Cardano (ADA) price has seen a lack of bullish momentum in recent days, leaving its future trajectory uncertain. Despite hopes for a rally, ADA has struggled to break free from its current consolidation range.

The coming days are expected to continue this pattern, as Cardano faces mixed signals from key indicators. ADA’s price outlook appears bleak without significant catalysts, raising concerns among investors.

Cardano Investors Slow Down

Cardano’s correlation to Bitcoin has been dropping sharply, a development that has caught the attention of the market. Currently, the correlation stands at 0.35, marking the lowest level in more than two and a half months.

A lower correlation with Bitcoin means that Cardano is less likely to mirror BTC’s price movements. Given Bitcoin’s proximity to breaching the $68,000 mark, Cardano’s weakened correlation suggests that ADA may not experience the same level of growth, limiting its upside potential.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

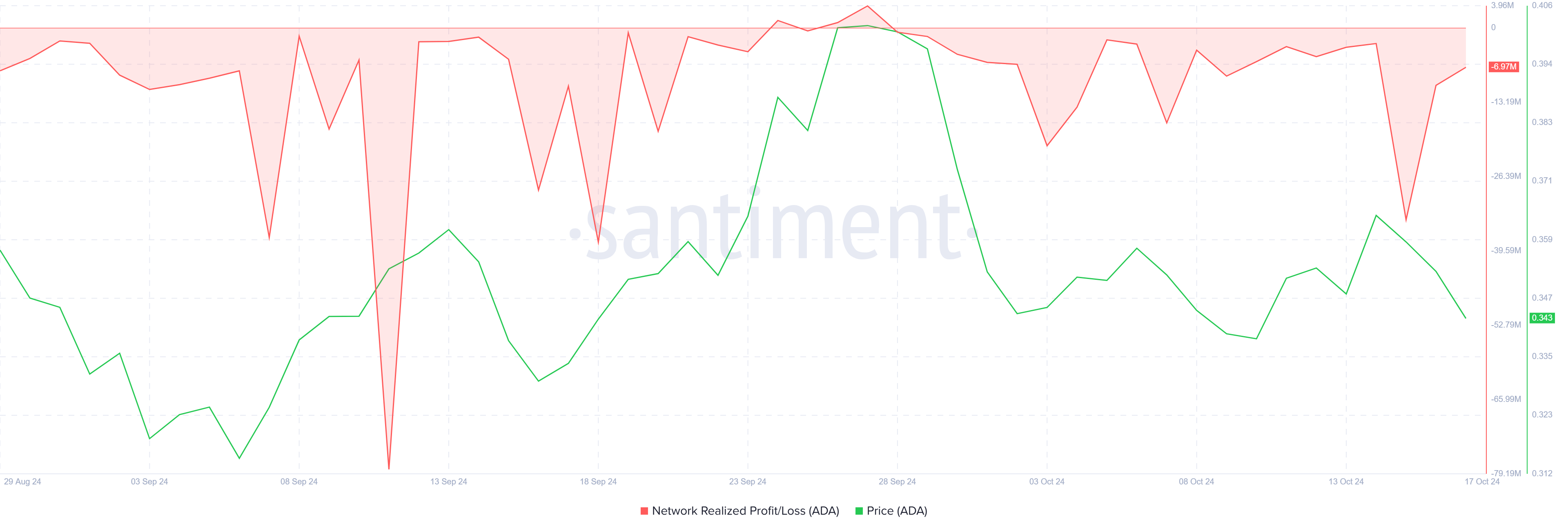

Cardano’s macro momentum is equally concerning. The realized profits/loss indicator currently shows that most ADA holders are experiencing losses. As a result, investors are less inclined to sell their holdings, preferring to hold onto their assets until prices recover. This “HODL” mentality suggests that selling pressure is low, but it also means that ADA does not see significant buying activity.

The lack of realized profits has led to a stagnant market environment for Cardano. ADA is unlikely to break out of its current range without fresh capital inflows or a change in sentiment.

ADA Price Prediction: Remaining Rangebound

Cardano’s price has been oscillating between $0.37 and $0.33 since the beginning of October. This consolidation is likely to continue as market forces remain balanced. Investors should expect ADA to stay within this range for the foreseeable future unless a major event shifts the market dynamic.

The mixed signals from Cardano’s macro indicators make it difficult to predict a clear path forward. While a bounce off the $0.33 support level is likely, a breach of the $0.37 resistance remains uncertain. This range-bound movement highlights the challenges facing Cardano’s price action.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

It could provide a clearer direction if Cardano breaches either of these levels. A breakout above $0.37 could push the price toward $0.40, while a fall below $0.33 would likely lead to a drawdown to $0.31.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-faces-uncertainty/

2024-10-18 07:54:48