It’s simple to understand why Chainlink (LINK) has recently drawn attention in the cryptocurrency community. The digital asset has experienced a remarkable 40% increase in just one week.

Related Reading

Demand for LINK significantly increased from $16.54 on November 26 to $25.73 by December 3. As the largest price increase since January 2022, this spike indicates a new wave of investor enthusiasm and momentum.

Surge Fueled By Whale Activity

Whale activity is one of the main drivers for this rally. LookonChain reported on December 3 that a whale address scooped up 269,861 LINK tokens, valued at $6.68 million. The acquisition of 107,838 tokens on a decentralized exchange by the whale, costing $2.6 million, shows that confidence in LINK continues to grow.

Furthermore, 162,024 LINK tokens, which were valued at $4.08 million, were withdrawn from Binance, underscoring the increased interest of institutional investors.

The price of $LINK has surged 36% today!

A whale bought 269,861 $LINK($6.68M) in the past 12 hours.

The whale spent $2.6M to buy 107,838 $LINK at $24.1 on DEX and withdrew 162,024 $LINK($4.08M) from #Binance.https://t.co/Zuxgpk23Sm pic.twitter.com/hNQ65oZkfi

— Lookonchain (@lookonchain) December 3, 2024

This isn’t just something whales do. Other large holders also play a crucial part. As small and medium-sized investors increase their shares, new investors are now jumping on the Chainlink bandwagon.

IntoTheBlock data shows that over the last 30 days, the number of LINK tokens owned by small buyers (1,000 to 10,000) has grown by 35%.

In the same vein, mid-tier investors, who held 10,000 to 100,000 LINK, experienced a significant 86.79% increase in accumulation.

Bullish Forecasts & Strong Market Performance

Chainlink’s market capitalization has now exceeded $15 billion, following a 25% increase in the past 24 hours. The asset’s remarkable performance is also contributing to the current optimism in the DeFi sector, which is on the brink of a $150 billion market capitalization.

$LINK/usdt DAILY

It’s $LINK SEASON, now we do $22 –> $52

https://t.co/kJOaCpeyML pic.twitter.com/dg3H5au2fU

— Satoshi Flipper (@SatoshiFlipper) December 3, 2024

Well-known figures such as Satoshi Flipper have predicted a target price of $52 for LINK, which is a particularly bullish outlook among analysts. A breakout rally has gained more steam, emulating the 2022-2023 trendline breakout, which signaled a substantial rebound in the broader market.

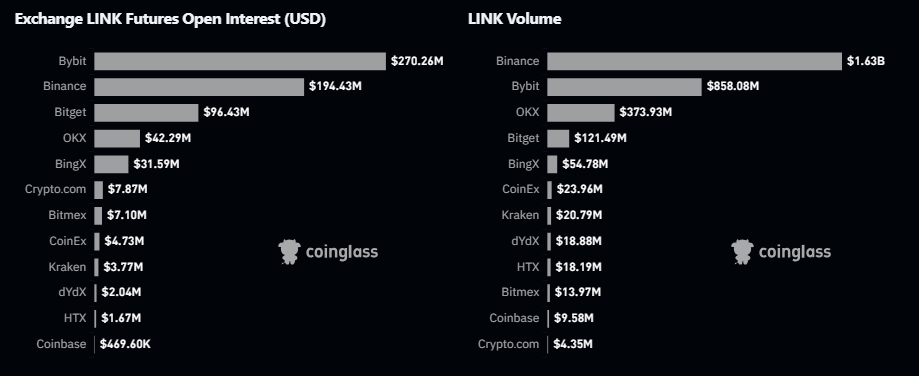

Coinglass indicators show a 57% growth in futures open interest to $708 million and rising investor interest. Trading volume in derivatives rose 450% to $5 billion. This shows a surge in speculative activity, which bodes well for LINK’s growth.

Related Reading

Chainlink: The Road Ahead

Chainlink’s price behavior suggests that the present surge could last; but, its long-term success depends on its capacity to maintain momentum. Strong purchasing pressure and rising whale activity point to a continuous optimistic view.

However, investors should exercise caution, as markets can fluctuate rapidly. LINK may achieve new price milestones in the upcoming weeks if it maintains its upward trajectory.

Featured image from IndiaMART, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/whale-activity-sparks-chainlink-rally-52-target-on-traders-radar/

2024-12-04 11:00:31