On Wednesday, December 11, Cardano’s (ADA) price dropped to $1.01 but has increased by approximately 15% over the last 24 hours. This increase has reignited hopes among the altcoin holders, suggesting that it could hold the uptrend firm.

However, recent on-chain data indicates that this might not be the case.

Cardano Investors Are Unconvinced

Cardano has been one of the top performers among the top cryptos in the last 30 days. During this period, the token rallied to a two-year high of $1.25 before cooling off and increasing again yesterday.

However, there are two major reasons why this Cardano price increase might not last. First, the holding time of transaction coins has significantly decreased. As the name implies, the coin holding time measures the amount of time a cryptocurrency has been held without being sold.

When it increases, it means holders are keeping their assets. On the other hand, a decline indicates otherwise, which is the case with ADA. Should this trend remain the same or continue, then ADA’s price might find it challenging to hold on to $1.16.

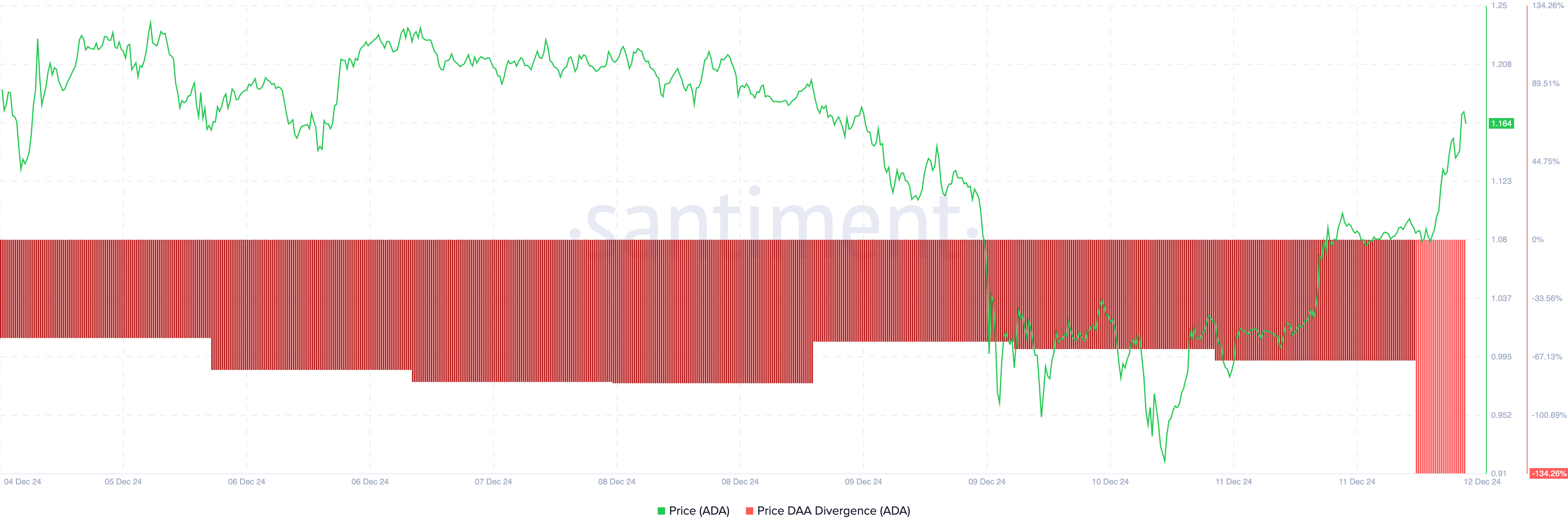

Second, the price-Daily Active Addresses (DAA) divergence further suggests that ADA’s rally might be short-lived. This metric evaluates the relationship between blockchain activity and price movement.

Typically, a rising price can attract more investors, boosting demand and valuation. Similarly, an increase in active addresses often signals higher investor interest, which is bullish for the cryptocurrency.

However, Santiment data shows that Cardano’s price-DAA divergence has plummeted by 134.26%. This indicates that while ADA’s price increased, active addresses declined — a bearish sign suggesting the rally may lack support. As a result, ADA could face a potential pullback.

ADA Price Prediction: To Go Under $1 Again?

Indicators on the daily ADA/USD chart seem to support this bearish outlook. One key indicator backing this thesis is the Moving Average Convergence Divergence (MACD). The MACD uses the difference between the 12 and 26-day Exponential Moving Average (EMA) to measure momentum.

When the reading is positive, momentum is bullish. But in this case, the MACD reading is negative, suggesting that the momentum around the token is bearish. Considering the current condition, the Cardano bullish price hike, which has taken it to $1.16, might find it challenging to extend.

In this scenario, ADA’s price could decline to $0.98. However, if momentum turns bullish, bulls might pave the way for an upswing. If that happens, ADA could jump to $1.33 and possibly move toward the $2 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ada-increase-heads-toward-dead-end/

2024-12-12 08:22:38