Many large-cap cryptocurrencies are up today, with Chainlink (LINK) seeing one of the biggest gains. Trailing only behind Polygon (MATIC), LINK’s price increased by 10% in the last 24 hours.

Despite the rise, the altcoin could be on the brink of retracement, and here is why.

Indicators Hint at Potential Chainlink Decline

LINK price aligns with BeInCrypto’s recent prediction of an increase beyond $11. However, data obtained from CryptoQuant suggest that the upswing could be short-lived.

The altcoin’s reserve on exchanges has reached its highest level since August 4. This metric tracks the total value of cryptocurrencies held across all exchanges. Typically, an increase signals potential selling pressure.

When long-term holders plan to keep a token, they usually move it off exchanges. On the other hand, when reserves decline, it suggests holders are removing tokens, which can reduce sell pressure and support price growth. In Chainlink’s case, the increase in reserves suggests more tokens are returning to exchanges, reinforcing the idea that maintaining the current uptrend could be difficult.

Read more: What Is Chainlink (LINK)?

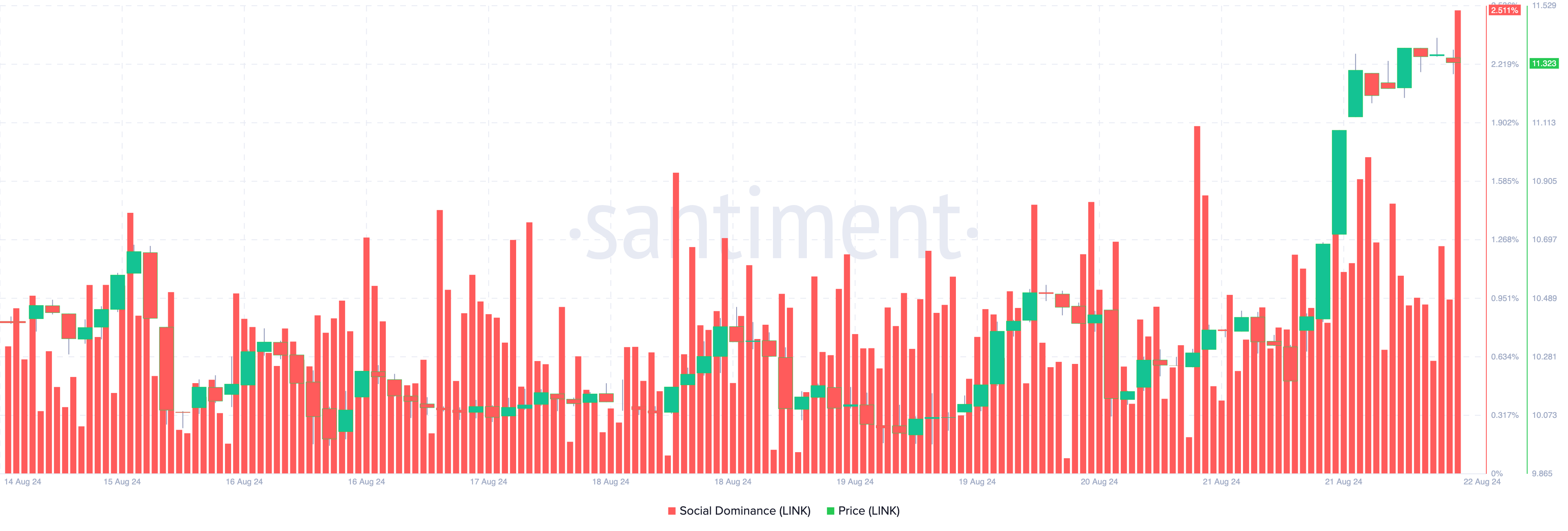

According to Santiment’s social dominance data, the recent performance of the cryptocurrency has captured broader market attention, diverting focus from other assets. Social dominance measures how frequently a project is discussed relative to others in the top 100. Historically, when mentions increase, there is often a correlation with price movements.

Typically, a rise in social dominance leads to higher prices. However, if the metric becomes excessively high, it can signal a potential price peak. This usually indicates a surge in Fear of Missing Out (FOMO), where traders rush in to buy after notable gains, even as the asset might be nearing a local top.

As such, if the pattern repeats itself, LINK price could erase some of its recently-made gains.

LINK Price Prediction: Reversal on the Horizon

On the daily chart, LINK has formed a bearish pennant, which could signal a pause in the current uptrend. A bearish pennant typically appears when three trendlines converge: the flagpole (resulting from an initial downtrend) and two lines representing resistance during consolidation and support at lower values.

Given the current market FOMO, a bearish pennant might lead to a breakdown below this pattern. If confirmed, LINK’s price could fall below $10, potentially sliding to $9.95. However, this scenario may be avoided if buying pressure intensifies, invalidating the bearish outlook and keeping the uptrend intact.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

If LINK’s price breaks out of the bearish pennant instead of breaking down, it could target the next resistance level around $13.10. A successful move would shift the market sentiment, potentially driving further buying activity and invalidating the bearish pattern.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/chainlink-link-price-up-yet-pullback-close/

2024-08-22 18:00:00