This week is filled with key developments across various crypto ecosystems, including Polygon and Binance, which are expected to impact the market in different ways.

Additionally, a crucial upgrade is scheduled for the Arbitrum Layer-2, alongside a highly anticipated testnet launch on the Fantom network. Traders should be ready to take advantage of the potential market volatility these events might trigger.

MATIC Migrates to POL

On September 4, Polygon will begin the long-awaited upgrade from MATIC to POL. POL will fully replace MATIC, becoming the native gas and staking token for the Polygon Proof-of-Stake (PoS) network. Following this initial phase, POL will play a key role in the network’s AggLayer, subject to community approval.

MATIC holders on Polygon PoS, as well as MATIC stakers and delegators on Ethereum, won’t need to take any action. However, those holding MATIC on Ethereum, Polygon zkEVM, and centralized exchanges may need to migrate.

“POL is an exciting and highly anticipated upgrade, mainly because it further expands the utility of Polygon’s native token to reflect and power the vision of Polygon as an ever-growing network of aggregated blockchains,” the Polygon network shared in a recent blog.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know

Despite the anticipation for the transition, BeInCrypto data shows MATIC has been down 1.18% since the Monday session opened. Around the due date, however, the token could display some volatility as investors position themselves to capitalize on the hype.

Binance Prepares to Launch Solana Staking

Interest in staking continues to grow, with Binance and other exchanges like Bitget and Bybit recently hinting at launching liquid staking tokens on Solana. This comes as Solana’s liquid staking total value locked (TVL) has surged in 2024, reaching $3.756 billion, up from around $1.9 billion in January, according to DefiLlama.

For Binance, launching Solana staking would signify a new revenue stream with new offerings from the suggested BNSOL symbol. With the BNSOL offering, the platform would be able to collect staking fees while stakers earn rewards or yields.

In hindsight, Binance invested in Solayer in early August to drive Solana’s restaking ecosystem. Solayer will help secure on-chain decentralized applications (dApps) with improved network bandwidth while at the same time securing Layer-1 (L1).

The tokens to watch around these events include Binance Coin (BNB) and Solana’s SOL. However, given Binance’s collaboration with Sanctum, a top-five Solana staking layer, CLOUD could also see a lot of volatility.

Sonic Testnet Goes Live

The Fantom Sonic Testnet is set to launch this week, adding to potential market volatility. Sonic is a new Layer-1 blockchain from Fantom Foundation, featuring an L2 bridge to Ethereum. It promises higher transaction speeds, better finality, and reduced storage requirements.

“On October 24, we announced Fantom Sonic and released its testnet environment to the public. The network upgrade will scale Fantom to beyond 2,000 transactions per second with a one-second finality while reducing storage requirements by up to 90%,” Fantom wrote.

Ahead of the testnet, Fantom’s token, FTM, has risen by 3.39%, trading at $0.422.

The testnet participants will have the opportunity to interact with Sonic by submitting transactions, performing swaps, and experiencing the network’s performance firsthand. Ahead of the testnet launch, Fantom’s token, FTM, has risen by 3.39%, trading at $0.422, according to BeInCrypto data.

Arbitrum Upgrade Stylus

Ethereum L2 scaling solution Arbitrum (ARB) will upgrade its Stylus on September 3 to enable writing smart contracts using Rust, C, and C++ coding languages. Notably, Stylus contracts are faster with significantly lower gas fees owing to the superior efficiency of WASM programs.

Arbitrum Nitro’s unique fraud-proving technology enables Stylus. When there is a dispute on an Arbitrum network, Nitro replays the chain’s execution in WASM. Honest Arbitrum validators will then bisect the dispute until a single invalid step is identified and checked on-chain via a “one-step proof.”

Read more: How to Buy Arbitrum (ARB) and Everything You Need to Know

The bottom line is that Stylus innovates on many levels, including but not limited to the fact that it is a single chain but supports multiple languages. Other perks include its multi-virtual machine (multiVM), cheaper execution, being fully interoperable, and providing cheap reentrancy detection.

