Analyst and trader Ali Martinez is turning bearish on Bitcoin (BTC) after the flagship digital asset printed corrective signals.

Martinez tells his 71,200 followers on the social media platform X that Bitcoin could dip nearly 9% from its current value.

“Bitcoin broke support! It looks like $55,000 is next.”

He looks at the hourly chart’s lower bound of a parallel channel to identify $58,100 as the key level of support that was recently broken as Bitcoin dipped to a low of $57,633 in the last 24 hours. Bitcoin subsequently recovered and is trading for $60,283 at time of writing, up 3.4% in the last 24 hours.

Although Bitcoin is now trading above the channel’s support, Martinez is not flipping bullish on the crypto king just yet, warning that BTC is flashing a bearish signal on the hourly time frame.

“The TD Sequential indicator presented a sell signal on the Bitcoin one-hour chart, anticipating a brief correction!”

The TD Sequential indicator is used in technical analysis to determine potential bullish or bearish reversal points.

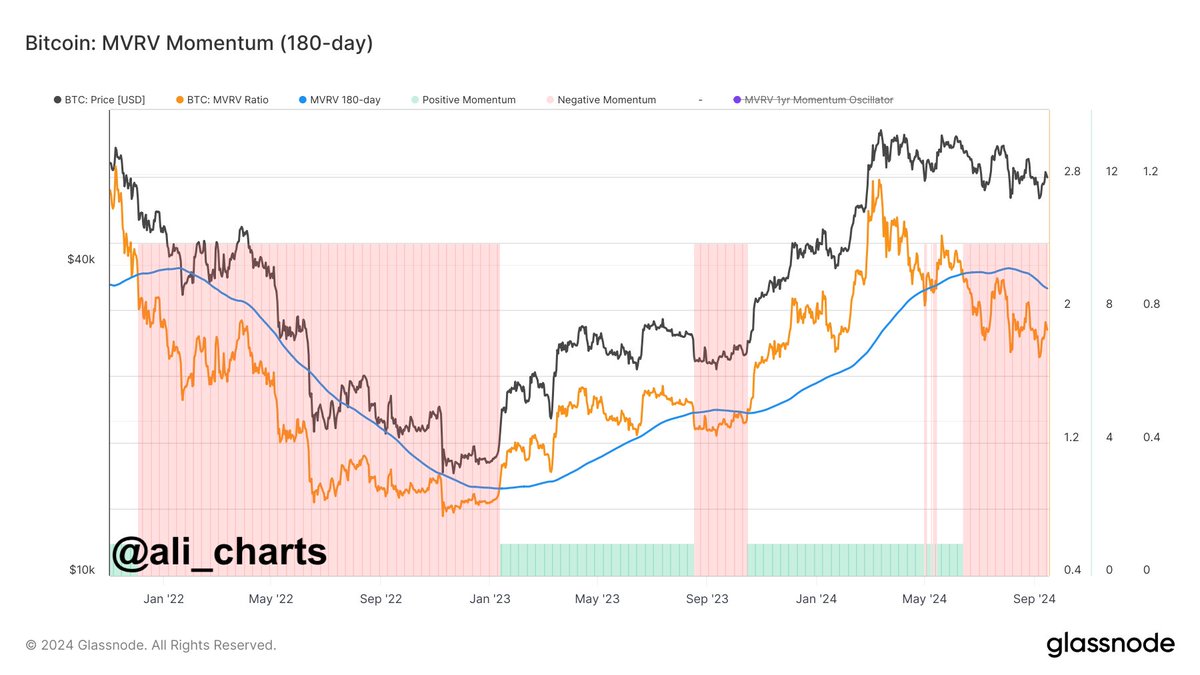

He also says that Bitcoin’s Market Value to Realized Value (MVRV) metric indicates that the flagship crypto asset has remained in a downtrend for months.

The MVRV compares the current market cap of Bitcoin to its realized capitalization (which is calculated based on the price at which Bitcoin was bought). When the MVRV value drops below zero, it indicates oversold conditions.

“Zooming out, the Bitcoin MVRV Momentum shows that BTC has been in a downtrend since breaking below $66,750 in June, and the trend hasn’t shifted yet!”

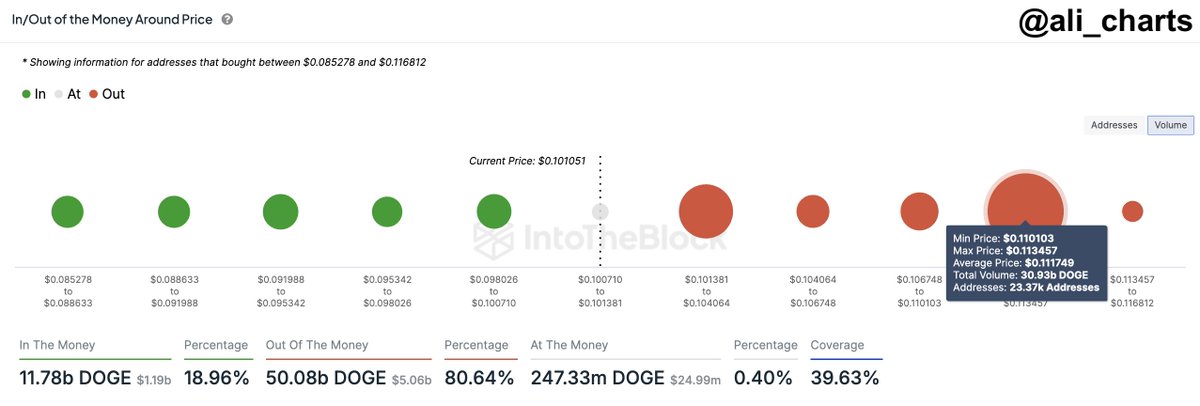

Next up, the trader uses the In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine a key resistance level for meme Dogecoin (DOGE).

“If you’re anticipating a Dogecoin breakout, keep in mind the key resistance level at $0.11, where 23,400 addresses are holding ~31 billion DOGE!”

DOGE is trading for $0.101 at time of writing, up 1.5% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/09/18/trader-warns-of-lower-prices-for-bitcoin-after-breaking-of-support-heres-his-downside-target/

2024-09-18 09:15:43