Bitcoin (BTC) is finally making a comeback, with recent price spikes signaling a potential start of the long-awaited market bull run. As the cryptocurrency retests the $57,000 level, this renewed momentum could ignite a positive price rally, potentially driving more gains for Bitcoin.

Bitcoin Retests New Levels At $57,000

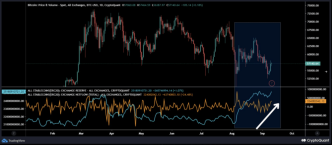

On Tuesday, September 10, Santiment, a market intelligence platform, disclosed a new positive change in Bitcoin’s price movements. The platform revealed in an X (formerly Twitter) post that Bitcoin’s market value has experienced a notable uptick, skyrocketing to $57,600 this week.

Related Reading

Notably, Bitcoin’s price surged more than 4.8% on Monday, September 8, marking a significant milestone for the cryptocurrency, which has been recording persistent price declines over the past few months. Earlier in August, the price of Bitcoin crashed below the $50,000 level, reflecting a decline of more than 20%.

This massive price decline was triggered by various factors including large scale liquidations from the German government and the increased sell off fears and market uncertainty fueled by Mt.Gox’s Bitcoin distribution plan. As the market digested the price crash, Bitcoin fought its way back from previous lows to hit its current price above $56,000.

Currently, the cryptocurrency is retesting new support levels around $57,000. A push above this price mark could potentially signal the onset of an even larger rally. Santiment has disclosed that Bitcoin’s recent price increase has come amidst short-selling activities ongoing on major crypto exchanges such as Binance and Bitmex since September 7.

Based on the current market sentiment, the market intelligence platform suggests that the prevailing Fear, Uncertainty and Doubt (FUD) amongst investors in the crypto market could contribute to an even higher price surge for Bitcoin.

This bullish sentiment is also shared by Michael van de Poppe, a popular crypto analyst, who has reported that Bitcoin is presently holding a price range between $58,000 and $56,000. Poppe indicated that the cryptocurrency is showing strong price fundamentals, while many altcoins are gaining momentum.

The analyst expressed surprise that Bitcoin was able to invalidate his previous bearish set up to break above $56,000. As such, Poppe expects more positive inflows into the market if Bitcoin can have a retest above $55,000. He believes that if the cryptocurrency can break through this level, its price could surge to new levels between $60,000 to $61,000 in the coming weeks.

Historical Patterns Suggests Imminent BTC Break Out

A crypto analyst, identified as ‘Rekt Capital’ on X has made a bullish projection for Bitcoin, anticipating a major price breakout for the cryptocurrency soon. Historical patterns currently suggest that Bitcoin could potentially experience a significant price rally and push out of bearish trends in the next two weeks.

Related Reading

Rekt Capital has disclosed that the month of September is typically a bearish period with limited monthly returns for Bitcoin. However, chances are that by October, Bitcoin’s price could surge considerably, extending this positive momentum into November and December.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-retesting-57000-good/

2024-09-11 22:00:20