IOTA, the native cryptocurrency of an open-source Distributed Ledger Technology (DLT) platform, has emerged as the top-performing altcoin in the last 24 hours. During this time, the asset’s value surged by 40%, and it is now trading at $0.48.

As an altcoin that has been out of the spotlight for a while, many may be wondering why the token has suddenly pumped. This on-chain analysis reveals the reasons for that and what could be next for cryptocurrency.

IOTA Sees Rising Demand as Old Cryptos Lead the Way

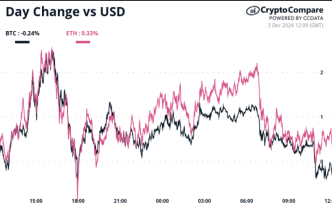

According to BeInCrypto’s analysis, IOTA stands out as the top-performing altcoin. This is largely due to the broader market’s growing interest in older cryptocurrencies from previous cycles. Notable assets like VeChain (VET), Hedera (HBAR), and Algorand (ALGO) have seen significant bids in the last 24 hours, with many of these coins having launched between 2017 and 2020.

In addition to the rising demand for older cryptos, IOTA’s strategic pivot to become a Real World Assets (RWA) project has bolstered its position.

Moreover, the commencement of the Rebased governance vote, which aims to reduce transaction costs, boost throughput, and introduce Move-based smart contracts on a parallelized DAG-based Layer-1 ledger, further strengthens the bullish outlook for IOTA.

From an on-chain perspective, Santiment data shows that IOTA’s volume has climbed to $675.51 million. This value is the highest it has reached since November 2017, validating the notion that the cryptocurrency is getting a lot of bids.

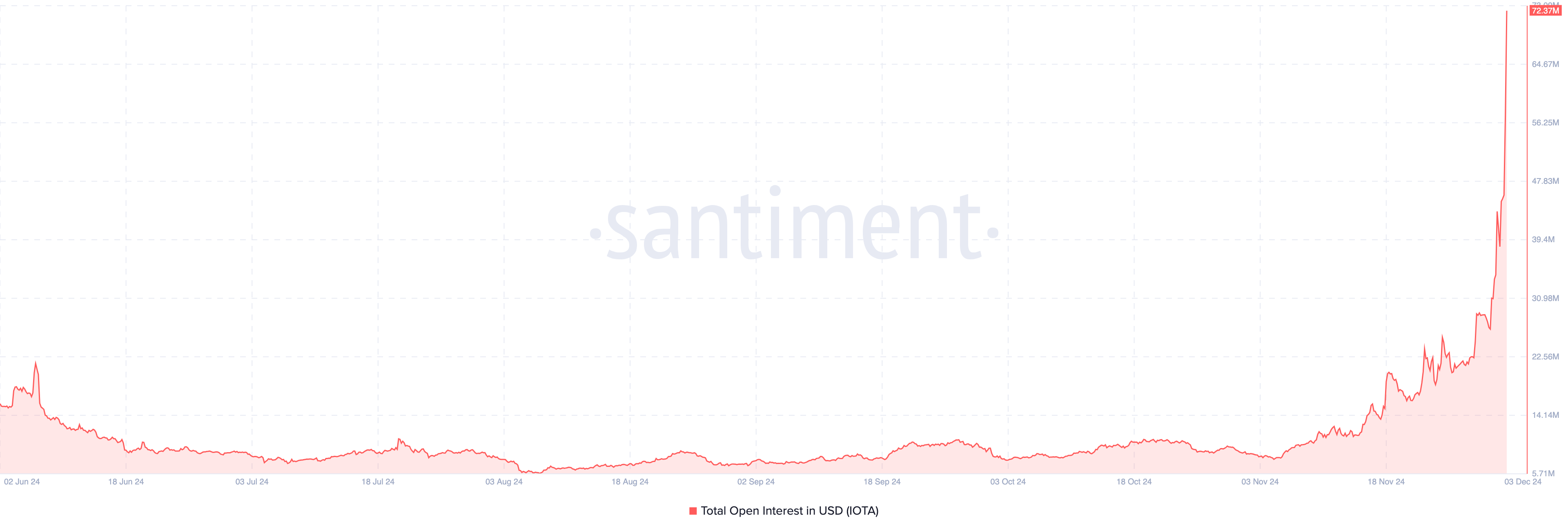

Should the volume continue to rise alongside the price, then IOTA could be worth more than $0.48 within a few days. Beyond the volume, IOTA’s Open Interest (OI) also climbed to $72.37 million. The OI measures the level of speculative activity around a cryptocurrency.

High OI typically indicates that significant capital is flowing in, with new long positions being established. This suggests that traders are increasingly confident in the market’s upward movement, contributing to a bullish sentiment.

On the other hand, low OI implies that traders are taking money out and closing existing positions. Therefore, the rise in the altcoin’s OI reflects growing participation, indicating that the altcoin’s price might continue to swing upwards.

IOTA Price Prediction: To Get Close to the $1 Mark

On the IOTA/USD chart, the Bull Bear Power (BBP) shows a notable hike. The BBP compares the strength of buyers to sellers. When it rises with a histogram green bar, it indicates that bulls are in control.

Conversely, if the BBP is negative, it means that bears have the upper hand, and prices can increase. For IOTA, it is the latter. Besides, the Money Flow Index (MFI), which shows the level of capital inflow into a cryptocurrency, has climbed, indicating that buying pressure around the token is very much present.

Should this remain the case, IOTA’s price might rise to the highest point of the wick of the last candlestick, at $0.53. In a highly bullish scenario with rising demand, it could inch closer to $1.

On the other hand, if profit-taking becomes a factor, IOTA might lose its spot as the top-performing altcoin and drop to $0.28.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/iota-outshines-market/

2024-12-03 11:00:00