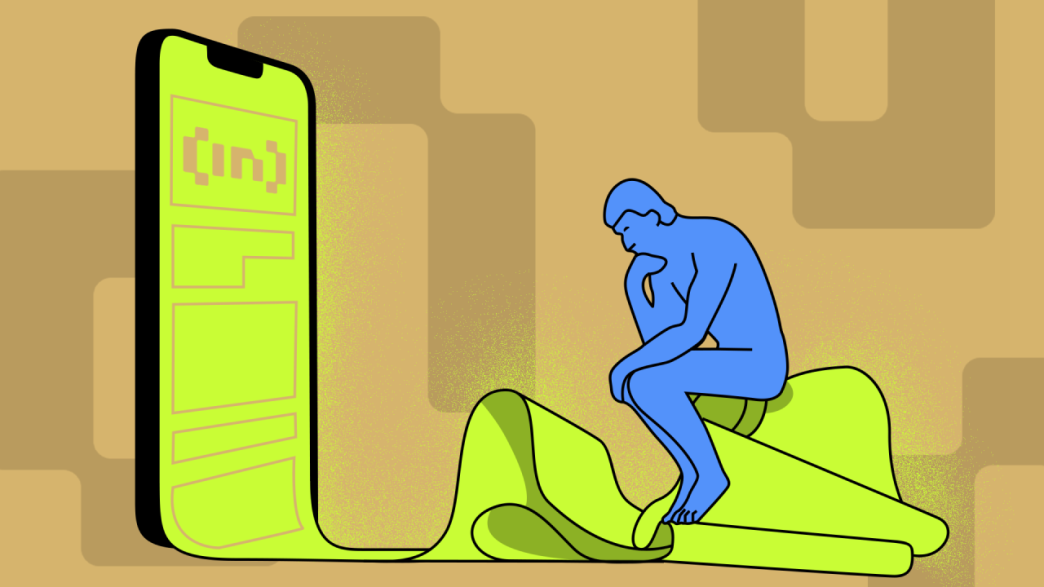

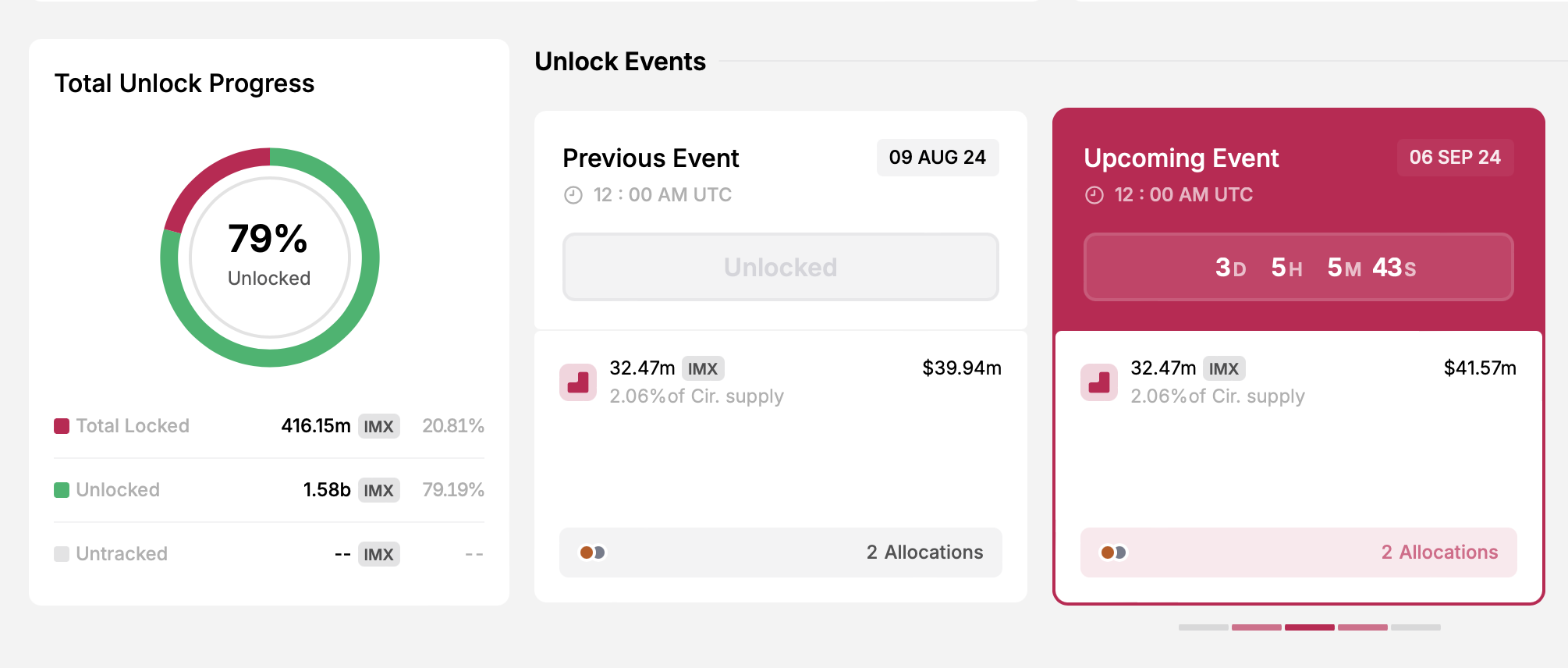

Immutable Unlocks $41 Million in IMX

On September 6, the circulating supply of IMX will increase by 32.47 million tokens. These newly unlocked coins will be allocated to the development of the project and the broader ecosystem.

This event will be a cliff unlock, meaning the tokens are released in larger, periodic batches rather than through a gradual, linear schedule. Unlike linear unlocks that provide more price stability, cliff unlocks can lead to increased market liquidity and volatility.

As such, investors should not be surprised if IMX price rallies ahead of the event and dumps on or after the unlock day as enlightened investors trade strategically.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/top-crypto-market-news-september-2-8/

2024-09-02 18:45:00