This week’s crypto calendar is packed with major events, including significant token unlocks across multiple ecosystems and the launch of Aptos’ staking exchange-traded product (ETP). Additionally, FTX victims are closely watching for anticipated settlements.

These developments are likely to increase volatility, particularly for ecosystem-specific tokens, urging traders and investors to adjust their strategies accordingly.

Avalanche, Oasis Network, Cardano Unlocks

BeInCrypto reported that several ecosystems have token unlock events lined up for the week. Key mentions include the Avalanche, Oasis, and Cardano, expected to unleash 1.67 million AVAX, 176 million ROSE, and 18.53 million ADA tokens, respectively.

Taken together, these three events make up unlocks worth approximately $90 million between Monday and Thursday. Of note is that all these events will constitute cliff unlocks, which increase the chances of significant price impacts. Meanwhile, investors typically view token unlocks as bearish catalysts since they increase token supply, potentially outpacing demand.

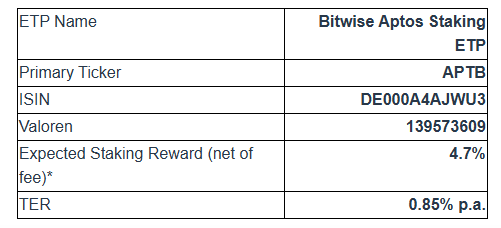

Bitwise’s Aptos Staking ETP Launch

Bitwise Asset Management is set to launch the Aptos Staking ETP (APTB) on the Swiss exchange SIX on Nov. 19, marking a major step in the crypto asset investment landscape. As the first Aptos Staking ETP, it demonstrates Bitwise’s commitment to expanding investment opportunities. APTB targets both institutional and retail investors, providing daily liquidity on the exchange with potential returns of approximately 4.7% after fees through staking.

FTX Settlements Hearings

Bankrupt cryptocurrency exchange FTX has secured significant settlements pending court approval, with a hearing set for Wednesday, November 20. The potential milestones, with Evolve Bank and the Silicon Valley Community Foundation (SVCF), could enable FTX to recover up to $21 million in assets, positioning it among the top crypto news this week.

These pending developments represent FTX’s efforts to maximize creditor recovery. The settlements highlight the firm’s strategy of negotiating asset returns and sidestep lengthy and costly litigation.

In its agreement with Evolve Bank, FTX will recover approximately $12.77 million from three accounts tied to West Realm Shires Services Inc., an FTX affiliate. Meanwhile, the bank will retain $462,698.65 for indemnification. As part of the deal, Evolve Bank has waived all potential claims against FTX, including indemnity and legal expenses under their prior agreement.

Similarly, FTX has reached a settlement with SVCF to recover $8.57 million and 34,208.70 FTT tokens. Former FTX executives Nishad Singh and Caroline Ellison originally donated these assets, with the foundation selling a portion before FTX’s collapse.

By agreeing to return the remaining funds and tokens, SVCF avoids litigation while FTX secures another step toward its recovery goals. Both settlements reflect FTX’s methodical approach to reclaiming funds amid its bankruptcy proceedings.

Kava 17 Mainnet Upgrade

Another top crypto news story this week is the voting period for the Kava 17 mainnet upgrade ending on November 20, which is expected to pass with a 99.47% approval so far.

It entails the deployment to Kava Mainnet at height 12766500 around 15:00 UTC on November 21. In this upgrade, the low-level data structure is updated to IAVL V1, an upgraded data format for the low-level storage of application data in the Kava blockchain.

The change in format results in much more chain performance synchronization and greatly reduces the storage footprint required for Kava nodes.

Lisk Airdrop Campaign

Lisk airdrop also makes it to the list of top crypto news this week. As BeInCrypto reported, Lisk launched its mainnet and airdrop campaigns with 15 million LSK tokens on November 12. The campaign, expected to start on November 21, will set the pace for an App Bounty Quest campaign that will launch towards the end of the year.

Meanwhile, the first season of the airdrop will run for four months. It incentivizes new users and builders to engage with Lisk’s blockchain ecosystem. In alignment with this effort, Lisk is implementing a comprehensive plan reflecting its past year’s progress through strategic partnerships and various programs. This launch represents a new phase for Lisk, and the results will be closely monitored.

Airdrop participants can earn points by completing a range of activities on the Lisk Portal. The number of tasks completed is directly proportional to points earned. It will determine the total LSK tokens received at the end of the campaign period.

Zero1 Labs v2 Token Unveil

Zero1 Labs, an innovative AI project making significant strides in artificial intelligence (AI), will unveil its V2 token on November 20.

“A bold step forward for the only community-run and launched AI ecosystem. DEAI will be the primary asset driving decentralized AI, supporting both Cypher Chain and Cypher Nodes. The first PoS chain with fully homomorphic encryption, purpose-built for AI,” the team shared on X (formerly Twitter).

Further, the Zero1 Labs team said it would not partner with the Artificial Superintelligence Alliance (ASI). It is taking a different path from peers like Cudos (CUDOS) and Injective (INJ). Notably, the debut will coincide with Nvidia’s third quarter (Q3) earnings, positioning its native token, DEAI, for volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/top-crypto-news-november-18-24/

2024-11-18 12:51:29