This week’s crypto news is dominated by Nvidia’s Q3 earnings report and Cardano’s Chang Hard Fork. Both events are set to influence the crypto market, particularly for AI-themed cryptocurrencies and the Cardano ecosystem.

Additional market-moving events include US economic data releases, Stacks’ Nakamoto upgrade, and significant token unlocks, making this week crucial for crypto traders and investors.

US Economic Data Could Impact Bitcoin and Broader Crypto Market

This week’s US economic events could heavily influence retail sentiment, potentially setting the stage for the next price movement in crypto markets. Key economic indicators, such as the US Consumer Confidence Index and initial jobless claims, are expected to provide insights into the economy’s health, which may impact Bitcoin and other cryptocurrencies.

Additionally, the Conference Board will release the US Consumer Confidence Index on August 27. This index offers insights into consumer attitudes and spending trends, which are crucial for understanding broader economic conditions.

Crypto markets are also closely watching the initial jobless claims report due Thursday. The report will provide fresh insights into the US labor market’s health, with recent trends showing a gradual cooling—a factor influencing the Federal Reserve’s cautious stance on rate cuts.

A key event to watch is Thursday’s second revision of Gross Domestic Product (GDP) data. A positive revision could signal strong economic growth, driving investors towards riskier assets like Bitcoin. Conversely, a downward adjustment might dampen sentiment, leading to a potential pullback in crypto prices.

“With key macro data points on the horizon, Bitcoin may continue its upward momentum as passive inflows persist. However, any signs of economic weakness could shift the narrative, possibly leading to renewed caution in the market,” analysts at 10x Research noted.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Nvidia’s Q3 Earnings: A Potential Boost for AI-Themed Cryptocurrencies

Both tech and crypto markets highly anticipate Nvidia’s upcoming Q3 earnings report on August 28. Analysts predict Nvidia will report a significant year-over-year increase in earnings. Nvidia’s consistent outperformance in previous quarters adds to the optimism, with the company well-positioned to exceed market expectations again.

As a leader in the AI technology space, Nvidia’s performance often influences AI-themed tokens. Over the past week, AI tokens such as Artificial Superintelligence Alliance (FET), Render, and SingularityNET (AGIX) have seen significant gains, driven by expectations surrounding Nvidia’s report. In a broader context, analysts at 10x Research have noted that Nvidia’s earnings report will also provide insight into the future of tech spending.

Stacks’ Nakamoto Upgrade to Revolutionize Bitcoin’s DeFi Space

Stacks, a prominent layer-2 solution on the Bitcoin network, will activate its Nakamoto upgrade on August 28. This upgrade, which is being hailed as Stacks’ most significant yet, will bring faster block times, transforming the Bitcoin DeFi ecosystem.

Currently, Stacks transactions take about 10 minutes to process, limiting the usability of Stacks DeFi applications. The Nakamoto upgrade will reduce transaction times to seconds, opening up new possibilities for high-frequency trading and complex DeFi strategies on Bitcoin.

The anticipated boost in Stacks’ native token, STX, reflects the market’s optimism about the upgrade. Crypto investors and traders expect the Nakamoto upgrade to drive significant price movements in the near future.

“STX is gonna get sent. BTC L2 narrative + Nakamoto upgrade next week. The last time STX broke out the diagonal resistance, it rallied +600% in 5 months,” crypto trader AlejandroBTC commented.

However, STX’s performance has been modest in the last 24 hours. At the time of writing, it is trading at $1.79, representing an approximately 0.5% decrease during the period.

GammaSwap Gears Up for Launch with Liquidity Bootstrapping Pool

GammaSwap, an on-chain perpetual options protocol, is preparing to launch its liquidity bootstrapping pool (LBP) on August 30. The LBP will use a Dutch Auction-like pricing mechanism to ensure a fair and transparent token distribution.

This launch is crucial for GammaSwap, as it sets the stage for the protocol’s broader adoption within the DeFi ecosystem. The LBP offers participants the advantage of dynamic pricing, allowing them to purchase tokens at their fair market value. Importantly, the structure of this event is designed to deter premature buying by bots or significant investors, ensuring a more equitable process.

GammaSwap has also prepared a comprehensive guide on how to participate in the LBP, equipping users with the necessary information to participate confidently in the event. This effort significantly enhances the anticipation and excitement surrounding GammaSwap’s introduction.

Cardano Delays Chang Hard Fork to September 1, Ensuring Ecosystem Readiness

On August 23, Cardano’s Intersect organization announced the postponement of the Chang hard fork to September 1. Initially scheduled for August 27, the delay allows more time for exchanges and decentralized applications (DApps) to complete necessary upgrades. Charles Hoskinson, the founder of Cardano, emphasized the importance of this delay.

“The magic of deadlines is that people who aren’t taking upgrades seriously suddenly say, damn, we got to get moving. When they get moving, we converge quickly. It looks like Binance and a few others need more time to get their houses in order, so the rocket is going to wait on the pad, another epoch for the weather to get better,” Hoskinson noted.

