Whales bought several promising altcoins in January, positioning themselves for potential gains in February 2025. ONDO saw aggressive accumulation as interest in Real-World Assets (RWA) surged, while VIRTUAL attracted buyers despite a sharp correction in the AI sector.

Meanwhile, ZRO whales steadily increased their holdings throughout the month, anticipating a rebound following LayerZero’s resolution of the FTX lawsuit. As these trends unfold, whale activity could play a key role in shaping February’s market movements.

Ondo (ONDO)

ONDO, a leading Real-World Assets (RWA) token, has surged nearly 17% in the last 30 days, pushing its market cap to $5 billion. As RWA adoption grows, ONDO continues to gain traction among investors.

Whales bought ONDO aggressively over the past two weeks. Addresses holding between 10,000 and 100,000 ONDO jumped from 1,727 to 2,221, while those with 100,000 to 1,000,000 increased from 289 to 332. Even larger whales, holding 1,000,000 to 10,000,000 ONDO, grew from 139 to 175.

With BlackRock and Morgan Stanley showing interest in RWA, ONDO could benefit significantly in February. As institutional players enter the space, whale accumulation may continue to drive prices higher.

Virtuals Protocol (VIRTUAL)

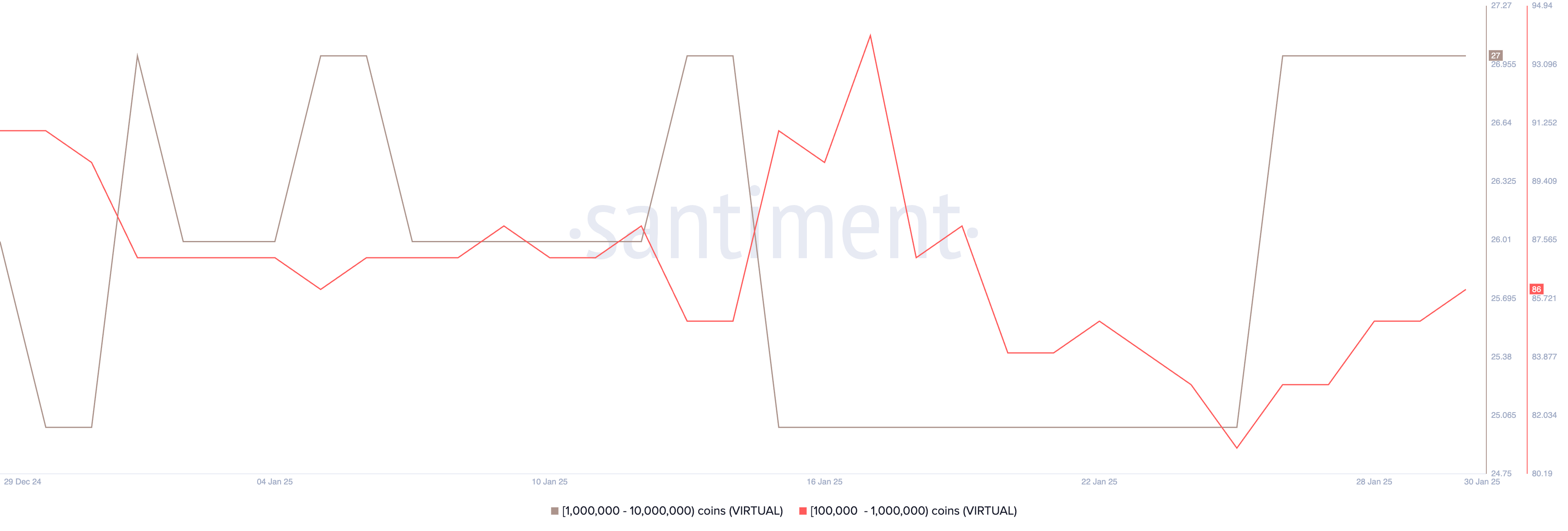

VIRTUAL is one of the top projects in the crypto AI agents trend, despite being down 40% in the last 30 days. Whales bought VIRTUAL last week, signaling the start of an accumulation trend.

Whales holding at least 100,000 VIRTUAL have been steadily increasing over the past week. This suggests confidence in the project despite its recent correction, with large holders positioning for a potential rebound.

With a market cap of $1.5 billion, VIRTUAL remains one of the biggest AI coins. If hype around crypto AI agents returns in February, this accumulation trend could help drive a price recovery.

LayerZero (ZRO)

ZRO was once one of the most hyped crypto projects but has dropped nearly 23% in the last 30 days. However, it’s up 5% in the last 24 hours after LayerZero resolved the FTX lawsuit.

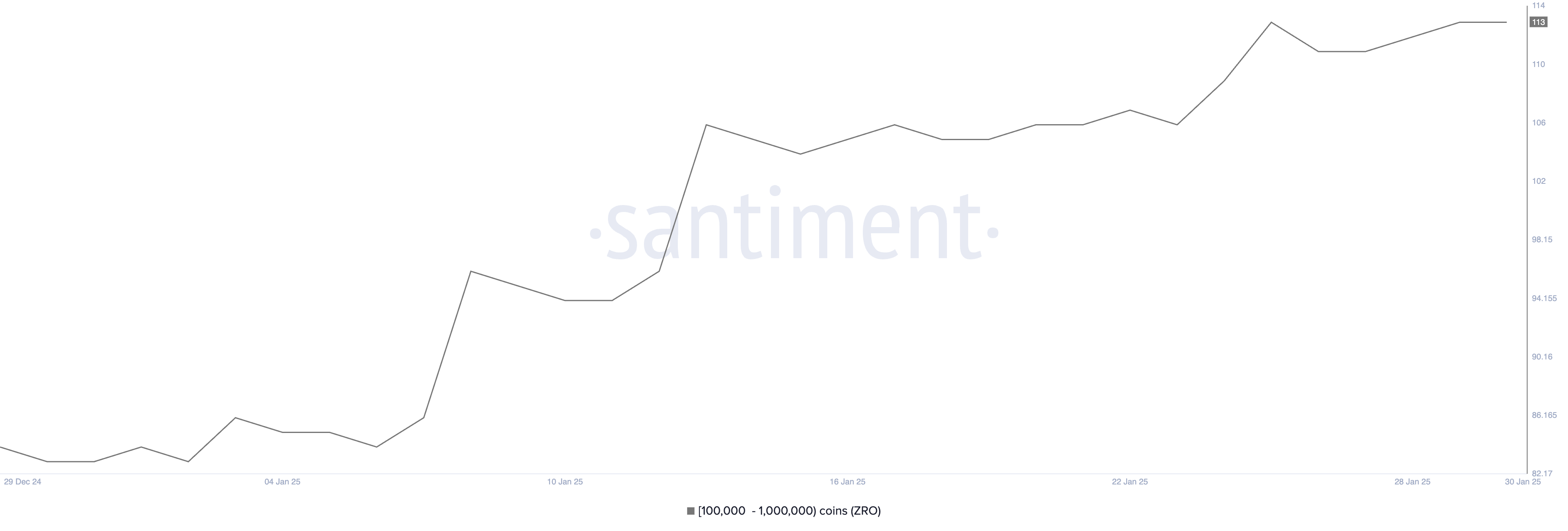

Whales bought ZRO steadily throughout January. Between December 29, 2024, and January 30, 2025, the number of addresses holding between 100,000 and 1,000,000 ZRO increased from 84 to 113.

With the lawsuit now settled, whale accumulation could drive further recovery. If momentum continues, ZRO may regain investor confidence in the coming weeks.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/what-crypto-whales-are-buying-in-february/

2025-01-31 17:00:00