Artificial Superintelligence Alliance (FET) is one of the top gainers today, registering a 10% increase within the last 24 hours. This FET recovery contradicts its performance in October, when its price decreased by 13.39%.

Following this rebound, on-chain data shows that the altcoin could be working toward wiping out those losses. Here is how.

Artificial Superintelligence Alliance Sees Buying Pressure

Yesterday, FET’s price was $1.10. But as of this writing, the altcoin’s value has risen to $1.25. According to the 4-hour chart, FET’s price climbed this high due to rising buying pressure.

Notably, Bull Bear Power (BBP) has jumped to the positive region after remaining in the red area since November 1. The BBP shows whether the strength of buyers is greater than that of sellers.

When the reading is negative, bears have the upper hand. Therefore, in this instance, bulls are in control. As such, the altcoin’s value could continue to climb if this remains the same.

Read more: How to Invest in Artificial Intelligence (AI) Cryptocurrencies?

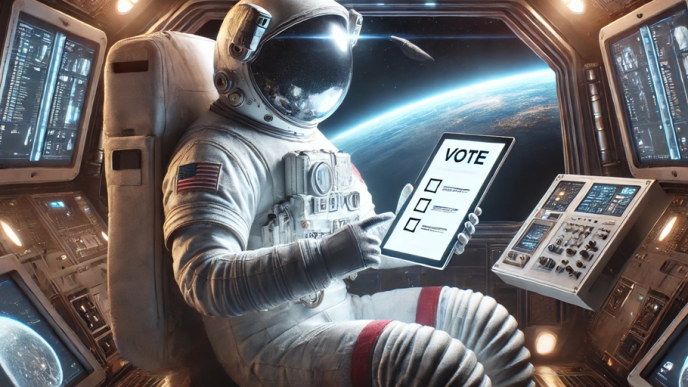

The Money Flow Index (MFI) is another indicator suggesting that the FET recovery could be swift. The MFI, which measures buying and selling pressure by analyzing price and volume data, has shown a positive trend for FET.

A rising MFI indicates increased buying pressure, which supports the likelihood of continued price growth as demand for the asset strengthens. Therefore, if bulls sustain this momentum, then the altcoin’s price might continue to rise.

FET Price Prediction: Token to Breach Resistance

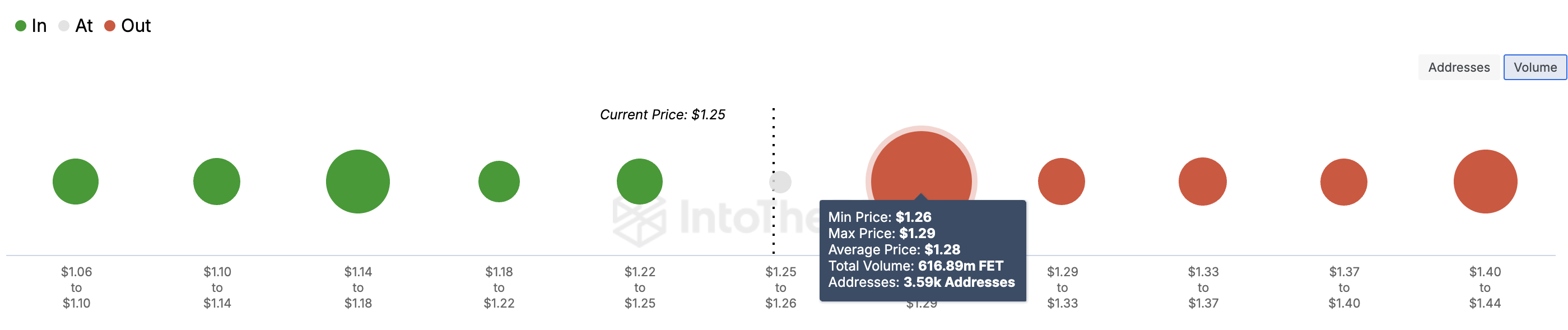

Since the IOMAP indicates that there is only one significant resistance level for FET at $1.28, where 3,590 addresses hold 616.89 million tokens, it suggests that surpassing this level could open up further upside potential.

Notably, the IOMAP tool categorizes addresses by whether they are making a profit, breaking even, or incurring losses at the current price

This accumulation zone acts as a key psychological barrier. The volume of tokens accumulated here is notably higher than the amounts held between $1.06 and $1.25, signaling that if buyers manage to push the price beyond $1.28, FET could gain strong momentum.

Read more: Which Are the Best Altcoins To Invest in November 2024?

Therefore, if buying pressure continues to increase, FET could rally all the way to $1.44. However, if bulls fail to breach the resistance, the altcoin price might pull back, and FET could drop to $1.10.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/fet-recovery-ongoing/

2024-11-05 23:00:00