TIA has defied expectations following the Celestia token unlock event, which saw the release of tokens worth $890 million earlier this week.

Over the past 24 hours, TIA has surged by 4%, outperforming the broader cryptocurrency market. This analysis examines whether the current price rally is likely to sustain its momentum or face a reversal.

Celestia Defies Expectations

On Wednesday, the Celestia token unlock event saw the release of 176 million TIA tokens, valued at approximately $890 million at current price. Token unlocks of this magnitude are often seen as “sell-the-news” events. The increase in circulating supply can drive selling pressure as holders may opt to sell their newly accessible tokens to secure profits.

However, the reverse has been the case for TIA. In the past 24 hours, the coin’s price has risen by 4%, positioning it as the top gainer among the 100 largest cryptocurrencies by market capitalization.

TIA continues to enjoy a strengthening bullish bias, as evidenced by its positive funding rate. BeInCrypto previously reported that following the token unlock event on Wednesday, TIA registered its first positive funding rate since September 10, reflecting the market’s optimism. As of this writing, this fee remains positive at 0.0085%.

Read more: 9 Best Blockchain Protocols To Know in 2024

An asset’s funding rate refers to the regular fee exchanged between traders in its perpetual futures market to ensure that its futures contract price aligns with its underlying spot price. When it becomes positive, it signals a shift from bearish to bullish sentiment, indicating that traders increasingly take long positions in anticipation of rising prices.

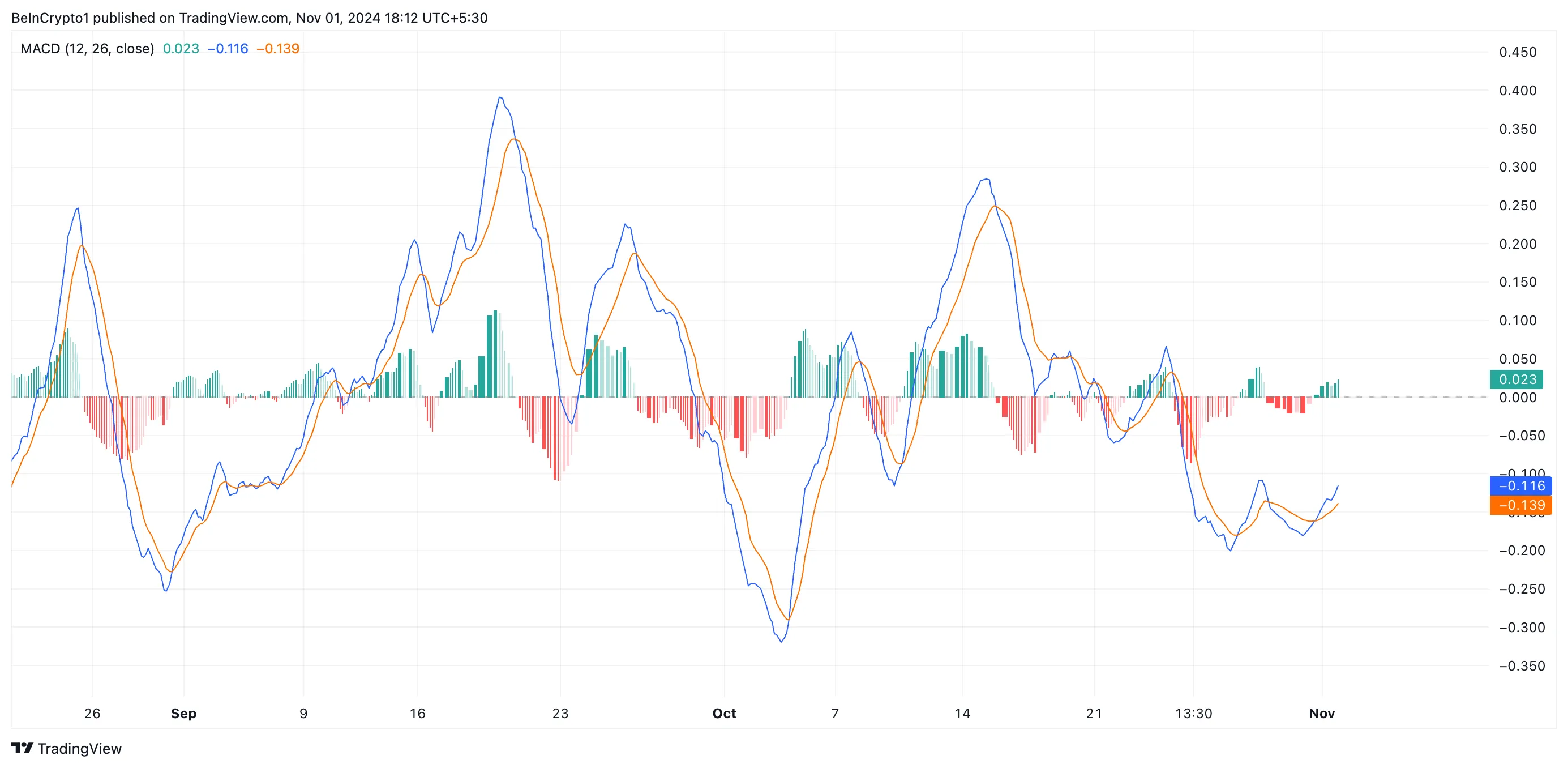

Moreover, TIA’s moving average convergence/divergence (MACD), which measures an asset’s price trends and momentum and identifies its potential buy or sell signals, confirms this bullish outlook.

At the time of writing, the coin’s MACD line (blue) is positioned above both the signal line (orange) and the zero line. This setup indicates a bullish trend, reflecting the upward momentum in the TIA’s price following the Celestia token unlock event.

TIA Price Prediction: Four-Month High Is on the Horizon

At the time of writing, TIA is trading at $4.83. Continued buying pressure could sustain its upward trend, pushing the price toward the $6.45 resistance. A successful breakout at this level could pave the way for TIA to reach a four-month high of $7.85.

Read more: Top 9 Safest Crypto Exchanges in 2024

Conversely, if selling pressure intensifies, TIA’s price may face downward momentum. Its price may potentially drop toward $3.75, its lowest level since September 7.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/celestia-token-unlock-price-rise/

2024-11-01 17:00:00