XRP is rallying after the SEC officially dropped its lawsuit against Ripple, triggering a 13% price surge in the past 24 hours. Strong technical signals and growing market participation are supporting the bullish momentum.

XRP’s network activity is also hitting record levels, with active addresses soaring to new highs. As traders digest the legal victory and positive market signals, XRP’s outlook is strengthening, increasing the chances of further upside in the near term.

XRP DMI Shows Buyers Are In Full Control

XRP’s DMI chart reveals a notable shift in momentum, with its ADX (Average Directional Index) rising to 20.4 from 15.64 following the news that the SEC is dropping its lawsuit against Ripple.

This increase signals a strengthening market trend, as the ADX tracks the overall strength of a trend without specifying its direction.

The recent surge suggests that the price action is gaining conviction, especially as the market digests the positive legal developments surrounding Ripple.

The ADX is often used alongside the +DI and -DI indicators, which help identify trend direction. Typically, an ADX above 25 confirms a strong trend, while values below 20 suggest a weak or range-bound market.

In XRP’s case, the +DI has jumped from 18.3 to 39, while the -DI has dropped from 19.63 to 12.97, indicating a clear bullish divergence.

This sharp rise in buying strength (+DI) combined with a weakening bearish signal (-DI) supports the idea that XRP is attempting to maintain and possibly extend its uptrend. If this dynamic continues, it could see further upside in the short term as bullish momentum builds.

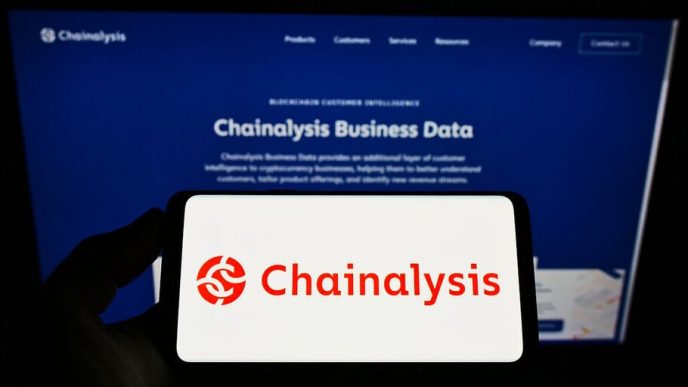

XRP Active Addresses Are Reaching New Records

XRP’s network activity has been surging, with the number of 7-day Active Addresses reaching an all-time high of 1.19 million. This is a massive increase from the 237,000 recorded on February 27, marking an almost fivefold rise in just a few weeks.

The spike in active addresses signals that XRP’s blockchain is seeing heightened participation, whether from retail traders, institutional players, or speculative interest.

Such elevated levels of activity are rarely seen and could indicate growing attention and usage of the network.

Tracking the number of active addresses is crucial as it offers insight into the level of user engagement and real demand on the blockchain.

Generally, an increase in active addresses can suggest that more participants are transacting or interacting with the network, which often correlates with stronger liquidity and potentially higher price volatility. In XRP’s case, this record-breaking surge in activity could act as a bullish signal, hinting at growing interest and possibly renewed capital inflows.

While it doesn’t guarantee immediate price appreciation, such strong network participation could help support XRP’s price and reduce downside risk, especially if coupled with other bullish technical or fundamental factors.

Can XRP Reach $3 Soon?

Its EMA lines are currently pointing to a potential new golden cross forming soon.

Should this scenario unfold, XRP price may first challenge the resistance at $2.648. If buying momentum strengthens further, the price might push toward $2.99, potentially breaking above the barrier at $3.

Conversely, a renewed downtrend could take shape if the bullish momentum fails to materialize and XRP’s price struggles to hold above its current range.

In this case, the key support level at $2.47 would become clear. A breakdown below this threshold could expose XRP to further downside risk, testing $2.21 and possibly driving it down to as low as $1.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/will-xrp-price-hit-all-time-high-as-sec-drops-ripple-lawsuit/

2025-03-19 23:30:00