Bitcoin (BTC) is showing signs of a potential parabolic rally in October. A combined reading of some on-chain metrics signals that the king coin is poised to move toward the $73,000 price mark.

This analysis delves into these metrics and highlights what BTC holders need to know.

Bitcoin Is the Talk of the Town

The spike in demand for Bitcoin Spot ETF is a notable marker of a potential rally above $70,000. Over the past week, these funds recorded only inflows, totaling $1.11 billion.

For context, on September 26, the Bitcoin Spot ETF inflows amounted to $366 million, representing its single-day highest since July 23. According to SosoValue, on that day, three major ETF providers — BlackRock, Fidelity, and Ark — recorded inflows of $118 million, $73 million, and $133 million, respectively, highlighting strong demand from US traditional investors.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Furthermore, shifts in the US economic environment strongly influence Bitcoin’s price. Since its launch, the coin’s price has been impacted by factors such as interest rate changes, inflation trends, employment data, and decisions made by financial regulatory bodies. Due to this, the uptick in demand or otherwise from US investors often impacts BTC’s price, making it imperative to track their activity.

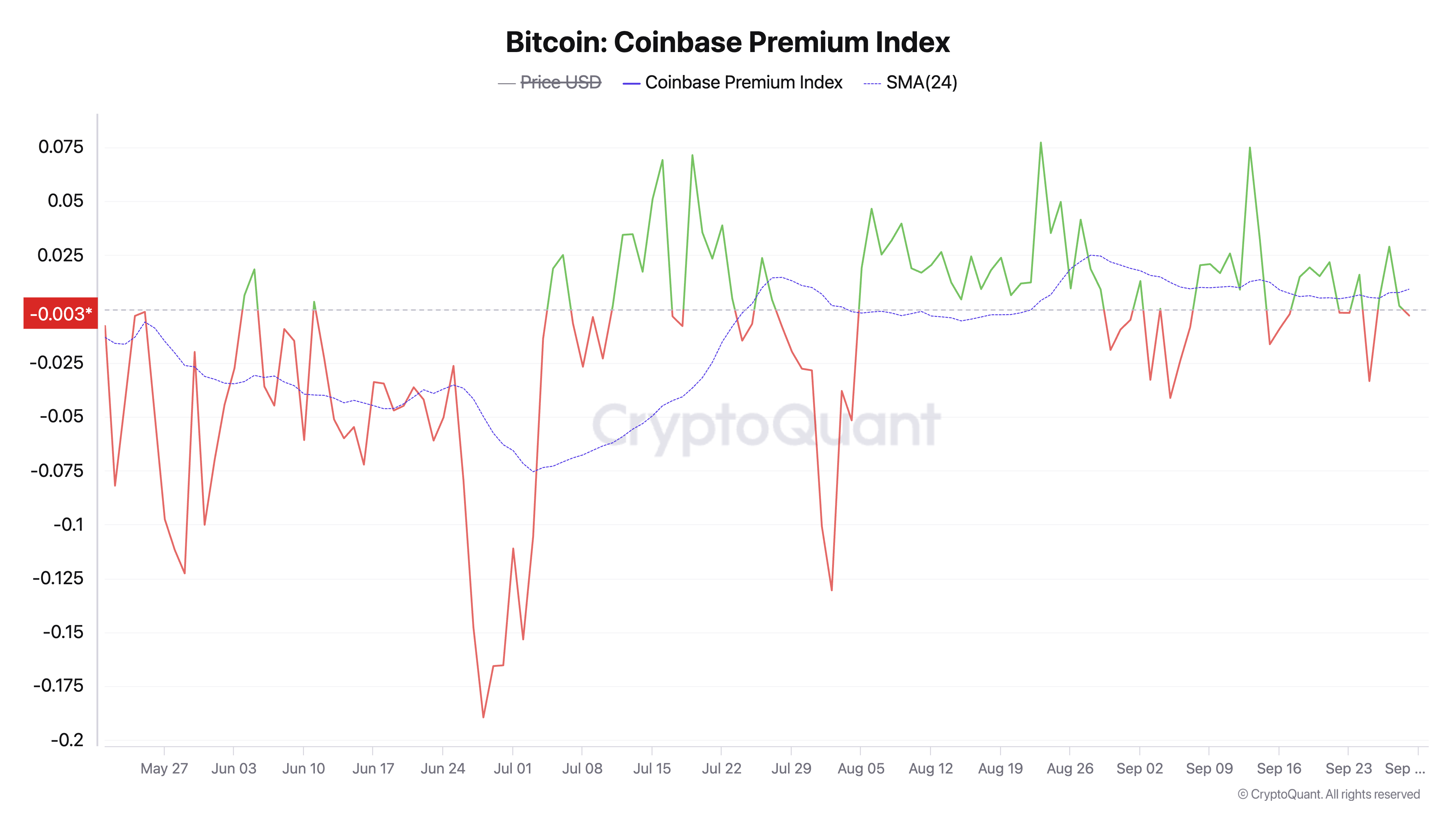

US-based retail and institutional investors have recently increased their BTC accumulation, as evidenced by its Coinbase Premium Index. In a recent post on X, Julio Moreno, Head of Research at CryptoQuant, noted that increased BTC demand in the US pushed the coin’s price toward $65,000.

