In recent days, the Binance Coin (BNB) market has shown indecision, with its price moving sideways, indicating that neither buyers nor sellers have enough momentum to drive a clear direction.

However, an uptrend in a key technical indicator suggests a bullish divergence is forming. A segment of the BNB market is anticipating an upward breakout and has started accumulating the altcoin in preparation.

Binance Coin Accumulation Underway Despite Price Consolidation

Between September 6 and 12, BNB’s price trended upward in an attempt to breach the long-term support formed at the $560 price level. However, since this attempt failed, the coin’s price has moved sideways without a strong upward or downward trend.

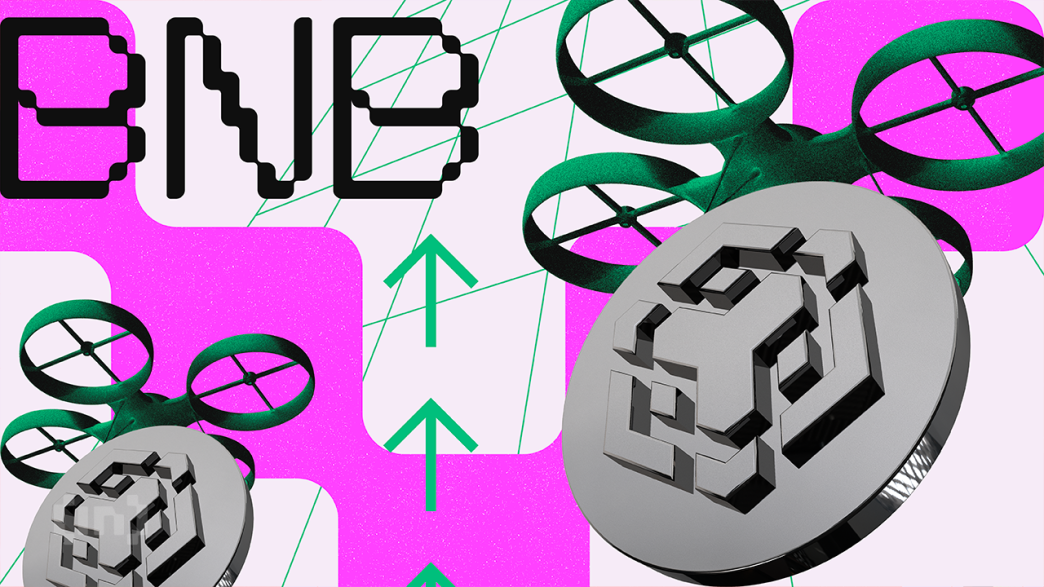

Interestingly, while BNB consolidates within a range, its Chaikin Money Flow (CMF), which measures the flow of money into and out of the asset, has climbed, forming a bullish divergence.

This divergence is formed when an asset’s price moves sideways while its CMF rises. It suggests that the buying pressure for the asset is increasing even though it is not yet evident in its price.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

A possible explanation is that the asset is being bought by “smart money” that anticipates a breakout to the upside once the price consolidates long enough.

