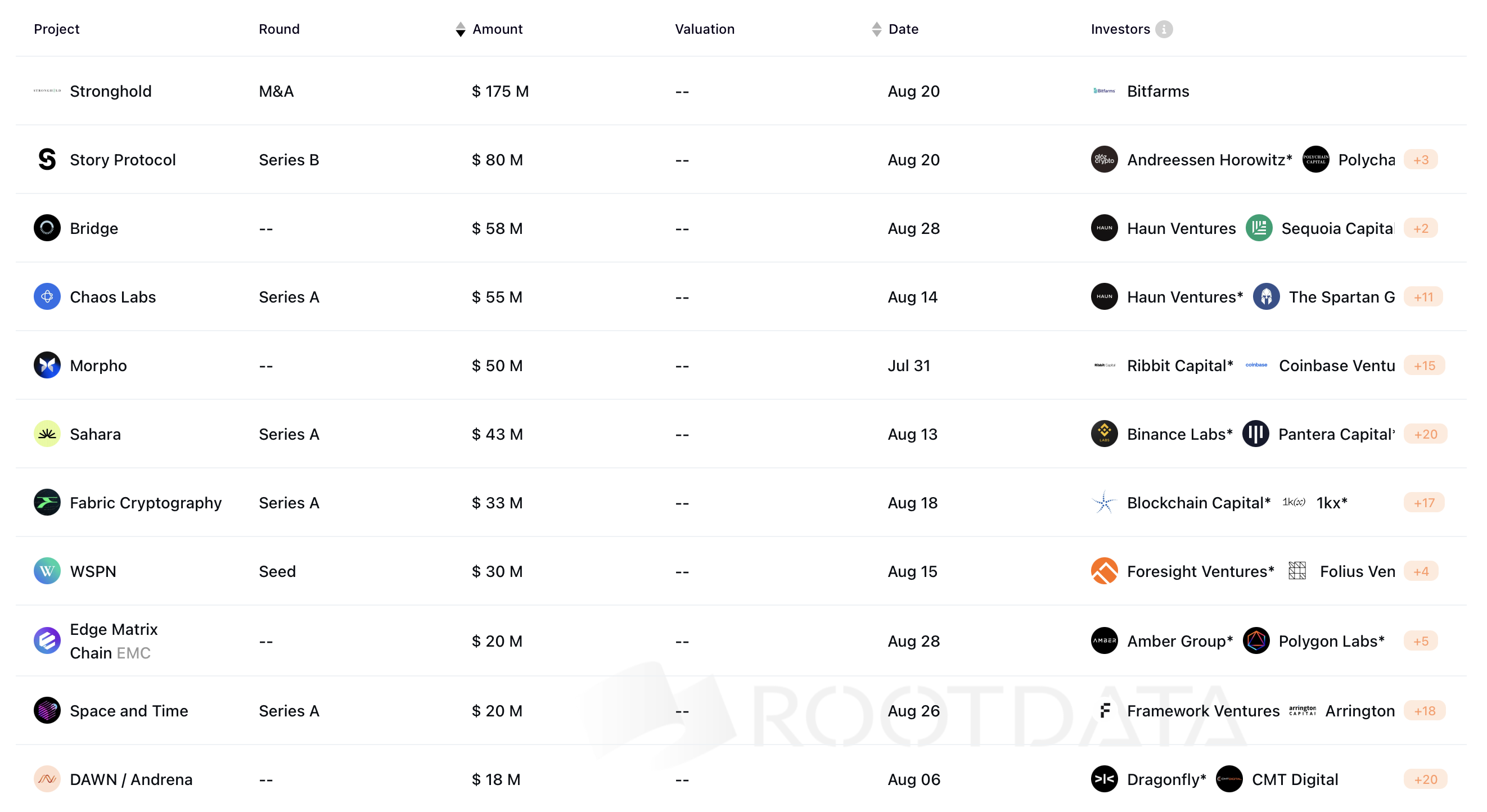

The largest event in August once again involved Bitcoin mining companies: Bitfarms announced its acquisition of competitor Stronghold Digital for $175 million in stock and debt, adding to the recent trend of mining M&As. Bitfarms will exchange 2.52 shares for each Stronghold share, a 71% premium over the 90-day volume-weighted average price of Stronghold on Nasdaq as of August 16.

“After three years of ongoing discussions, I am proud to announce this transformative acquisition. With this transaction, we expect to expand and rebalance our energy portfolio to 950 MW with nearly 50% in the US by the end of 2025 and have visibility on multi-year expansion capacity up to 1.6 GW with approximately 66% in the US, up from approximately 6% today,” Bitfarms CEO Ben Gagnon said.

IP-focused Story Protocol secured $80 million in a Series B funding round led by Andreessen Horowitz, with participation from Polychain and other investors. Founded in 2022, Story has now raised a total of $140 million, with the latest round reportedly valuing the company at $2.25 billion.

Story’s blockchain platform allows intellectual property (IP) owners to store their IP on the network, embedding usage terms—such as licensing fees — into smart contracts. This ensures that owners are compensated whenever their IP is used.

“Big Tech is stealing IP without consent and capturing all the profit. First, they will gobble up your IP for their AI models without any compensation. The current state of AI completely destroys the incentive to create original IP for all of us,” Story co-founder S.Y. Lee stated.

The third-largest funding, totaling $58 million, was secured by Bridge, a stablecoin network founded by former Coinbase and Square executives. Bridge aims to challenge traditional financial systems like Swift and credit card infrastructures by offering a more efficien alternative.

Other notable funding rounds in August included Chaos Labs, which raised $55 million for DeFi risk management, and Morpho, securing $50 million to integrate DeFi into the internet’s infrastructure. Sahara AI raised $43 million to enhance AI sovereignty, while Fabric Cryptography secured $33 million to develop cryptographic hardware.

Read more: Top 12 Crypto Companies to Watch in 2024

One smaller funding round stood out due to the current hype around meme coin launchpads. Parlay Labs, the first multichain, no-code platform for launching meme coins, secured a $2 million round led by DNA.fund. Notable individual investors included Jon Najarian of Market Rebellion and Rick Schlesinger, Co-Founder of EOS New York.

“The focus on meme coins was predicated on current market demand. Parlay wanted to enter the market with a product that creators and users wanted to use, not something that we thought they should use. Currently Parlay offers creation and trading across the EVM spectrum. Plans are to expand across even more chains during this first quarter of launch, and let creators who favor other protocols enjoy the same tool’s currently offered by Parlay on EVM,” Parlay team told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Daria Krasnova

https://beincrypto.com/crypto-investment-august-2024/

2024-09-04 08:45:21