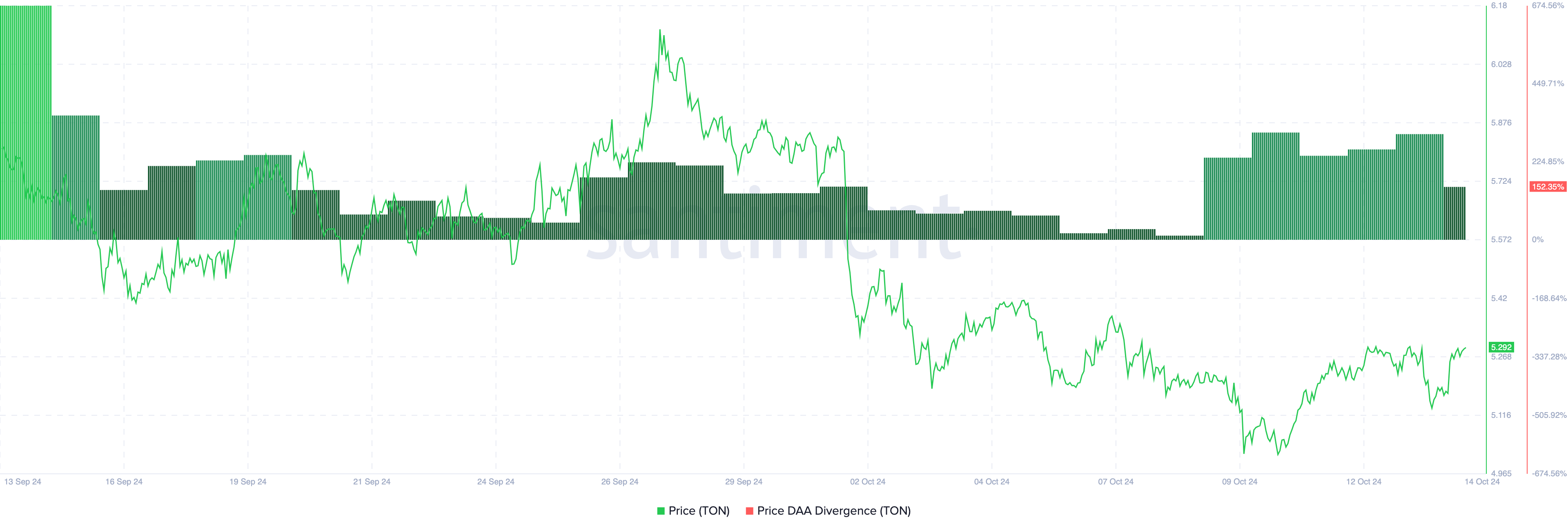

Toncoin (TON) is finally offering what appears to be a crucial buying opportunity for investors. While the token remains 35% below its all-time high, several key metrics suggest that TON’s price may be entering a favorable accumulation zone.

Since July, TON has struggled to retest the $8 mark despite showing signs of potential breakouts at various points. However, according to this on-chain analysis, there is a strong chance the altcoin could reach that level before the end of 2024.

Toncoin’s Sharpe Ratio and User Growth Indicate Healthier Market

Toncoin’s price is currently $5.29 and has been swinging around the same area since October 11. However, the Sharpe ratio, which measures risk-adjusted returns, indicates that the cryptocurrency has reached a low-risk area.

Using CryptoQuant data, when the Sharpe ratio turns red, it is at a high-risk area that usually foreshadows a price correction. But as of this writing, Toncoin is in the green zone, indicating that the altcoin has provided an attractive option for those wondering if the current price levels might produce favorable returns.

Read more: Top 9 Telegram Channels for Crypto Signals in October 2024

In light of this development, crypto analyst Maartunn suggests that TON is showing signs of recovery. However, in his post on CryptoQuant, he encouraged investors to be cautious and wait before committing significant capital to the altcoin.

“Although I wouldn’t advise buying directly at this moment, it could be beneficial to add it to a watchlist or wait for an extremely low-risk signal before taking action. With the Sharpe Ratio cooling down and the number of unique users rising above 100 million, this coin is beginning to look healthy again,” Maartunn wrote.

Toncoin’s price Daily Active Addresses (DAA) divergence supports this outlook. Typically, a drop in DAA divergence indicates declining user engagement and often serves as a sell signal. However, as of this writing, the metric has risen, suggesting that increasing activity on Toncoin’s network could support its potential price growth.

TON Price Prediction: Rally Beyond $7 Possible

A look at the chart shows that Toncoin’s price is nearing the 61.8% Fibonacci retracement spot. Currently positioned at $5.52, this ratio, also known as the golden pocket ratio, is considered a strong support area.

Therefore, if TON reclaims that level, it could provide the necessary strength to drive the price hike. By the look of things, hitting $5.52 could send the altcoin up to $6.19— the 38.2% Fib level, which is also a significant area.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Should this happen, Toncoin could rally to $7.27. The last time the cryptocurrency hit that level was after Binance listed the Telegram-native token. However, if TON encounters rejection at $6.19, the forecast might not come to pass. Instead, it could decline to $4.44

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/toncoin-price-buying-opportunity/

2024-10-14 19:00:00