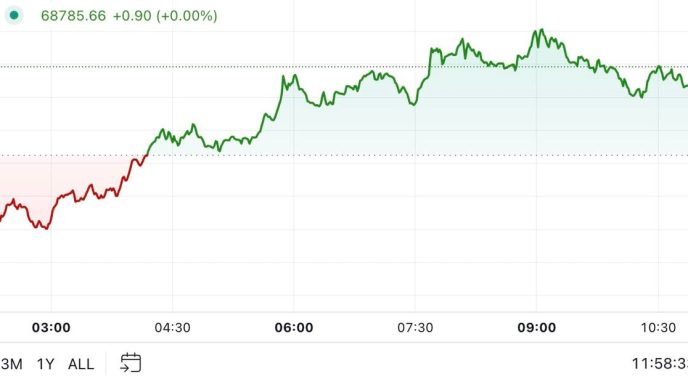

After skyrocketing above $72,000 earlier last week, the Bitcoin price has experienced an unexpected crash below the $70,000 mark ahead of the US Presidential elections. Reports have cited the influence of whales and the upcoming results of the US Presidential elections as catalysts to this price decline.

Bitcoin Price Crashes As Market Braces For US Election Results

The Bitcoin price seems to have experienced a pre-election crash. It is now trading below the $70,000 mark after declining by over 3.64% in just a few days. Many are labeling this sharp decline to the $68,000 level as the “biggest Bitcoin crash,” signaling that the most significant downturn in Bitcoin’s history has just started.

Related Reading

Market intelligence platform Santiment has noted the recent Bitcoin crash, highlighting the decreasing number of non-empty wallets by investors. According to the analytical platform, there have been 211,540 fewer addresses than three weeks ago. This massive reduction is seen as a sign of intense Fear, Uncertainty, and Doubt (FUD) typically associated with future bullish performance and a strained market.

Currently, the crypto market is in suspense mode as investors, both retail and institutional, await the results of the US Presidential elections. Even large-scale Bitcoin investors, often called ”Whales,” have been relatively mute, adopting a “Wait-And-See” attitude as they closely watch how the results of the US election impact the dynamics of the market.

Santiment also notes that Bitcoin whales have been reducing their transaction activity, signaling a change in market sentiment. The market intelligence stated that “Bitcoin whales are patiently awaiting the US Presidential election results as their activity settles from last week’s spike near crypto’s top.

The outcome of the US elections are expected to start pouring in today, and many crypto traders and investors are already preparing for major market volatility and unpredictability. On X (formerly Twitter), there has also been a spike in mentions related to Presidential candidate Donald Trump, who has gained significant support from various crypto community members.

How The US Presidential Elections Could Impact The BTC Price

Many crypto analysts hold varying opinions and predictions regarding the future of the crypto market after the US presidential elections. With major candidates, Kamala Harris or Trump vying for Presidency, investors and crypto experts are closely watching the market for changes.

Related Reading

According to crypto analyst Crypto Rover, the last time former President Trump won the US election, Bitcoin pumped 2,714%. The analyst has suggested that if history repeats itself, that is, if Trump wins the current Presidential elections and Bitcoin price experiences a similar surge, then the pioneer cryptocurrency could be worth $2 million by 2025.

Moreover, Santiment has revealed that in the previous election in November 2016, Bitcoin crashed by 5.5% after Trump was announced as President. In contrast, in November 2020, the Bitcoin price surged by 22.6% after Joe Biden was announced as President.

Based on social sentiment on X, it appears many members of the crypto community are supporting Trump as the next US President. However, Adam Khoo, a crypto analyst, has noted that over 50 million US citizens have already voted in the US elections, with exit polls showing a significant landslide victory for Harris.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-presidential-elections/

2024-11-05 13:00:46