Bitcoin (BTC) price holds above $61,000 as US CPI inflation data falls to 2.9% in July, lower than expectations.

CPI data measures price increases in consumer goods and services. After running stale for most of 2023, the influence of US macroeconomic data on Bitcoin and crypto markets is resuming.

CPI At 2.9%, Falls Lower Than Expectations

The US Bureau of Labor Statistics (BLS) released July’s Consumer Price Index (CPI) inflation data, which came in at 2.9%. This is also lower than the 3% recorded in June.

Markets had anticipated 3%, which means the general inflation is slightly (0.1%) lower. The CPI data indicates that general inflation is slightly lower than expected, but the underlying inflation (excluding volatile items) is as predicted. Also, the underlying inflation, which excludes volatile items, is as was expected.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Both core and headline month-on-month (MoM) inflation figures align with expectations. The headline year-on-year (YoY) gain comes in slightly below predictions. A summary of the BLS data on Wednesday is as follows and suggests the inflation data is broadly in line with market predictions

- US CPI (MoM) (July) | Actual: 0.2% VS -0.1% Previous; Est. 0.2%

- US CPI (YoY) (July) | Actual: 2.9% VS 3.0% Previous; Est. 3.0%

- US CORE CPI (MoM) (July) | Actual: 0.2% VS 0.1% Previous; Est. 0.2%

- US CORE CPI (YoY) (July) | Actual: 3.2% VS 3.3% Previous; Est. 3.2%

“If the FED waits for 2% inflation to cut rates we have waited too long,” Fed Chair Powell said.

Notably, this marks the first month with CPI inflation below 3.0% since March 2021. The first-rate cut since 2020 may come next month.

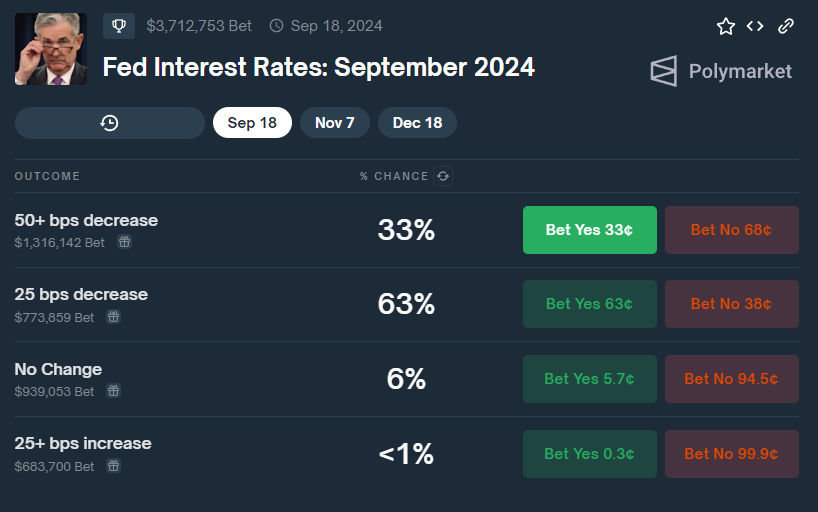

Last night’s softer US PPI print shifted market expectations towards a 50 basis points (bps) rate cut by the Fed in September, with the probability now at 52.5% for 50 bps versus 47.5% for 25 bps.

Given this news, traders have trimmed the Federal Reserve’s rate-cut bets. This is on the assumption that lower-than-expected inflation data could influence economic policy to reduce interest rates.

A decrease in the CPI may increase consumers’ purchasing power. This is positive news for Bitcoin and crypto markets because consumers may tend to spend more when purchasing power increases.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

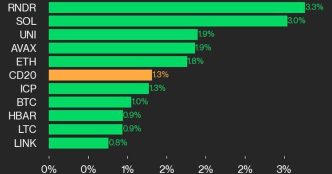

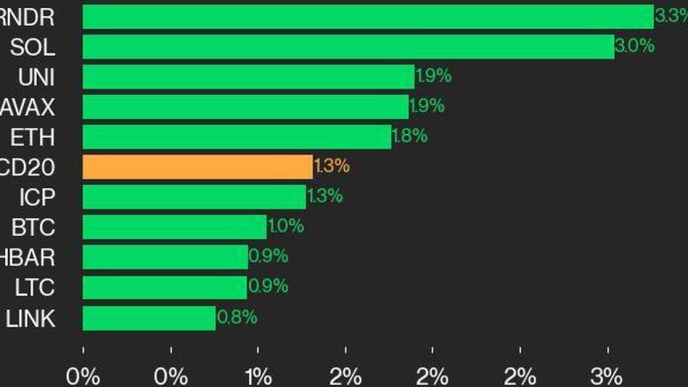

In the immediate aftermath of the release, Bitcoin price extended the gains, holding above $61,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/bitcoin-holds-above-61000-as-cpi-inflation-falls/

2024-08-14 13:11:54