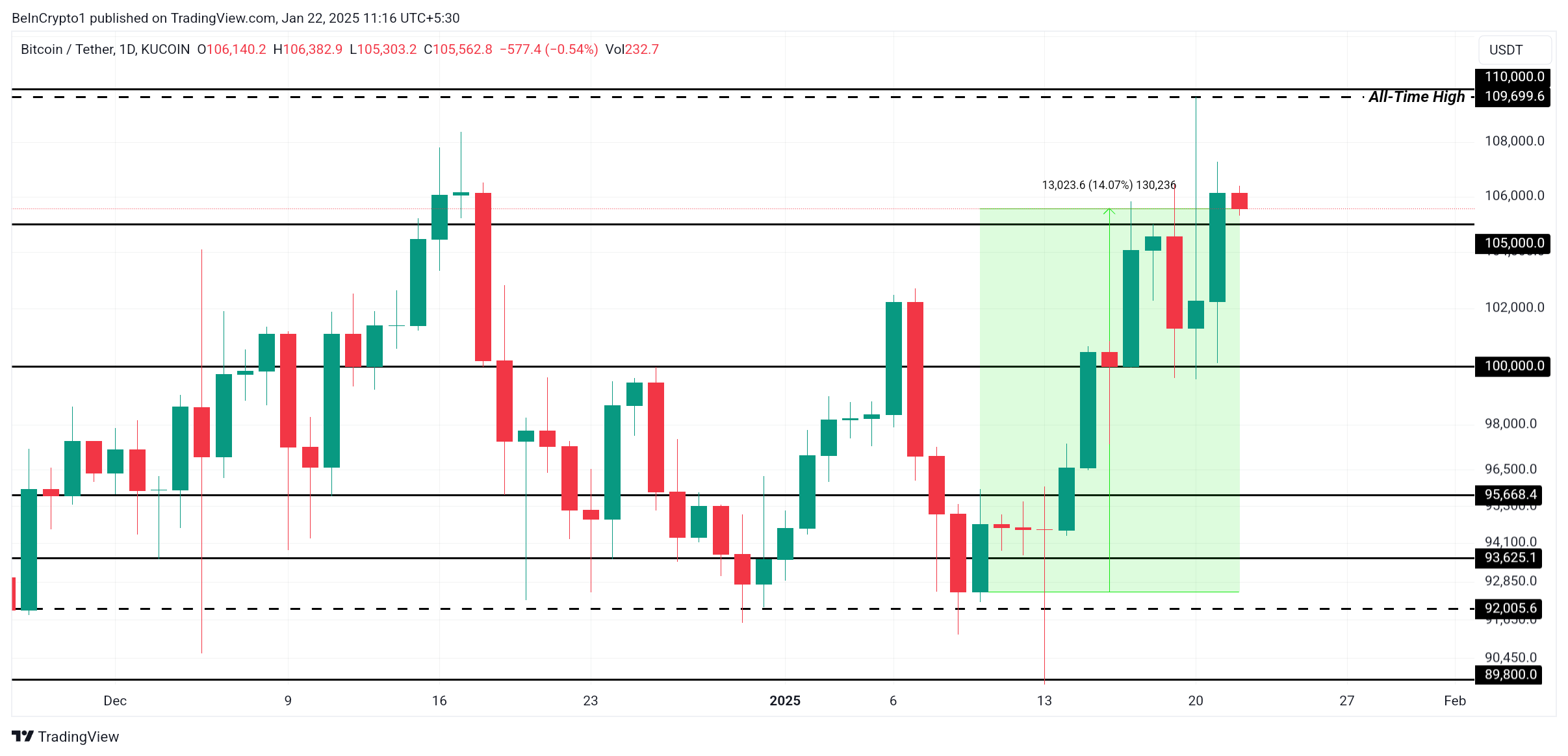

Bitcoin, the leading cryptocurrency, has once again captured the spotlight after rallying to a new all-time high of $109,699.

With the $110,000 milestone in sight, Bitcoin’s recent price action is being closely monitored by investors. A combination of sustained market conditions and renewed institutional interest has positioned the crypto king for potentially historic gains.

Bitcoin Investors Are Bullish

Market sentiment has shown a significant shift in recent weeks, particularly through the lens of Coin Days Destroyed (CDD). Late 2024 saw a period of elevated CDD, signaling heavy activity among Bitcoin long-term holders (LTHs) cashing out during the rally.

However, January has brought a notable cooldown in CDD, indicating reduced selling pressure from these key investors. This trend suggests that most profit-taking among LTHs is complete, paving the way for a more stable price trajectory.

Low CDD is often interpreted as a positive sign for Bitcoin’s recovery. It reflects conviction among long-term investors, who are holding onto their coins rather than selling into the market. Such investor behavior typically builds confidence and supports upward price momentum, providing a favorable backdrop for Bitcoin’s push to $110,000 and beyond.

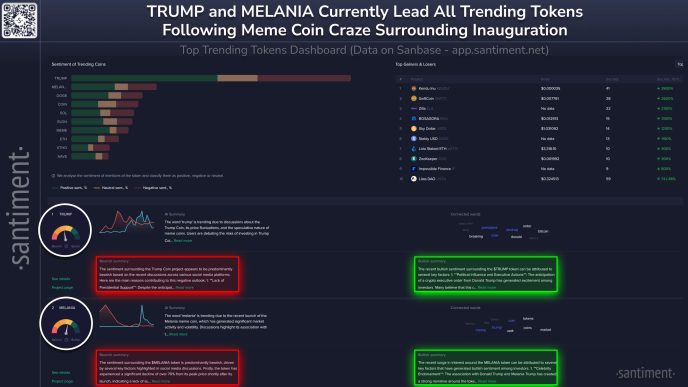

Bitcoin’s macro momentum has also gained strength, supported by the accumulation activity of smaller investors, often referred to as “Shrimps” and “Crabs.” These holders, who possess less than 10 BTC, collectively added over 25,600 BTC worth approximately $2.71 billion. This surge in accumulation is proof of growing confidence among retail investors.

The Shrimp-to-Crab balance spike indicates a broad base of support for Bitcoin’s price. This demographic’s increasing participation reflects long-term bullish sentiment. Their buying activity often stabilizes the market, acting as a cushion during corrections and amplifying price rallies during bullish phases.

BTC Price Prediction: Onto New High

Bitcoin’s recent all-time high of $109,699 was fueled by strong market fundamentals and strong investor sentiment. If momentum continues, the cryptocurrency could breach the $110,000 mark, cementing its position as a high-performing asset in 2025. This milestone would likely attract additional buying interest, reinforcing Bitcoin’s bullish outlook.

To secure its ascent, Bitcoin must establish $105,000 as a strong support level. Currently trading around $105,562, the crypto king appears well-positioned to achieve this. A successful defense of this support zone could propel Bitcoin to new highs, unlocking further upside potential.

However, failure to maintain $105,000 as support could lead to a retracement toward $100,000. Such a decline would negate Bitcoin’s recent gains and dampen short-term bullish sentiment, raising the risk of prolonged consolidation before a renewed rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-could-soar-to-new-high/

2025-01-22 09:00:00