As the crypto market prepares for its traditional “Uptober” rally, market participants are closely watching whales movements. These large holders are known for their accumulation patterns, which serve as early indicators of potential price increase.

So, what are these whales accumulating ahead of October?

The Whales Are Interested In the Big Boys

In an exclusive interview with BeinCrypto, Juan Pellicer, Senior Researcher at on-chain analytics firm IntoTheBlock, noted that as October approaches, crypto whales are maintaining their focus on assets with larger market capitalization.

“This trend aligns with the current cycle, which seems to be driven primarily by institutional demand. These institutional players typically gravitate towards more established, liquid assets in the crypto space,” Pellicer said.

Leading altcoin, Ethereum (ETH), is one of the assets that these large holders are accumulating ahead of October. According to Santiment’s data, there has been a notable rise in ETH accumulation by wallet addresses holding between 10 million and 100 million ETH. Over the past 26 days, this group has added 910,000 ETH to their holdings, valued above $2.40 billion at market prices.

Dogecoin Puts Holders in Profit

Another coin with a large market capitalization that crypto whales are accumulating ahead of October is leading meme coin Dogecoin (DOGE). This has been fueled by the coin’s 24% price growth over the past month. As of this writing, the meme coin trades at $0.12, its highest price level since August 2.

DOGE whale activity, tracked through the netflow of its large holders, reveals that investors holding more than 0.1% of the coin’s circulating supply have been increasing their holdings. In the past week alone, the net flow among DOGE’s large holders has surged by an impressive 134%.

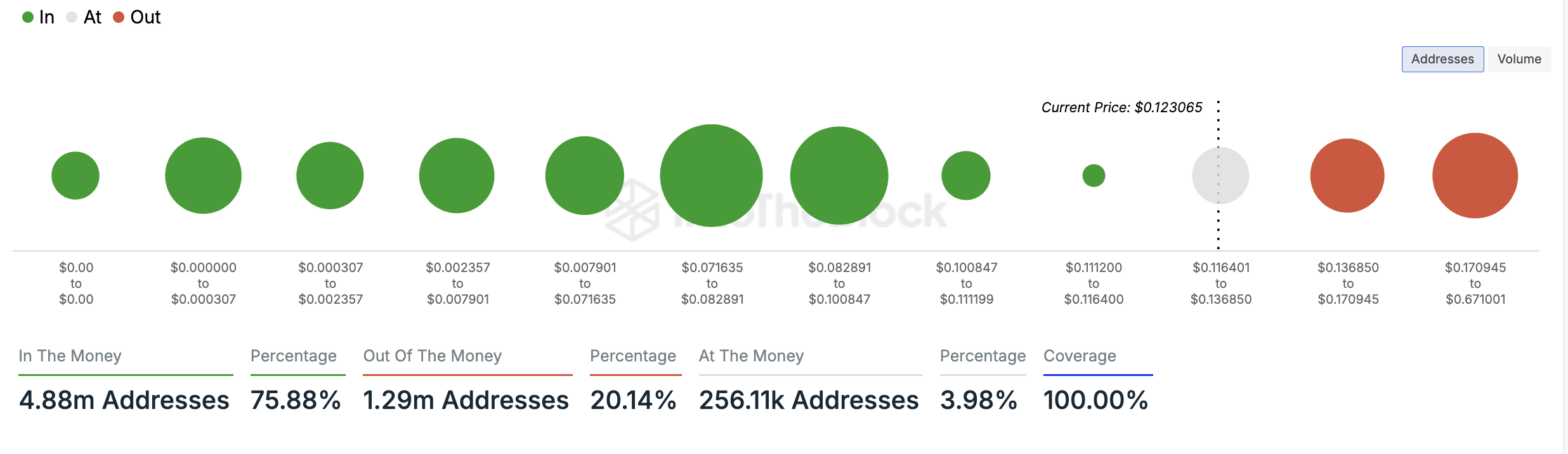

Apart from DOGE’s price rally, the fact that most of its holders are in profit may be another reason why its whales have continued to fill their bags. An assessment of DOGE’s Global In/Out of the Money shows that 76% of all the meme coin holders are in profit. Conversely, only 20% of total coin holders are at a loss.

Toncoin Sees Rise in Large Transactions

Telegram-linked Toncoin (TON) is another asset that has caught the attention of crypto whales. The daily count of large transactions involving the altcoin has skyrocketed over the past month.

According to data from IntoTheBlock, the number of TON transactions valued between $1 million and $10 million has skyrocketed by 179% in the last 30 days. Similarly, larger transactions exceeding $10 million have seen an impressive increase of 83% during the same period.

Read more: What Are Telegram Bot Coins?

The rise in an asset’s large transaction count is a bullish signal. When retail investors observe large holders increasing their trading activity, it often boosts their confidence, leading to more buying activity and sustained price growth.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/what-crypto-whales-are-buying-for-october-gains/

2024-09-27 15:00:00