Immutable (IMX) has seen a sharp 14% price decline over the past 24 hours following a Wells Notice issued by the SEC.

This regulatory concern coincides with today’s token unlock. Here’s what’s happening and what might be next for IMX’s price.

Immutable Sentiment Turns Bearish

In the early hours of November 1, Immutable disclosed in a blog post that the US SEC had served it a Wells notice.

For context, a Wells Notice is a communication issued by the US Securities and Exchange Commission (SEC) to individuals or entities under investigation for potential violations of securities laws. It informs them of the findings and allows them to respond before any formal charges are filed.

While the SEC did not outrightly mention the reason for the notice, Immutable believes that the agency’s claims could be targeting the “listing and private sales” of its native IMX token in 2021.

Despite the regulatory scrutiny, the blockchain project expressed confidence that it has not engaged in any wrongdoing.

Following the development, the Weighted Sentiment around the IMX token dropped to the negative region. This decline indicates that most comments about the altcoin are pessimistic, which is a bearish sign.

Read more: What Is Immutable X?

Interestingly, this news coincides with the project’s scheduled unlock of IMX tokens valued at $44 million. Given the recent price drop and the upcoming supply increase from the token unlock, the IMX price could continue declining.

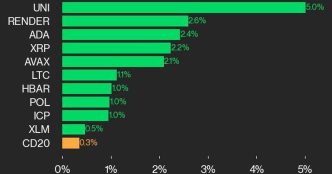

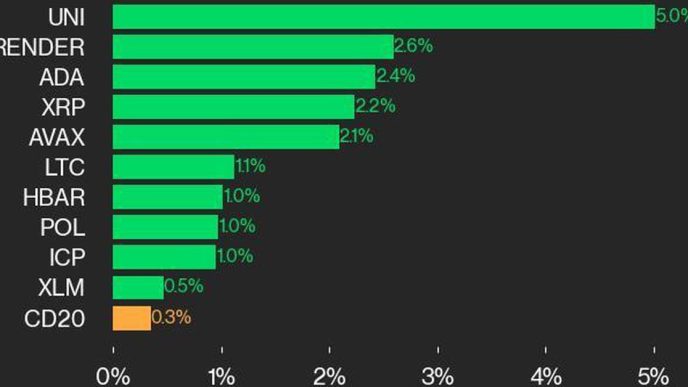

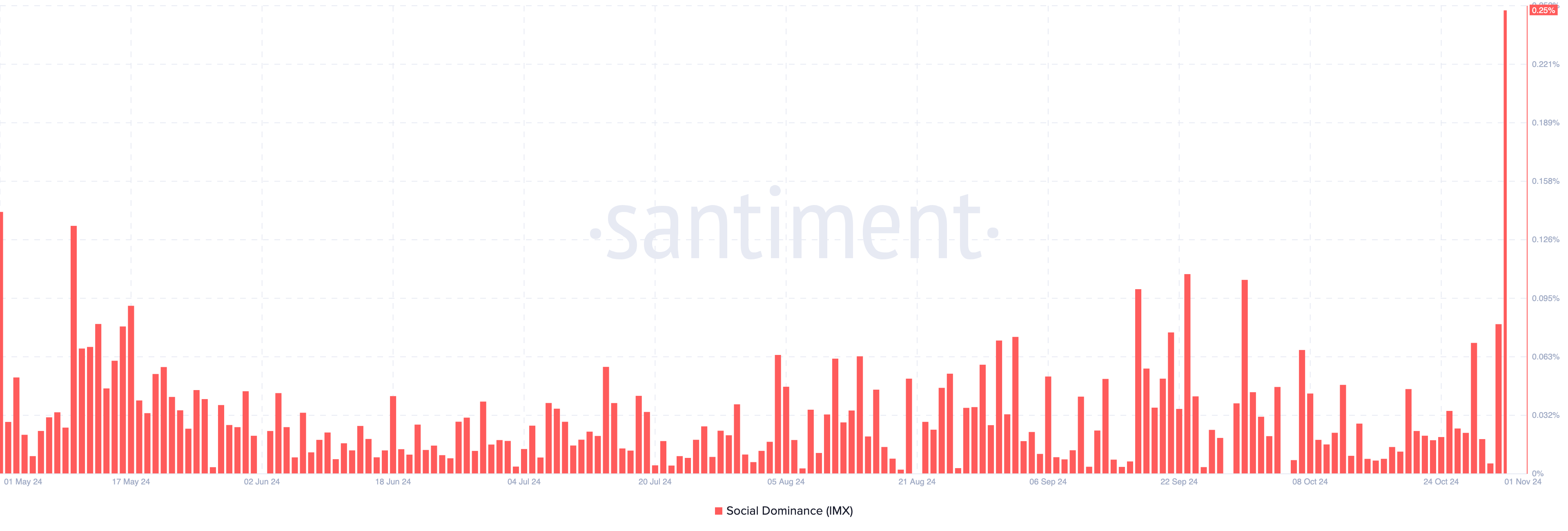

Meanwhile, this development has caused a massive surge in Immutable’s social dominance. According to Santiment, social dominance measures how much discussion an asset receives compared to other cryptocurrencies in the top 100.

So, the increase in IMX’s social dominance suggests that attention has shifted away from other cryptos and onto IMX. However, this uptick isn’t necessarily positive, as the heightened focus could stem from concerns over recent negative news surrounding the project.

IMX Price Prediction: Trend Remains Bearish

The daily chart shows that the Immutable price, at $1.17, has fallen below the 20- and 50-day Exponential Moving Averages (EMAs). The EMAs use price changes to predict a cryptocurrency’s trend.

Typically, when a cryptocurrency’s price is above the indicator, the trend is bullish. On the other hand, if the price falls below the indicator, the trend is bearish, as it is with IMX. If this remains the case, IMX’s price might decrease to $1.08.

Read more: What Are Altcoins? A Guide to Alternative Cryptocurrencies

In a highly bearish case, the price could drop below the $1 threshold. However, the altcoin might rebound if demand for IMX increases. In that scenario, it could rise to $1.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/immutable-price-sec-token-unlock/

2024-11-01 13:00:00