Cardano’s price has risen by 12% over the past month. As the market cools down, ADA could experience a correction, potentially leading to a short-term dip in October.

This analysis looks into how the gradual resurgence in ADA selling activity could cause its price to drop by 29% over the next few weeks.

Cardano Holders Begin to Take Profits

Cardano’s Chaikin Money Flow (CMF) has trended downward over the past few days. The CMF tracks the movement of capital into and out of the market, and while it remains positive, its gradual decline could serve as a cautionary signal.

A positive but declining CMF suggests that, although buying pressure is still present, the intensity of that buying is weakening. This indicates that demand for the asset may be tapering off, with buyers showing less aggression. If the trend continues, it could signal a shift toward reduced market interest or increased selling pressure.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

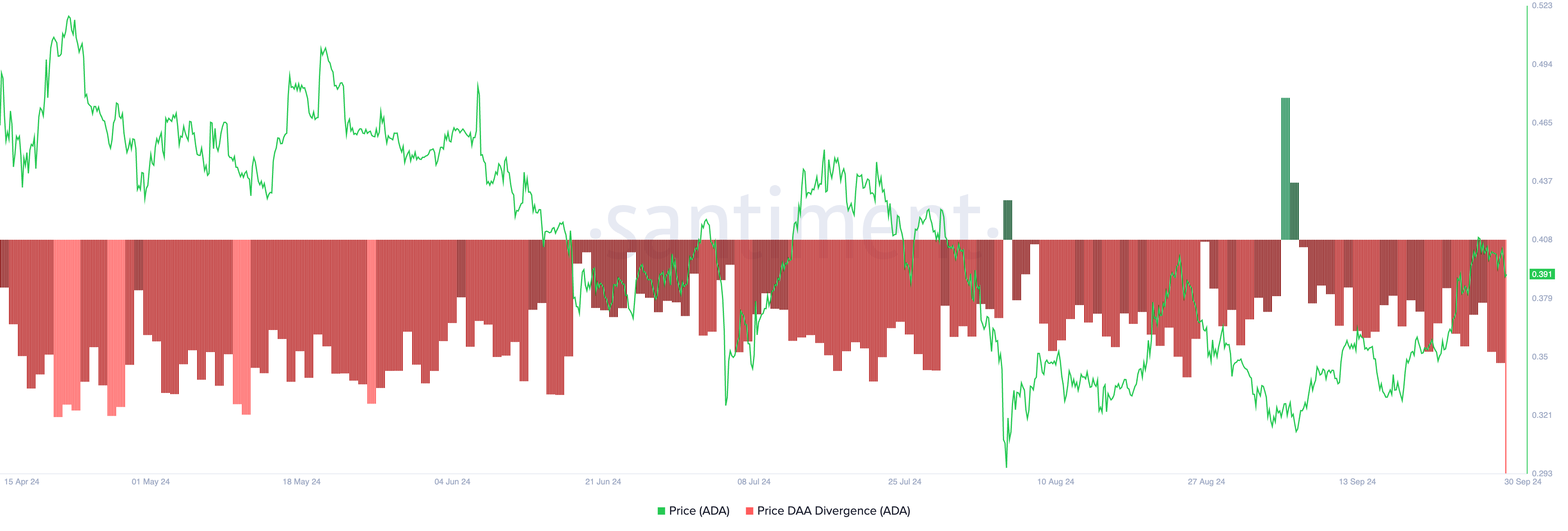

Furthermore, the negative readings from Cardano’s price daily active-address (DAA) divergence confirm the reduced demand for the altcoin. This metric, which measures an asset’s price movements with the changes in its number of daily active addresses, is at -43.3% at press time.

For context, it has been negative since September 7. This suggests that much of ADA’s rally this month has been driven by the broader market surge rather than a specific demand from traders for ADA.

ADA Price Prediction: A 29% Price Drop Is Likely

Cardano is currently priced at $0.39 and is looking to fall below its Ichimoku Cloud, which recently became a support level.

The Ichimoku Cloud indicator identifies trends, support and resistance levels, and potential market reversal points. When an asset’s price approaches the cloud, it signals weakening bullish momentum, suggesting that the recent upward price movements are losing strength.

If Cardano bulls fail to defend the cloud as a support level, ADA’s price may fall by 29% in the near term, causing it to trade at the August 5 low of $0.27.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if the market trend shifts from bearish to bullish, and ADA begins to witness a rise in demand, its price may climb toward resistance at $0.47.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-price-in-october-2024/

2024-09-30 11:30:00