Leading altcoin Ethereum (ETH) is witnessing a resurgence in bullish sentiment. This comes at a time when Bitcoin’s (BTC) dominance is weakening, suggesting that investors are shifting their focus toward ETH and other altcoins.

As ETH accumulation steadies, the coin could be setting the stage for trading above $2,900.

Ethereum Leads, Bitcoin Follows

Ethereum has surged 13% over the past week, outperforming Bitcoin, which has risen by just 6% during the same period. The ETH/BTC ratio has also continued its upward trend, increasing by 33% over the last seven days, indicating a growing preference for Ethereum over Bitcoin. As of this writing, the ETH/BTC ratio stands at 0.04.

Read more: Ethereum Restaking: What Is it and How Does it Work?

The ETH/BTC ratio gauges Ethereum’s strength relative to Bitcoin. A rising ratio indicates that ETH is outperforming BTC, signaling growing bullishness toward Ethereum.

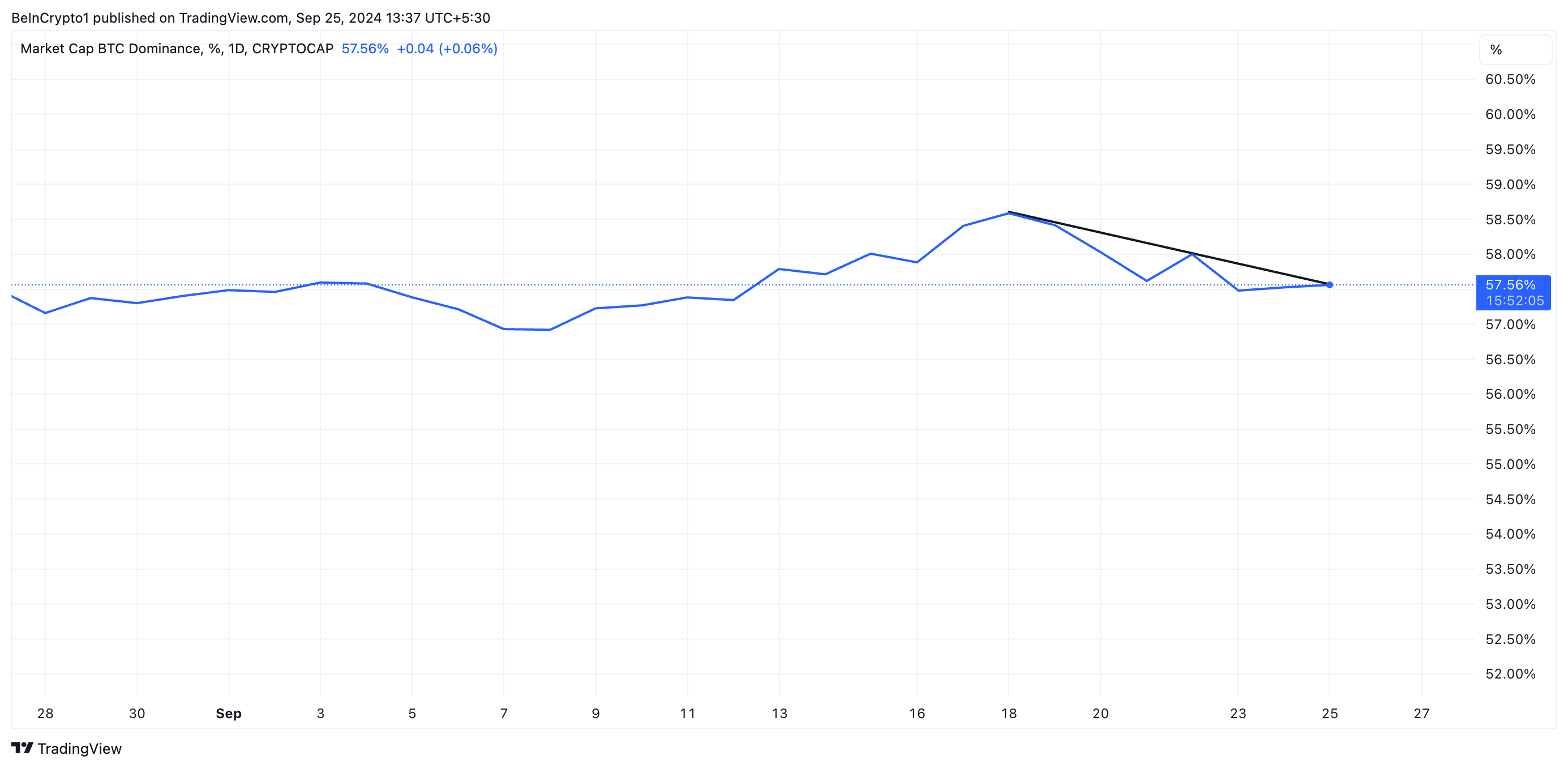

This spike in the ETH/BTC ratio coincides with a drop in Bitcoin dominance (BTC.D), which measures Bitcoin’s market capitalization as a percentage of the entire cryptocurrency market. Currently at 57.56%, BTC.D has fallen by 0.01% over the past week. A decline in Bitcoin dominance often points to increasing interest in altcoins, as demonstrated by the upward trend in the ETH/BTC ratio.

The recent surge in Ethereum’s value has been partly driven by increased activity among large holders, or whales. On-chain data reveals a steady rise in significant transactions involving ETH over the past month.

For instance, the number of ETH transactions valued between $1 million and $10 million has grown by 14% over the last 30 days, while those above $10 million have surged by 21% during the same period.

An increase in large transactions often signals bullish momentum. When retail investors observe heightened activity among whales, it tends to boost their confidence, leading to more buying and contributing to sustained price growth.

ETH Price Prediction: The Bulls Have Control

Ethereum’s Directional Movement Index (DMI) supports the bullish outlook highlighted above. The coin’s DMI, which measures its price trends and direction, shows the positive directional indicator (blue) resting above the negative directional indicator (red) at press time.

This setup indicates that buying pressure is stronger than selling activity among ETH market participants.

Read more: How To Buy Ethereum (ETH) With a Credit Card: Complete Guide

If demand continues to grow, Ethereum could break through the resistance at $2,871, potentially pushing its price above $2,900 and toward $3,104. However, if accumulation slows and profit-taking increases, ETH’s price might drop to the support level of $2,582 or lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ethereum-rising-eth-btc-ratio/

2024-09-25 09:58:50