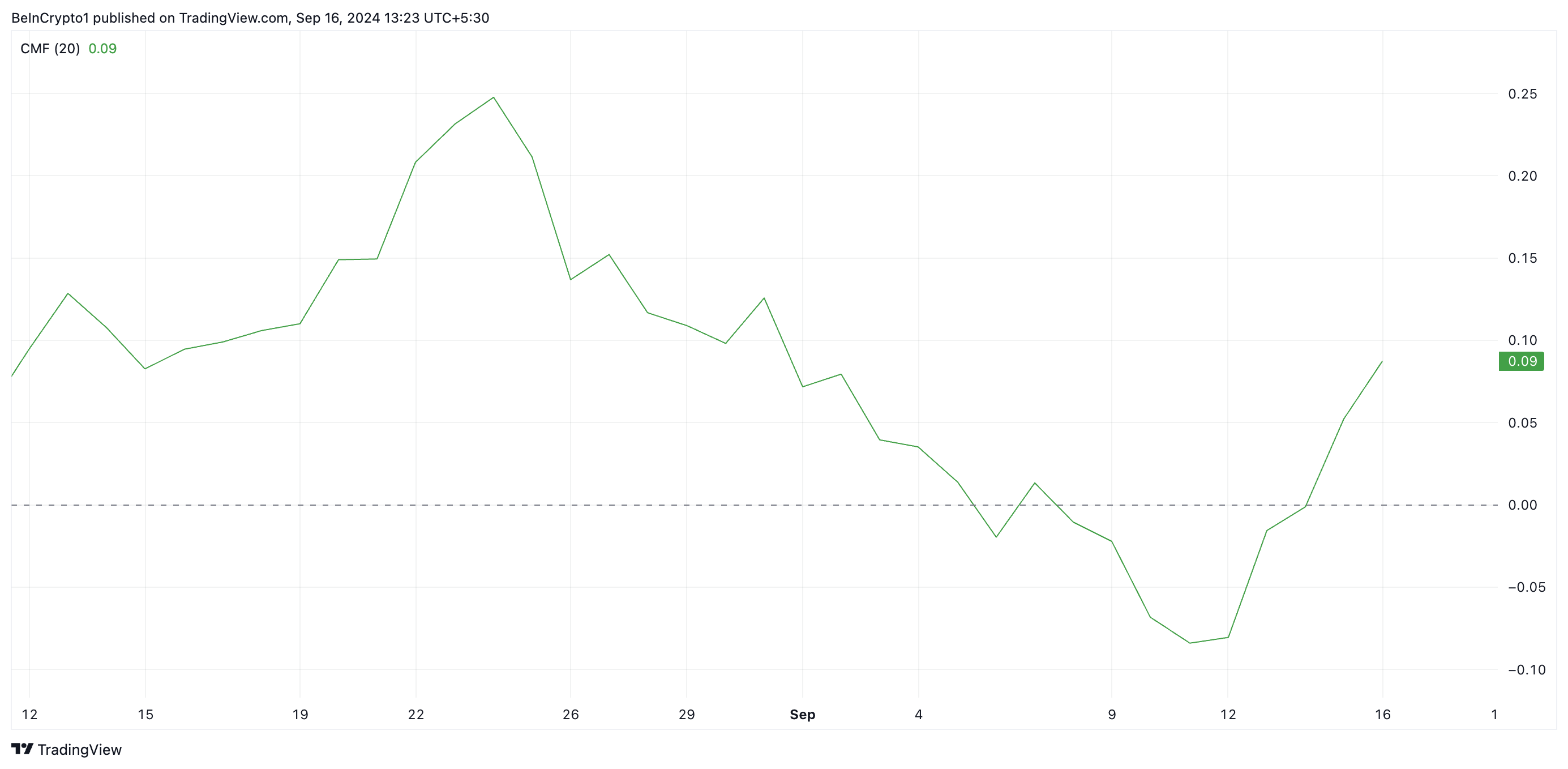

BNB’s positive Long/Short ratio confirms the bullish bias toward the altcoin. As of this writing, this ratio, which measures investor sentiment, sits at 1.04.

This suggests that more traders are taking long positions and are anticipating a price rise.

BNB Price Prediction: Why a Break Above $598 is Important

If these long positions succeed and BNB breaks out of its sideways pattern into an uptrend, the price could surpass $560 and aim for a key resistance level formed at $598 since July. BNB has tested this resistance thrice since then, failing to break through on each attempt.

If this retest succeeds, the coin may rally to a three-month high of $645.90.

Read more: 9 Best Crypto Desktop Wallets for 2024

However, if the BNB price breaks out of its consolidation in a downtrend, its price will plummet toward support at $468.90, invalidating the bullish projection above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bnb-price-prediction-upswing-possible/

2024-09-16 11:00:00