Dogecoin (DOGE) recently broke above a falling wedge pattern, which it had been trading within for several months. This type of breakout typically signals a potential upside reversal, hinting at a continued rally.

When a falling wedge resolves, the price often rises by the maximum distance between the upper and lower trendlines. For Dogecoin, this could suggest a significant price surge of up to 72%. Should meme coin holders anticipate such a rally?

Dogecoin Holders Remain Optimistic

Dogecoin’s positive funding rate highlights growing optimism among its holders about its potential for a sustained rally. Trading at $0.11 at the time of writing, the meme coin has seen its price surge by over 10% in the past week.

Since September 17, the coin has posted only positive funding rate, indicating the persistent demand for long positions. This is a bullish signal because it creates a self-reinforcing cycle in which more traders enter the market because they believe the coin’s price will grow — a sentiment that ultimately propels prices even higher. At press time, the meme coin’s funding rate is 0.01%.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

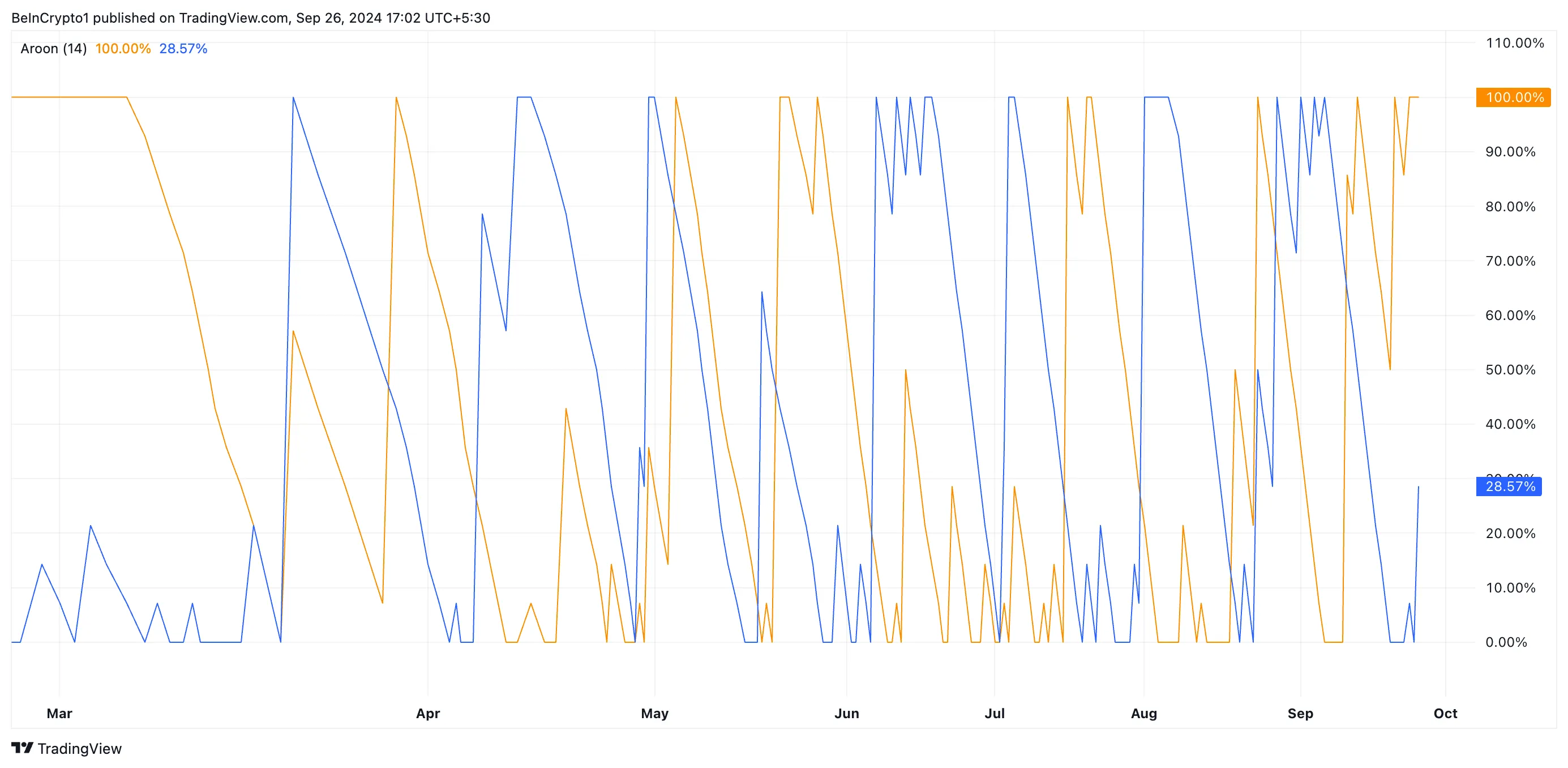

Dogecoin’s Aroon indicator, which measures trend strength, supports the possibility of a continued rally. The Aroon Up Line, currently at 100%, signals that DOGE is in a strong uptrend, with buying pressure keeping prices near recent highs.

Traders view a 100% reading as a sign that the upward trend could persist, especially when the Aroon Down Line is low. As of now, DOGE’s Aroon Down Line stands at 28.57%, indicating a lack of recent lows and reinforcing the strength of the current uptrend.

DOGE Price Prediction: Coin Must Break Key Resistance First

As stated above, a breakout above a falling wedge pattern typically sees the asset’s price rise by the maximum distance between the upper and lower trendlines. In DOGE’s case, this suggests a potential 72% surge, bringing its price to $0.19.

However, for this rally to occur, DOGE must first break through a key resistance level at $0.15. Successfully retesting this level could clear the path for the price to reach $0.19.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/20

On the flip side, if profit-taking increases and demand for DOGE weakens, the price could retest the upper boundary of the falling wedge. Should this level fail to hold as support, Dogecoin’s price may drop to $0.08.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/two-reasons-dogecoin-price-could-surge/

2024-09-26 15:34:52