VIRTUAL price has skyrocketed, cementing its position as the leader among AI crypto agents and now ranking as the 4th largest AI coin in the market, above WLD. With a staggering 536.03% increase in the past 30 days, VIRTUAL has also entered the Top 50 largest cryptocurrencies by market capitalization.

The coin’s impressive rally has been fueled by strong momentum, pushing it to new all-time highs as it aims to break further resistance levels. However, with its RSI in overbought territory, traders are keeping a close eye on potential corrections that could challenge its current bullish trajectory.

VIRTUAL RSI Is Showing an Overbought Zone

VIRTUAL Relative Strength Index (RSI) is currently at 83, a sharp increase from 60 just one day ago. RSI is a key momentum indicator that measures the speed and magnitude of price changes on a scale from 0 to 100.

Values above 70 indicate overbought conditions, suggesting strong bullish momentum, while values below 30 reflect oversold conditions and potential undervaluation. VIRTUAL’s RSI is well above the overbought threshold, highlighting significant buying pressure as the asset pushes toward new all-time highs.

Between December 12 and December 14, VIRTUAL’s RSI consistently stayed above 70, signaling strong momentum during that period. While this trend could continue in the coming days as VIRTUAL attempts to break new records, staying above 70 for an extended period is challenging and often unsustainable.

An RSI this high suggests the potential for a correction, as buyers may eventually take profits, easing upward pressure on the price. Traders should be cautious of a potential pullback in the near term.

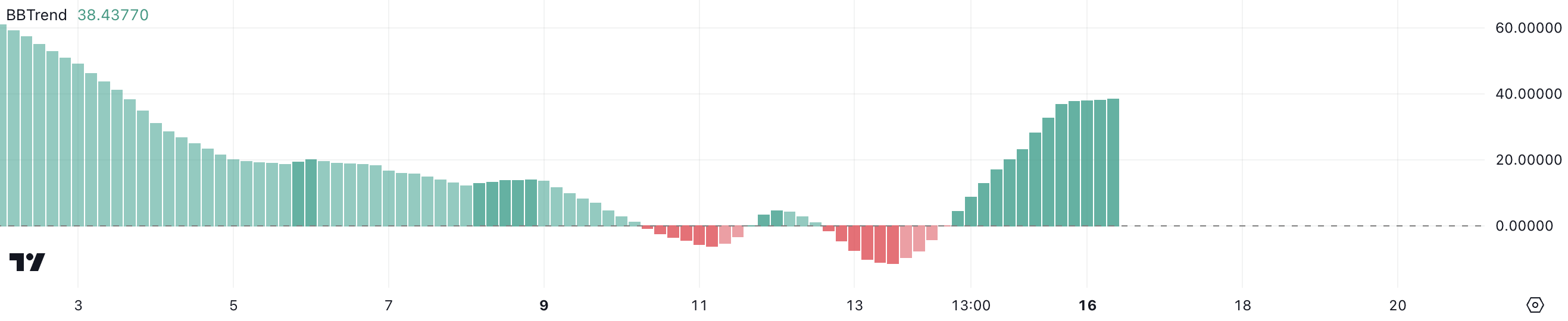

VIRTUAL BBTrend Is Still High

VIRTUAL’s BBTrend is currently at 38.4, a significant rise from -0.01 on December 14. This sharp increase indicates a substantial shift in momentum, highlighting strong bullish activity.

BBTrend, derived from Bollinger Bands, measures price momentum and trend direction. Positive values suggest bullish trends, and negative values point to bearish pressure. The move into firmly positive territory shows the strength of VIRTUAL’s current uptrend.

After reaching levels around 36 on December 15, VIRTUAL’s BBTrend stabilized at 38.4, signaling sustained bullish momentum. This elevated BBTrend value suggests that VIRTUAL is in a strong uptrend, with price movement likely supported by continued buying pressure, as the narrative around AI crypto agents becomes more popular.

However, the stabilization indicates a possible plateau in momentum, which traders should monitor closely for signs of either further acceleration or potential consolidation in VIRTUAL price trend.

VIRTUAL Price Prediction: Will It Fall Below $2?

VIRTUAL price is currently reaching new all-time highs, showcasing strong bullish momentum despite its high RSI levels. If the uptrend continues, VIRTUAL could break through key resistance levels and test $3.5 or even $3.75 in the near term, solidifying its position as the top-performing artificial intelligence coin in the last month.

However, if the uptrend loses steam, a correction may occur, with VIRTUAL price potentially testing support levels at $2.28 and $1.99. Should these supports fail to hold, the price could drop further to $1.34, marking a significant retracement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/virtual-price-top-50-crypto/

2024-12-16 21:30:00