This hard fork is a critical milestone in Cardano’s development. It marks the transition to the Voltaire era, which will decentralize network management. Named in honor of Cardano enthusiast Phil Chang, the upgrade aims to alter the blockchain’s ownership structure, empowering the community to play a central role in decision-making.

In anticipation of the hard fork, Cardano’s native token, ADA, has shown positive performance, with a 12.1% increase over the past week. At the time of writing, ADA is trading at $0.37.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

SUI and Other Major Token Unlocks This Week

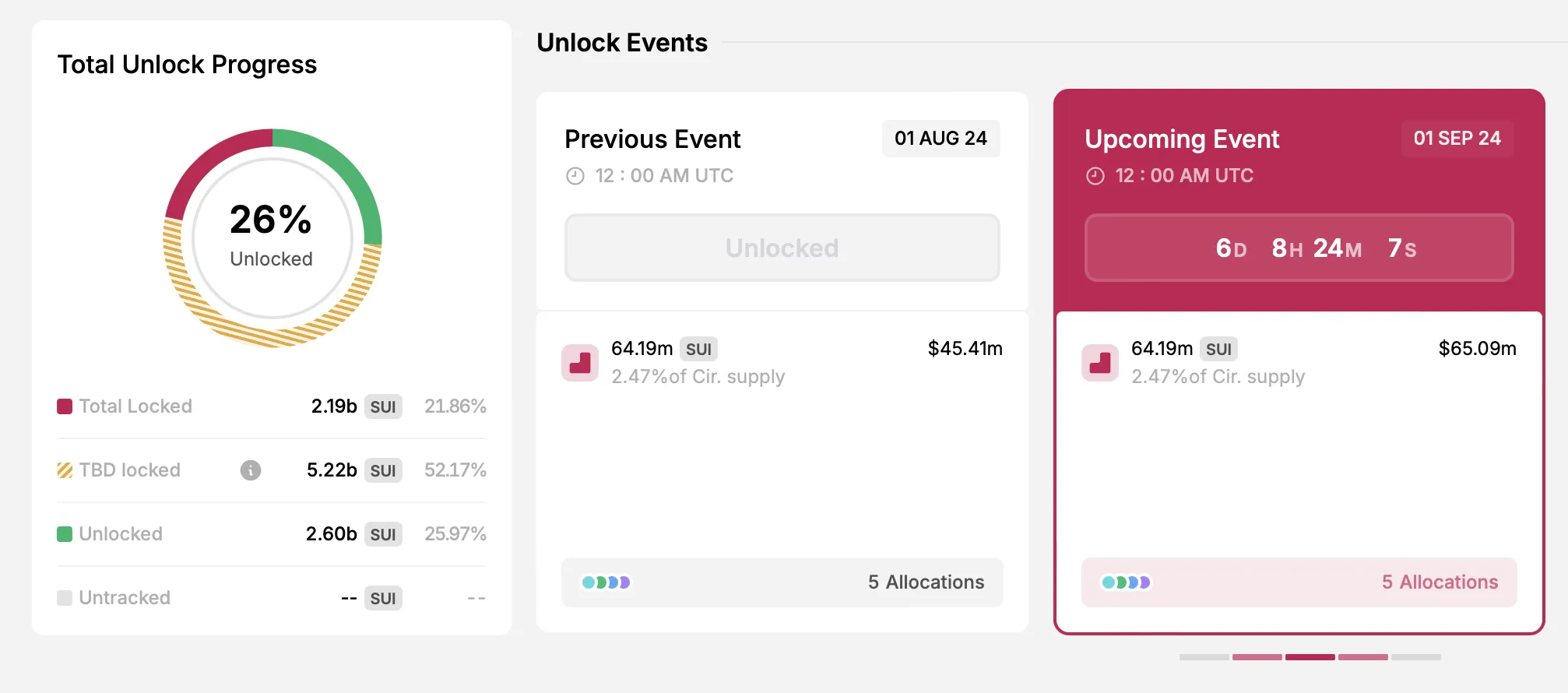

This week, the crypto market is set to witness several significant token unlocks, with a total value of over $179 million. Among the most notable are Sui (SUI), Optimism (OP), and ZetaChain, with unlocks valued at approximately $65 million, $50.46 million, and $33.05 million, respectively.

According to TokenUnlocks, Sui will release 64.19 million of its native tokens allocated for Series A and B participants, the community reserve, and the Mysten Labs treasury on September 1. Meanwhile, Optimism will unlock 31.34 million OP tokens on August 31 for core contributors and investors. Additionally, ZetaChain is set to release nearly 54 million ZETA tokens, valued at approximately $33.05 million, on September 1.

Token unlocks often increase market liquidity and volatility. As these tokens enter circulation, their prices could be affected, making it essential for traders to monitor the events closely. Read this article for further detailed information on major crypto token unlocks this week.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Source link

Lynn Wang

https://beincrypto.com/top-crypto-market-news-august-26-september-1/

2024-08-26 14:32:52