Ethereum (ETH) price has jumped 43.88% in the last 30 days, showing strong momentum. The declining supply of ETH on exchanges suggests that holders are becoming more confident, moving their tokens to long-term storage.

At the same time, whales are stepping in and accumulating more ETH, adding to the bullish sentiment. With EMA patterns also leaning positive, the market seems to be gearing up for an interesting phase.

ETH Supply on Exchanges Is Decreasing

Between November 3 and November 18, the Ethereum supply on exchanges increased significantly, rising from 12.2 million to 12.7 million.

This upward trend indicated a growing accumulation of ETH on platforms where it can be easily sold or traded. Such behavior often reflects a bearish sentiment, as users may be preparing to liquidate their holdings in response to market uncertainty or price expectations.

The decline in ETH supply on exchanges, which dropped to 12.6 million by December 1, signals a potential shift in sentiment. When users withdraw ETH from exchanges, it suggests a reduced likelihood of selling.

This move is often considered bullish, as it implies holders are opting for long-term storage. This could be an early sign of growing confidence in ETH price.

Whales Are Accumulating ETH Again

Ethereum whales began accumulating again towards the end of November, with noticeable activity starting on November 20. This accumulation trend is significant, as it reflects renewed interest from large holders who have the potential to influence the market.

Such behavior often draws attention from market participants, as whale actions can indicate strategic moves based on future price expectations.

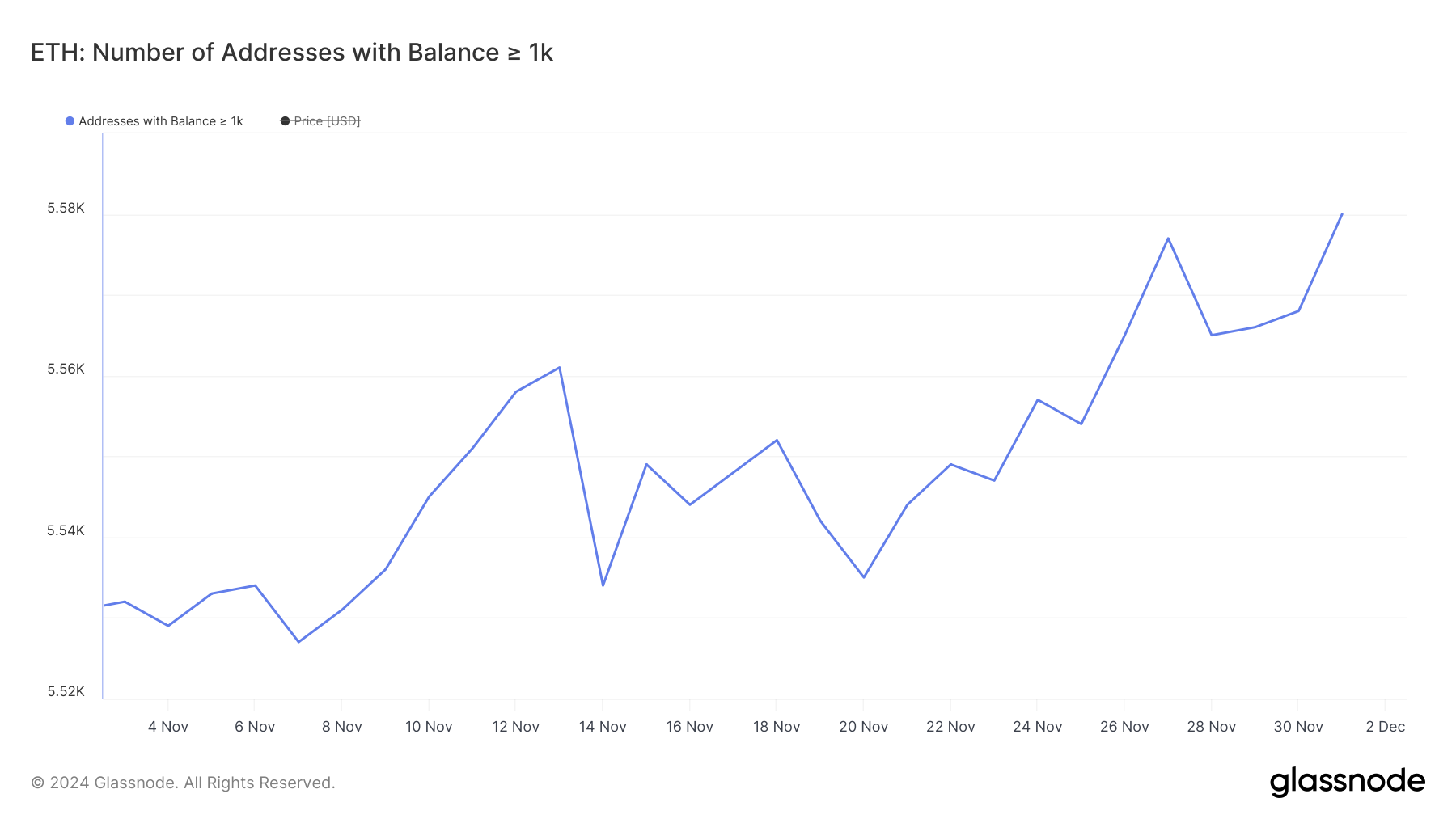

Tracking ETH whales is crucial because their holdings and trading behavior can significantly impact the market. When the number of whales increases, as seen with a rise from 5,535 on November 20 to 5,580—its highest level since October 13—it suggests strong confidence among major players.

This accumulation could be bullish for Ethereum price, as whales tend to hold long-term positions, reducing the circulating supply and creating upward pressure on prices.

ETH Price Prediction: A Potential 10% Correction?

ETH’s EMA lines are currently bullish, with short-term averages positioned above long-term ones. However, the price dipping below the shortest EMA suggests a loss of immediate momentum.

This signals caution, as it may indicate a weakening of the uptrend if the price fails to recover quickly.

If ETH’s uptrend regains strength, it could test key resistance levels at $3,688 and $3,763. Breaking past these points might push ETH price towards $4,000, a price not seen since December 2021, signaling a strong bullish reversal.

On the other hand, if short-term EMA lines decline further and a downtrend forms, ETH price could face a correction to $3,255, representing a potential 10% pullback.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ethereum-whales-accumulate-caution-looms/

2024-12-02 19:30:00