PEPE price is showing signs of a breakout despite the slight decline over the last 24 hours.

The investors are backing this outcome, making the meme coin’s future appear appealing.

PEPE Investors See Profits

PEPE price could be breaking out of the bullish descending wedge pattern that it has been in since mid-May. One of the biggest driving factors is not more participation but less from a particular group of investors, the short-term holders.

PEPE’s short-term holders, defined as those who hold the coin for less than a month, have seen their dominance drop to just 8%. This marks the lowest level on record, indicating a significant shift in the sentiment towards PEPE.

The drop in short-term holder dominance is noteworthy because these investors are typically more inclined to sell. With fewer short-term holders in the market, the selling pressure on PEPE has decreased, which could be a positive sign for the altcoin.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

The diminished influence of short-term holders suggests that more investors are holding onto their PEPE for longer periods. This could contribute to a more stable price environment.

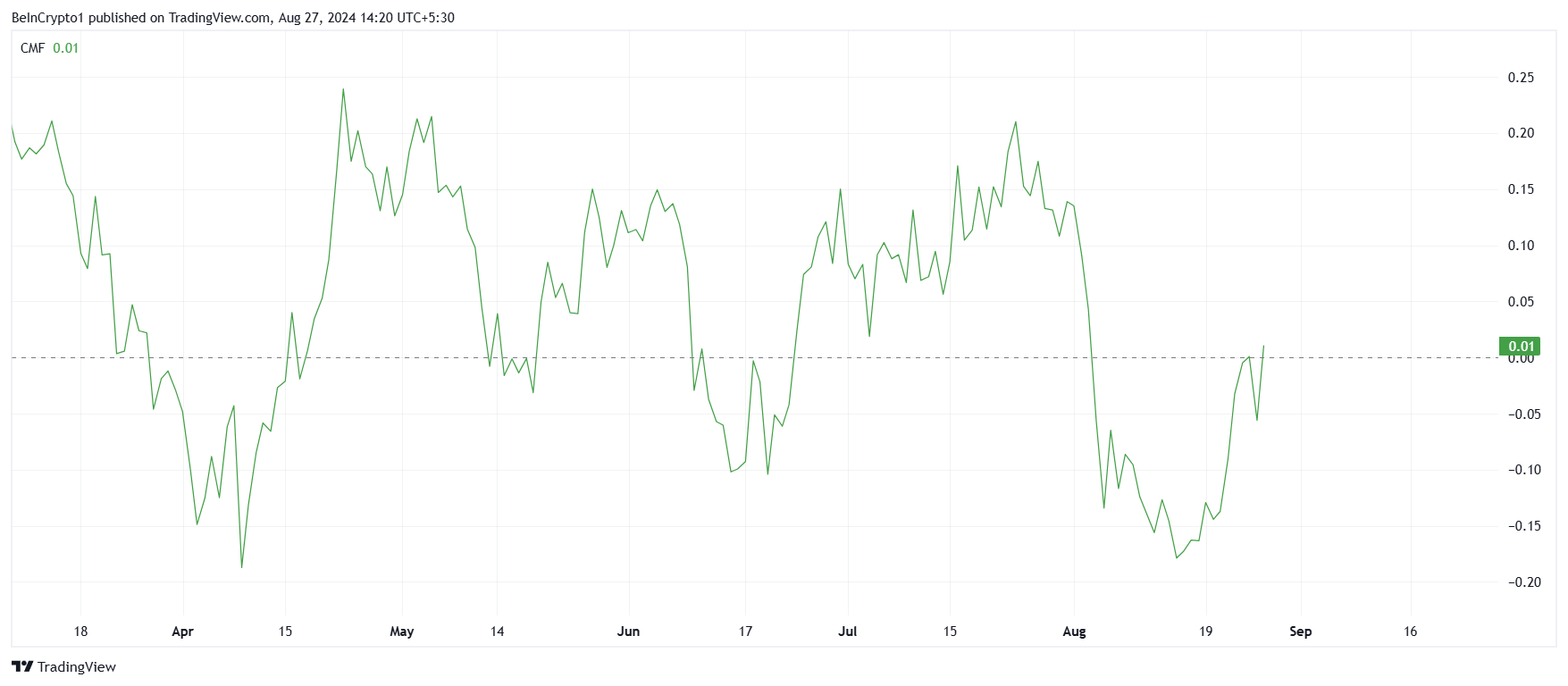

Adding to the optimistic outlook, the Chaikin Money Flow (CMF) indicator for PEPE shows that inflows have been very strong. This suggests that a significant amount of capital is entering the market, which could help fuel a recovery for the altcoin.

Thus, the combination of reduced short-term holder dominance and strong inflows points to a potential recovery for PEPE.

PEPE Price Prediction: Noting a Rally Could Be Difficult

While the positive cues point towards growth for PEPE price, there is an equal possibility of a decline. The bullish pattern suggests that the meme coin could note a 79% rise upon breakout, which could push it beyond an all-time high.

Realistically, upon breakout, the PEPE price will likely first aim to flip $0.00001146 into support. Achieving this will determine whether the altcoin can continue its uptrend.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

On the other hand, trading at $0.00000845, the meme coin is holding above the supports of $0.00000840 and $0.00000775. Losing these levels will send PEPE to test the lower trend line of the pattern, and if it falls below it, it invalidates the bullish thesis. As a result, the crypto asset could drop to $0.00000600 or lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pepe-price-poised-for-gains/

2024-08-27 15:00:00