Solana’s (SOL) price has had one of the most dejecting trajectories as volatility continues to keep profits at bay.

With September upon the crypto market, BeInCrypto’s analysis points towards an ever more bearish month for SOL.

Solana Loses Institutions’ Backing

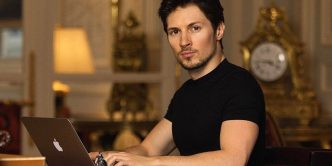

Solana’s price typically follows Bitcoin and Ethereum, but institutional investors are having a stronger influence on it lately. Unfortunately, this influence has been negative, as these investors have taken a bearish stance.

Throughout August, large wallet holders consistently withdrew their investments. By August 24, SOL experienced $34.3 million in outflows, making it the least favored crypto asset during that period.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

These outflows will likely continue in September. Griffin Ardern, Head at BloFin Research & Options, supports this view, suggesting that SOL might underperform, potentially faring worse than Ethereum.

“For Solana, we tend to believe that its price performance will be similar to ETH, but its price will be more solid than ETH. Since Solana has not yet entered the portfolio of traditional market investors, its ability to obtain liquidity will be worse than BTC and ETH, and the impact of liquidity changes on SOL prices will be relatively more significant, which means that its volatility will be higher than BTC,” Ardern told BeInCrypto.

However, Ardern also mentioned that SOL has more attractive narratives and applications for investors compared to Ethereum, such as meme coins. Because of this, its price performance could potentially outperform Ethereum’s, despite the current bearish outlook.

SOL Price Prediction: For the Better or for the Worse?

Solana’s price might not take a single path but fluctuate between bullish and bearish, just as it did in August. The range between $160 and $126 has been a strong consolidation zone for the past five months.

SOL is expected to stay within this range, with potential to break out toward $169. However, its broader consolidation between $186 and $126 might prevent a full escape.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

The bearish-neutral outlook will only change if $186 flips into support, which could trigger the launch of spot Solana ETFs, although this is not expected soon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Daria Krasnova

https://beincrypto.com/what-to-expect-from-solana-in-september/

2024-09-01 19:00:00