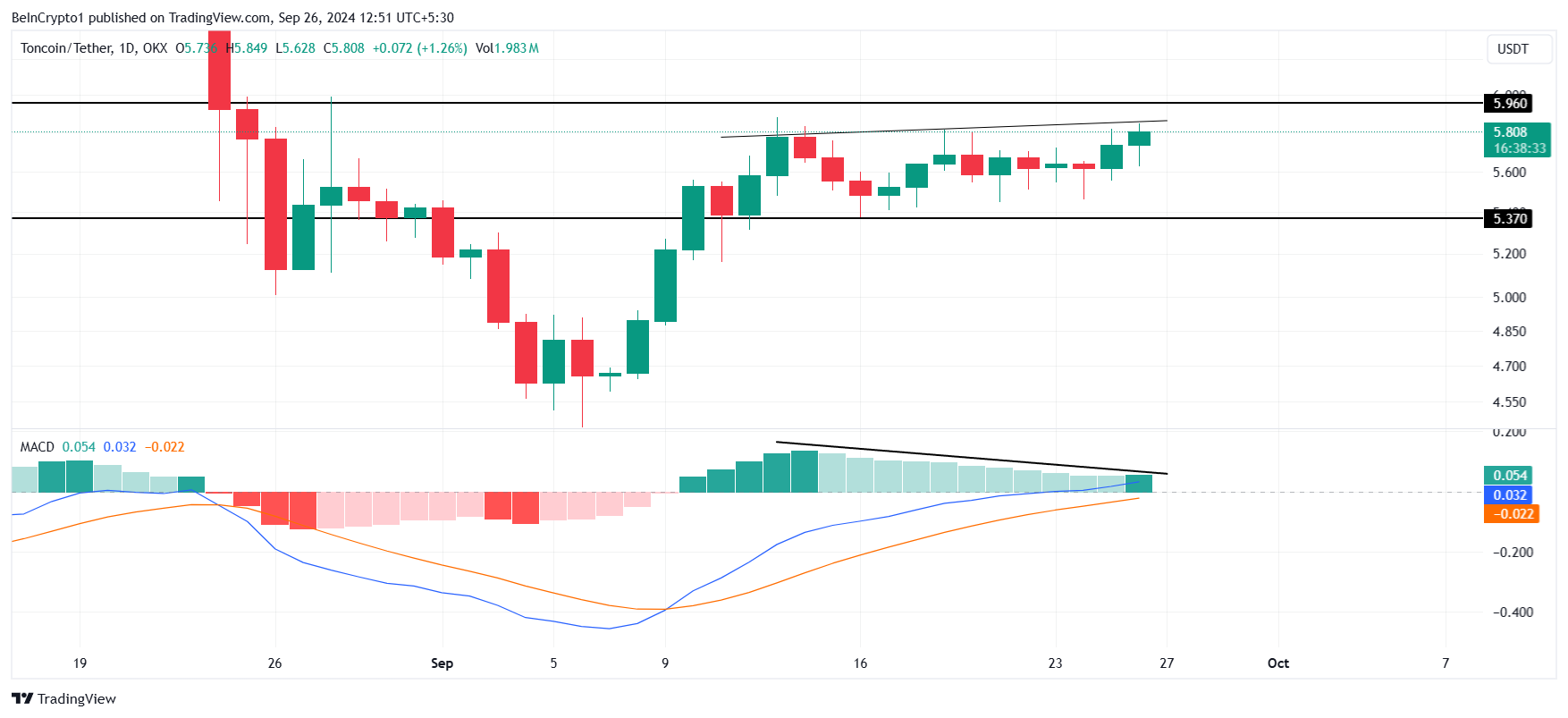

Toncoin’s price has been consolidating between $5.96 and $5.37, unaffected by broader market cues. While a breakout from this consolidation is possible, technical indicators suggest otherwise.

As Toncoin remains steady within this range, the potential for a correction looms large. Despite recent price action showing slight gains, a closer look at the technicals paints a different picture.

Toncoin Is Looking at a Drop

Long-term holders (LTH) of Toncoin have shown strong confidence by holding onto their assets without much movement over the past month. This is further confirmed by an uptick in the Mean Coin Age (MCA), a measure of how long coins have been sitting in the same wallet. A rise in the MCA generally reflects increased confidence among holders, as they are choosing not to sell, even amid market fluctuations.

However, Toncoin’s history shows that an uptick in MCA often precedes a decline in price. The lack of movement from long-term holders could indicate weakening momentum, a common precursor to price corrections. If this trend continues, we could see a repeat of previous price declines, making Toncoin vulnerable to a correction in the near term.

Read more: What Are Telegram Bot Coins?

Looking at the macro momentum, technical indicators are signaling a potential downturn for Toncoin. The Moving Average Convergence Divergence (MACD) is nearing a double-top divergence, which often signals an impending reversal. This pattern, coupled with the higher high forming in price, suggests that bullish momentum may soon reach its peak.

A test of the $5.96 resistance level would confirm this double-top formation. If the token fails to break through this level, it would further support the bearish outlook. The divergence between price action and the MACD indicator points to a likely correction in the coming days, with the risk of a sharp decline growing stronger.

TON Price Prediction: Following the Pattern

Toncoin is currently trading at $5.80, hovering close to the $5.96 resistance. While it may test this barrier, breaking through is unlikely, given the current technical setup. A rejection at this level could lead to a drawdown, bringing Toncoin back to the $5.37 support zone.

Although a correction seems imminent, Toncoin may be able to hold above $5.37 if bearish cues do not intensify. However, should bearish momentum increase, a drop to $4.86 could be on the horizon. The market will be closely watching how Toncoin reacts to these critical levels.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

On the flip side, if optimism surrounding the start of Q4 prevails, Toncoin might break out of its current consolidation range. A breach of $5.96 could push the token toward $6.36, potentially invalidating the bearish scenario. In this case, a bullish rally could emerge, providing new opportunities for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/toncoin-potential-price-correction-ahead/

2024-09-26 08:30:00