Starting in 2025, Americans trading digital assets on centralized exchanges (CEXs) will see their crypto transactions reported to the Internal Revenue Service (IRS).

This change marks the first tax year requiring third-party reporting for crypto transactions. It aims to bolster compliance and ensure accurate taxation of digital asset activities.

US Crypto CEXs to Report Transactions to IRS

Crypto brokers, including custodial exchanges like Coinbase and Gemini, will track transaction details for their users throughout the year. They will issue a new tax form, the 1099-DA, which will report purchases and sales to both taxpayers and the IRS. According to CNN, this information must be included in 2025 tax returns filed in early 2026.

Form 1099-DA will provide transaction details. However, brokers will not be required to report cost basis until the 2026 tax year. Cost basis refers to the original purchase price of a crypto asset, which is used to calculate taxable gains or losses.

The report highlighted, Citing Jessalyn Dean, that this phased implementation aims to ease the transition for both brokers and taxpayers. Dean serves as vice president of tax information at crypto tax software provider, Ledgible.

The timeline differs for those trading on decentralized platforms like Uniswap. Peer-to-peer (P2P) transactions will fall under third-party reporting requirements starting in 2027. However, decentralized platforms will only report gross proceeds, as they lack access to cost-basis information.

“[The companies that will be on the hook to provide the reporting are] brokers who take possession of the digital assets being sold by their customers. These brokers include operators of custodial digital asset trading platforms, certain digital asset hosted wallet providers, digital asset kiosks, and certain processors of digital asset payments (PDAPs),” the IRS noted on its site.

Bitcoin ETF (exchange-traded fund) investors will face third-party reporting this year. ETF issuers will provide a 1099-B or 1099-DA form, detailing taxable events like share sales or any gains and losses within the fund.

However, citing the US Treasury, the report articulated that despite the increased reporting, the changes do not introduce new taxes for digital asset investors. Instead, they aim to streamline compliance and reduce inadvertent errors.

US Crypto Tax Rules Ahead of Trump’s Inauguration

This report comes only weeks after the IRS published new crypto tax guidelines focusing on DeFi services. As BeInCrypto reported, DeFi brokers were required to report detailed customer and transaction data. The rules apply to front-end DeFi services interacting with users but exempt the underlying protocols themselves.

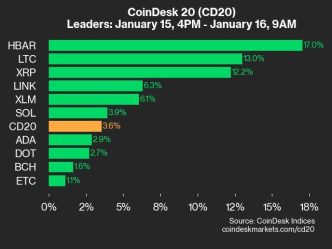

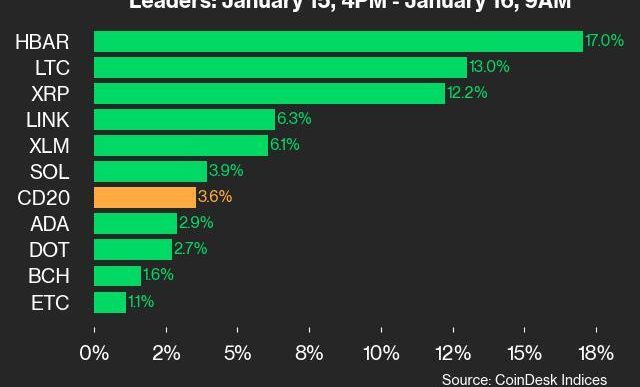

Notably, the rollout of these regulations aligns with Donald Trump’s upcoming inauguration. His return to the White House has sparked renewed pro-crypto sentiment, fueled by policies supporting blockchain innovation and digital assets.

Among other commitments, his administration’s plans include establishing a Senate Crypto Subcommittee to provide clarity and promote innovation within the sector. The bullish market sentiment reflects optimism around the Trump administration’s potential to create a more crypto-friendly regulatory environment.

Against this backdrop, Anthony Pompliano, a prominent Bitcoin advocate, recently outlined key recommendations for Trump to bolster the industry’s growth. Pompliano cited clear regulations that foster innovation while protecting investors, among other recommendations.

The US SEC (Securities and Exchange Commission) is also expected to undergo a policy overhaul under Trump’s leadership. Industry insiders anticipate a shift toward more accommodating crypto regulations, which could pave the way for broader adoption and clearer guidelines.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/irs-to-track-crypto-transactions-on-cexs/

2025-01-16 13:54:37