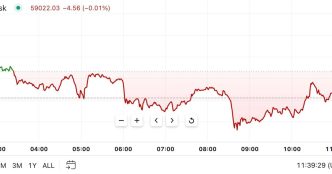

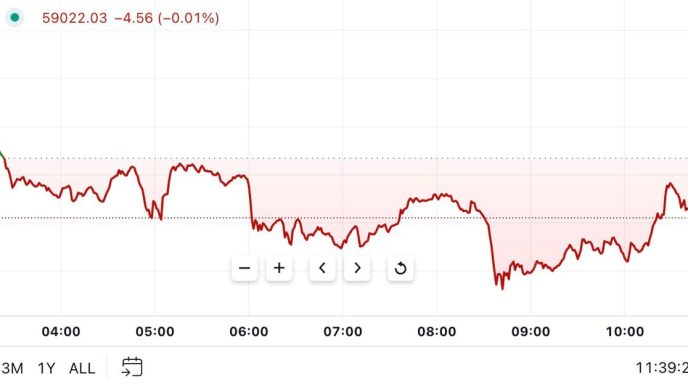

Chainlink’s (LINK) price follows the broader market cues and, as a result, is currently stuck and moving sideways.

However, the opportunity for a breakout is around the corner, and it will be presented by the Bollinger Bands.

Key Indicator for Chainlink

Chainlink’s price hovered between $9 and $12 for most of the previous month. This, however, is not an uncommon occurrence for LINK. In the past, the altcoin has gone on to consolidate for as little as 32 days and for a good 83 days as well.

At present, it has been 30 days, and by the looks of it, LINK will take more than just 32 days to rise. This is evident in the Bollinger Bands, a technical analysis tool consisting of a middle band and two outer bands placed two standard deviations away from the middle band. They help identify price volatility and potential overbought or oversold conditions in an asset.

Generally, when the indicator squeezes, i.e., the bands narrow, the volatility comes to a halt. This is a signal of an eventual surge in volatility, which frequently results in a rise. Similar incidents have been noted in the past.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

While the bands did squeeze in the latter half of August and LINK rallied, it failed owing to bearish macro financial markets. This failed breakout extended the next potential squeeze, leaving more room for consolidation.

Secondly, a key group of investors has also been unnaturally bearish. The addresses holding between 1 million and 10 million LINK have been very slow at accumulating. Despite the low prices, in the last 11 days, these investors have bought only $40 million worth of LINK.

Their skepticism influences the overall confidence of the investors. The drawdown of slow accumulation is a delayed recovery, which, by the looks of it, is fated for Chainlink’s price.

LINK Price Prediction: Walls Ahead

Chainlink’s price is trading at $10.57 at the time of writing, attempting to flip the barrier of $10.79 into support. This local support level is crucial for LINK as a bounce-off could help the altcoin break out of the broadening descending wedge.

In effect since late May, this pattern suggested a 37% rally is on the cards following the breakout, placing the target at $15.6. However, considering the aforementioned cues, a delay is likely, which could lead to either a failed breach or consolidation under $12.3 for LINK.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

Nevertheless, if the broader market cues change for good in the next week, a rise is possible. The breakout will be confirmed once Chainlink’s price flips $12.94 into a support floor, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/chainlink-link-price-rally-delayed/

2024-09-03 12:00:00