Uniswap (UNI) price has surged nearly 20% in the last 24 hours, reaching its highest levels in three years. This rapid rally has pushed UNI price closer to breaking key resistance levels that could lead to even greater gains.

Metrics such as RSI and BBTrend suggest improving momentum, with the potential for continued upward movement if bullish sentiment holds. However, maintaining strong support at $14.5 will be crucial to sustaining this uptrend and avoiding a deeper pullback.

UNI RSI Is Still Below the Overbought Zone

Uniswap RSI has surged from 33 two days ago to 67, reflecting a sharp increase in bullish momentum. This rapid rise indicates that the asset has moved from oversold conditions into a more neutral-to-bullish range, aligning with its recent price recovery.

The current RSI level suggests strong buying activity, but it is nearing the overbought threshold, where further upward movement could face resistance if buying momentum slows.

RSI, or Relative Strength Index, measures the speed and magnitude of price changes to assess overbought or oversold conditions. Values below 30 indicate oversold levels, signaling potential buying opportunities, while values above 70 suggest overbought conditions that can lead to price corrections.

If UNI’s RSI can break past 70 and sustain itself above this level without an immediate correction, Uniswap price could continue rising. Historical trends show that when UNI’s RSI remained above 70 for extended periods, it often preceded significant price gains before a pullback occurred, suggesting further upside potential in the short term.

Uniswap BBTrend Is Now Negative

UNI BBTrend has recovered to -0.82, up from -2.47 a few hours ago, signaling an improvement in price momentum. This shift indicates that the bearish pressure seen earlier is easing, suggesting a potential stabilization or even a reversal toward bullish conditions.

Although the BBTrend remains in the negative zone, the upward movement reflects growing support and a possible return of buying interest.

BBTrend, or Bollinger Band Trend, measures the strength and direction of price movements based on Bollinger Bands. Positive values indicate bullish momentum, while negative values signal bearish conditions. Uniswap BBTrend was positive from November 24, peaking at 22.6 on December 9, before turning negative between December 11 and 12.

The recent recovery from -2.47 to -0.82 suggests that selling momentum is weakening. If BBTrend turns positive again, UNI price could see an even bigger surge.

UNI Price Prediction: Can It Get Back to $25 After 3 Years?

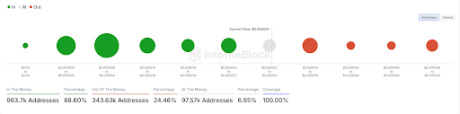

UNI price currently holds a strong support level around $14.5, which could serve as a key area to stabilize the price in case of a downtrend. If this support fails, the price could drop further, potentially testing $13.5 as the next significant level.

These support zones are crucial to prevent a deeper correction and maintain market confidence during periods of selling pressure.

On the other hand, if the current uptrend persists, UNI price could soon test resistance at $19.47, with the potential to rise to $20. Breaking these levels would mark Uniswap’s highest price in three years, signaling strong bullish momentum.

A continued rally toward $25 would represent its highest price since November 11, 2021, highlighting a possible return to the long-term bullish territory if the uptrend strengthens further.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/uni-highest-level-in-3-years/

2024-12-12 23:30:00