If sentiment remains bullish and demand for the coin in that region continues to rise, Bitcoin’s price may chart a course toward trading above $70,000 over the next few weeks.

BTC Price Prediction: Rising Open Interest Poses Risks

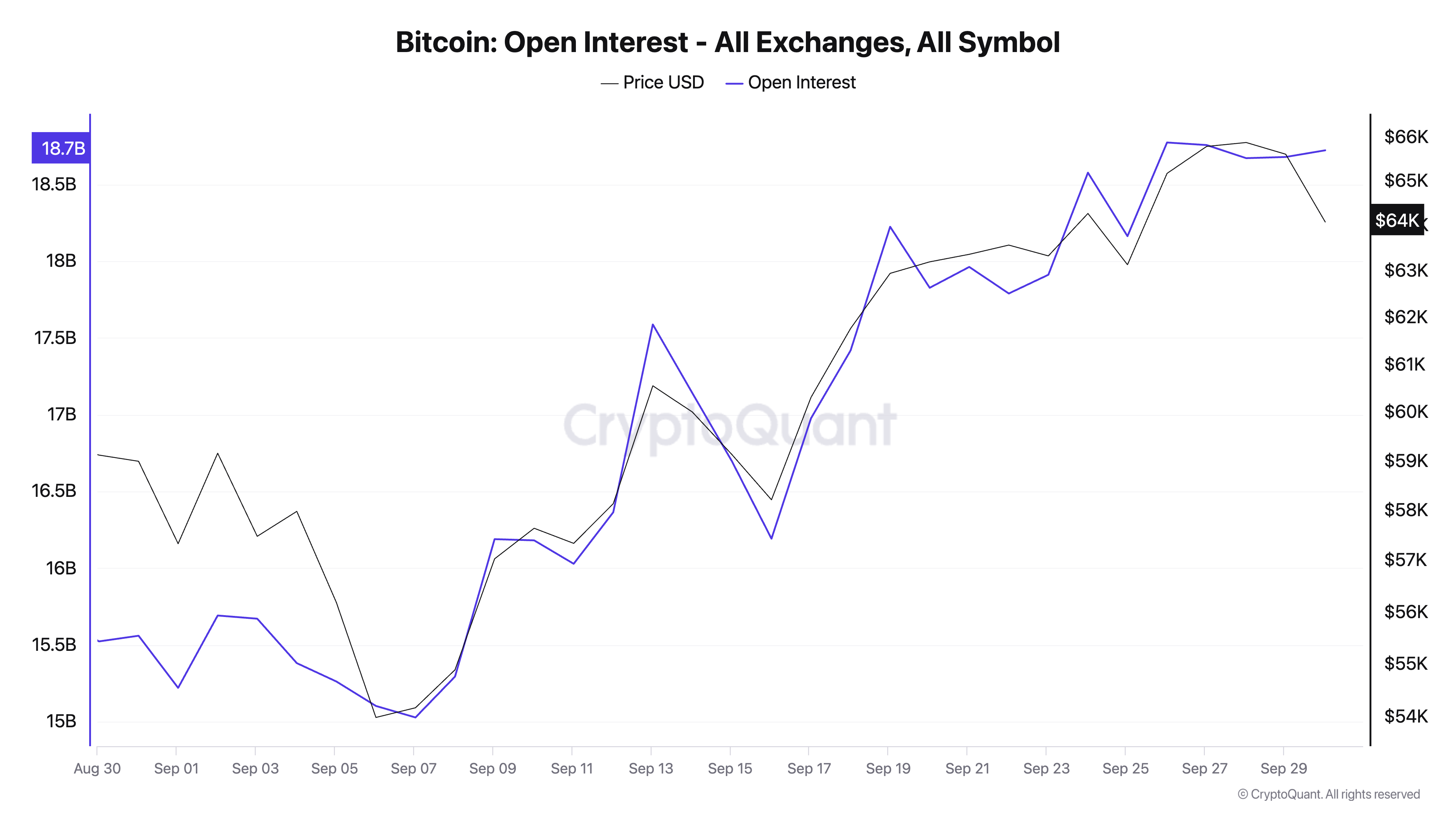

Bitcoin’s rising open interest is another good indicator that its price rally will continue. The coin’s open interest measures the total number of outstanding futures or options contracts that have not been settled or closed. Per CryptoQuant’s data, this currently stands at $19 billion, rising by 26% over the past 30 days.

Generally, the rise in an asset’s open interest signals increased market activity and could propel price to new highs. However, some analysts think it poses risks to holders of long positions.

“Open Interest is high, very high, with over $19.1B. We’re in a high-risk zone, and in my opinion, it’s not the best time for fresh long positions,” analyst JA Martuun said in an X post.

A combined reading of the on-chain data above points to a sustained bullish bias toward Bitcoin. If this trend is maintained, its price will establish local support at the $64,312 price level and aim to breach resistance at $67,929. A successful break above this level will set BTC on the path to trading at $73,777. It last reached this price level on March 14.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

However, Bitcoin’s Crypto Fear & Greed Index readings indicate an overheated market. When the index is in the “Greed” zone, coin holders are overwhelmingly optimistic. Historically, this has been a sign of a potential price correction.

If Bitcoin’s price corrects, it may plummet by 15% to trade at $54,302, invalidating the bullish thesis above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-price-may-reach-73000-in-october/

2024-09-30 18:00:00