Artificial Superintelligence Alliance (FET) has been on a downward trend since September 25, losing 9% of its value. While the dip might appeal to investors seeking buying opportunities, the token’s technical setup indicates a potential further decline of up to 50%.

This analysis highlights what investors looking to trade against the market need to take note of.

Artificial Superintelligence Alliance Is Undervalued, But There Is a Catch

An assessment of FET’s market value to realized value (MVRV) ratio, which measures the overall profitability of all its holders, shows that it has turned negative. As of this writing, the token’s 7-day and 30-day MVRV ratios are -51.03 and -10.81, respectively.

When an asset’s MVRV ratio is negative, it trades at a value below the average price at which most investors acquired the asset. As such, if all its holders sold their tokens at the current market price, they would collectively realize a loss.

Further, it also indicates that the asset is undervalued, presenting a buying opportunity for traders looking to buy low and sell high. Historically, a negative MVRV signals that the asset is traded below its historical acquisition cost and may be due for a rebound.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

However, while readings from FET’s MVRV ratio flash a buying opportunity, traders who heed the signal may record losses as its technical setup hints at the possibility of an extended decline.

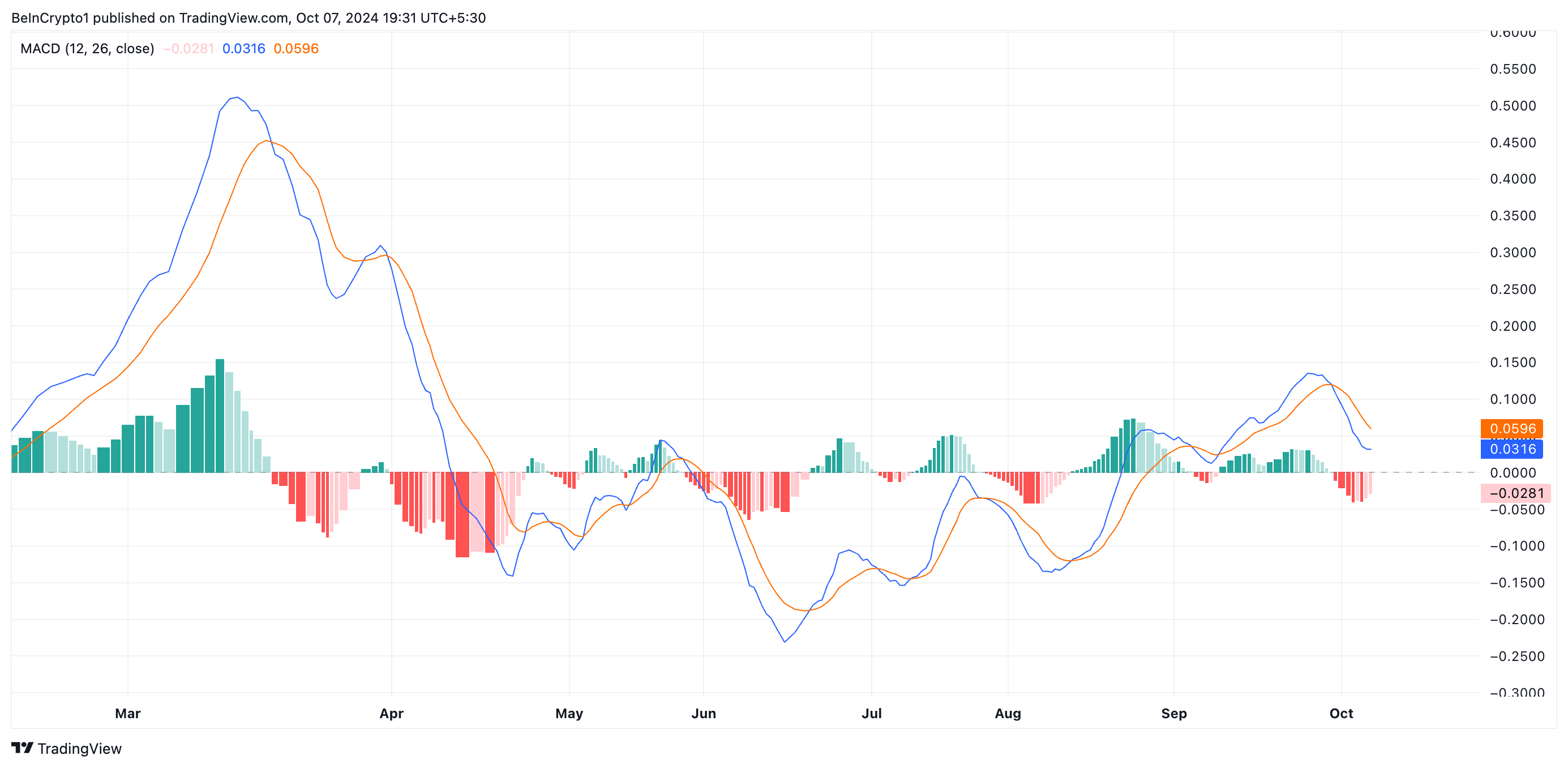

FET’s moving average convergence/divergence (MACD) indicator, assessed on a one-day chart, signals a strengthening selling pressure. As of this writing, the indicator’s MACD line (blue) is below its signal line (orange) and poised to breach its zero line.

The MACD line crossing below the signal line suggests the current downward price movement is gaining momentum. It implies that there is increasing selling pressure in the market.

FET Price Prediction: Downtrend Is Strong

FET’s Aroon Down Line, which measures the strength of its downtrend, confirms that its price decline is gaining momentum. As of this writing, this stands at 71.43%.

A reading near 100% for the Aroon Down line suggests that the price has been making consistent lower highs and is in a strong downtrend. If this downtrend continues, FET’s price may fall by 53% to trade at its August 5 low of $0.70.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

However, if it sees a spike in buying volume, FET’s price may witness a rebound and rally toward $2.42.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/fet-price-may-decline/

2024-10-07 20:00:00