The leading coin, Bitcoin, has been trading within a narrow range since the beginning of February. It has struggled to break out of consolidation as both buying and selling pressures remain subdued.

On-chain data suggests that this period of sideways movement could persist due to weakening activity on the Bitcoin network.

Bitcoin Could Face Prolonged Sideways Movement as Network Activity Drops

According to a recent report by pseudonymous CryptoQuant analyst Avocado_onchain, Bitcoin network activity has been steadily declining, contributing to BTC’s recent narrow price movements. If this continues, “we must consider the possibility of another prolonged consolidation phase, similar to what began in March 2024,” the analyst says.

One such data Avocado considers is the number of daily active wallet addresses on the Bitcoin network. According to CryptoQuant’s data, when observed using a 30-day small moving average (SMA), the daily count of addresses that have completed at least one BTC transaction has plummeted by 2% since February 1.

A decline in active daily wallets on the Bitcoin network signals reduced user demand. This can contribute to downward price pressure on the coin, as decreased network activity typically aligns with lower buying interest.

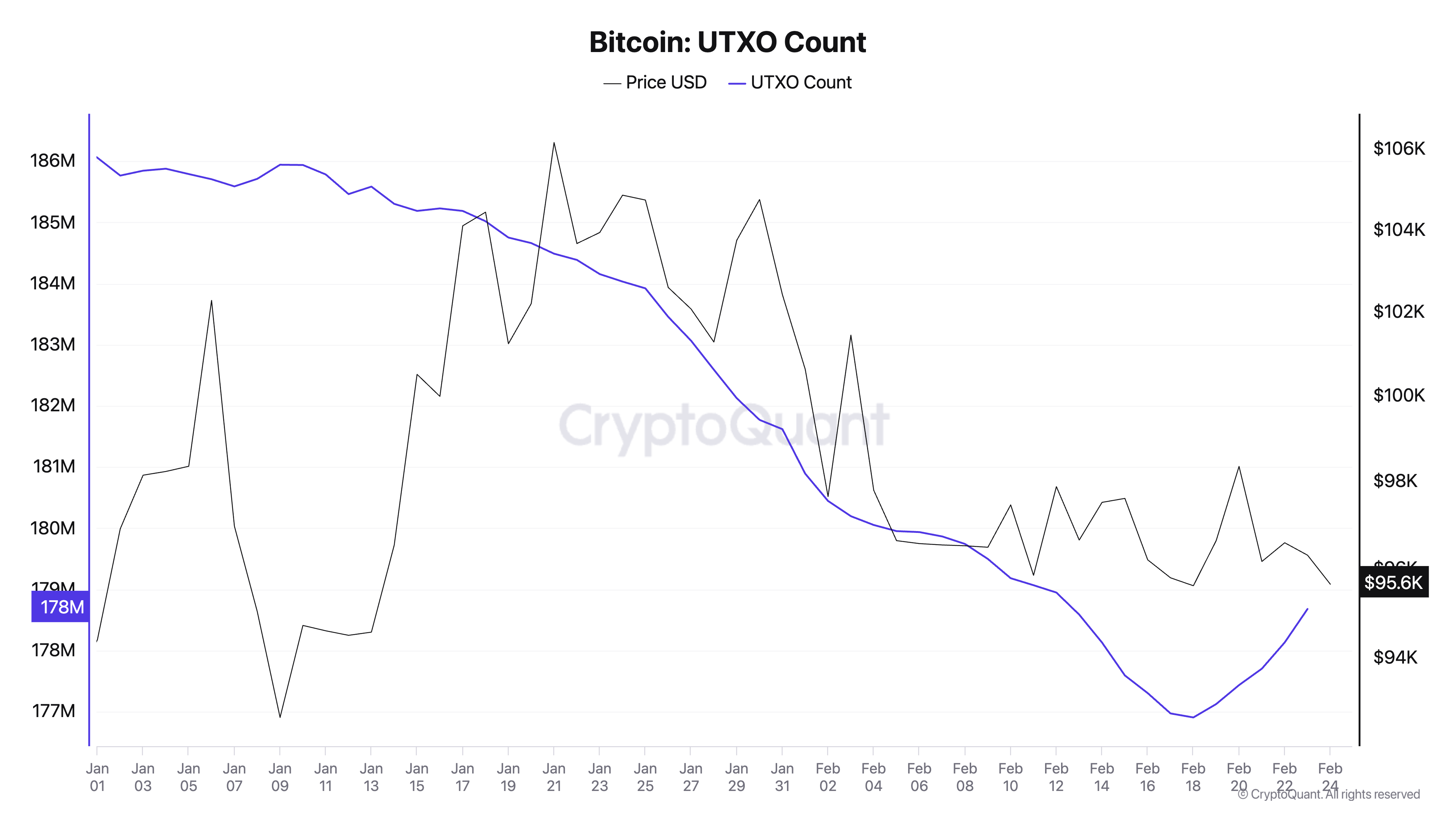

In addition, Avocado reports that “the number of UTXOs is also decreasing, with the magnitude of the decline similar to the correction period in September 2023.”

Unspent Transaction Output (UTXO) tracks the amount of Bitcoin left after a transaction, which can be used as input for future transactions. It represents the available balance that can be spent on the network. When the number of UTXOs declines, fewer new coins are being distributed or moved, suggesting reduced transaction activity. This indicates a period of consolidation, where investors are holding rather than spending their coins.

“If this trend continues, we could see signs of investor exodus similar to the market cycle peak of 2017. However, a simple decline in UTXOs alone is not enough to confirm the end of the current cycle, as other indicators still suggest a bullish outlook,” Avocado writes.

Bitcoin Hovers Near Key Support—Will It Hold or Break Lower?

As of this writing, BTC trades near the support line of its horizontal channel at $95,527. If the Bitcoin network activity wanes, further affecting the demand for the king coin, its price could break below this level. In this scenario, BTC could drop to $92,325.

On the other hand, if market trends shift and the buying pressure gains momentum, the coin could rally toward the resistance at $99,031 and attempt a crossover. If successful, BTC could reach $102,665.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-network-activity-falls/

2025-02-24 13:08:40