The United States Treasury Department has acknowledged Bitcoin as a “digital gold,” emphasizing its primary role as a store of value.

Alongside this recognition, the Treasury highlighted the growing significance of stablecoins, which are driving demand for Treasury bills in the evolving financial landscape.

Treasury Acknowledges Bitcoin and Stablecoins

The Treasury’s report underscores the swift expansion of digital assets, including Bitcoin, Ethereum, and stablecoins, but notes that the market remains small compared to traditional financial instruments like US government bonds.

“Primary use case for Bitcoin seems to be a store of value aka ‘digital gold’ in a decentralized finance (DeFi) world,” the Treasury stated.

The financial regulator noted that Bitcoin has established itself as a store of value akin to gold. According to the report, Bitcoin’s market value surged from $6.4 billion in 2015 to $134 billion in 2019 and further skyrocketed to approximately $1.3 trillion in 2024. This growth reflects heightened interest in decentralized finance (DeFi) and digital tokens.

Indeed, the report arrives amid growing comparisons of Bitcoin to gold, including recent remarks by Federal Reserve Chairman Jerome Powell. This has bolstered optimism within the crypto market, which sees Bitcoin as a key component of the financial future.

However, the US Treasury noted that most individuals engage with cryptocurrencies as speculative investments, aiming for future value appreciation. As such, digital currencies have not yet supplanted traditional assets like Treasury bonds, which remain in high demand.

“Structural demand for Treasuries may increase as the digital asset market cap grows, both as a hedge against downside price volatility and as an ‘on-chain’ safe-haven asset,” Treasury stated.

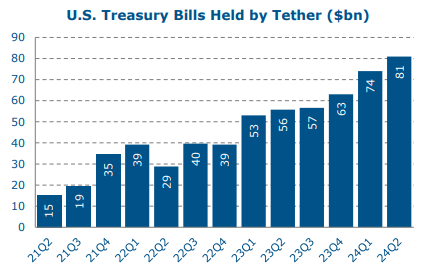

For context, the Treasury report spotlighted the rapid expansion of stablecoins and their growing role in the crypto ecosystem. Over 80% of all cryptocurrency transactions involve stablecoins, which act as key intermediaries in digital markets.

Fiat-backed stablecoin providers, such as Tether, primarily rely on US Treasury bills and other treasury-backed assets as collateral. These holdings account for approximately $120 billion in US Treasuries. As the stablecoin market grows, the demand for Treasury securities is expected to rise. This would be driven by their use as a hedge against price volatility and as a safe-haven asset within blockchain networks.

Overall, the Treasury’s recognition of Bitcoin and stablecoins signals an increasing intersection between traditional finance and blockchain-based innovations. While the department maintains a cautious stance, its acknowledgment of digital assets suggests a willingness to explore their potential.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Oluwapelumi Adejumo

https://beincrypto.com/us-treasury-recognizes-bitcoin-as-digital-gold/

2024-12-08 17:00:00