JUP, the native token of the Solana-based decentralized exchange Jupiter, has been on a tear in the past few weeks. It currently trades at $1.01, surging by 25% over the past month.

BeInCrypto’s assessment of its technical and on-chain setup suggests the possibility of an extended rally. This analysis highlights the price targets that JUP holders need to look out for.

Jupiter Prints Green

JUP’s double-digit rally in the past month has pushed its price above the Ichimoku Cloud, a key indicator used to track the momentum of an asset’s market trends and identify potential support/resistance levels.

When an asset’s price remains above the cloud, it signals a strong bullish trend, showing that buyers are in control and market sentiment is positive. JUP’s price has stayed above the cloud on the daily chart since October 18, indicating potential support levels.

Read more: 11 Top Solana Meme Coins to Watch in October 2024

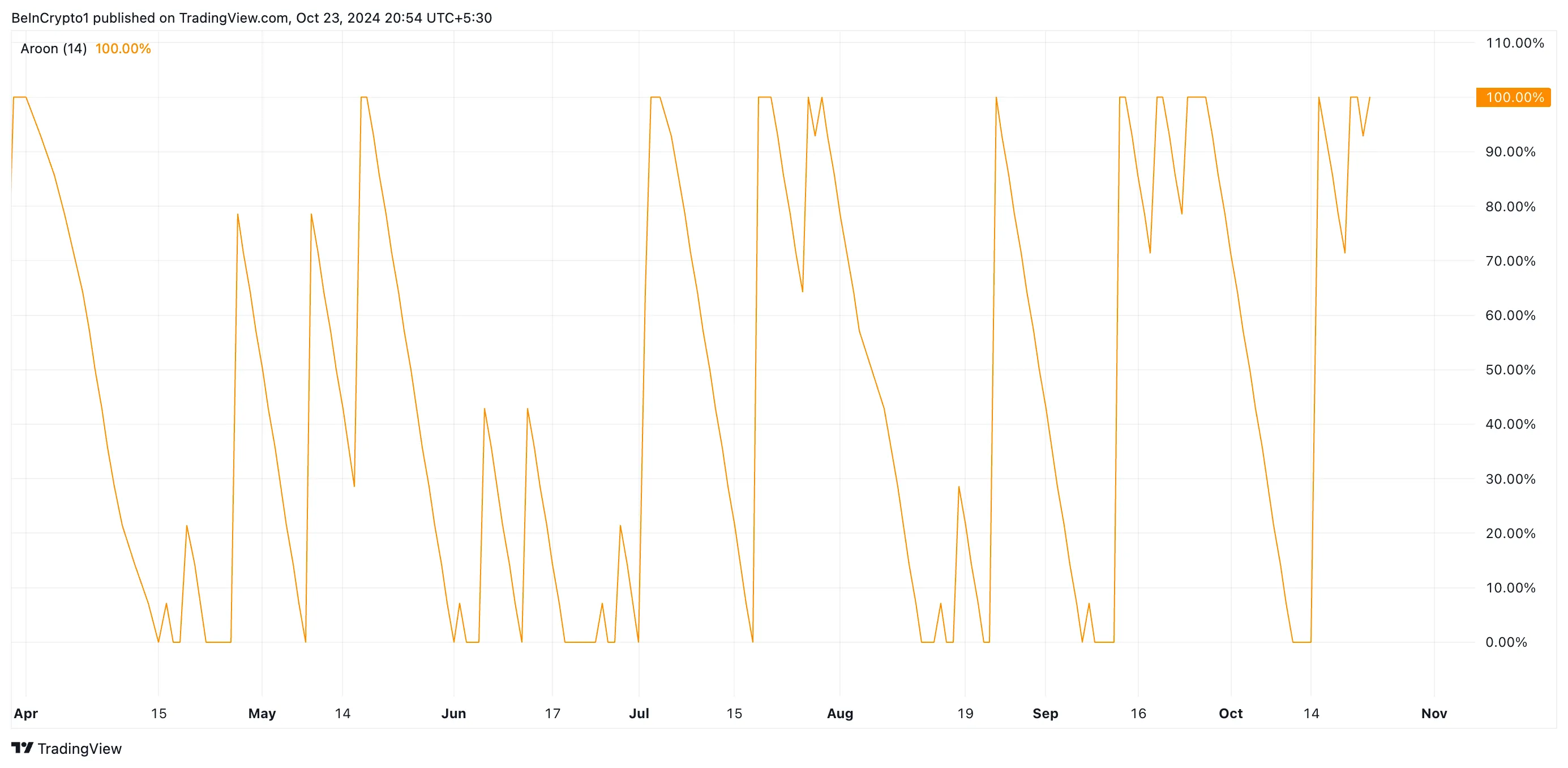

This suggests that, despite minor pullbacks, the token’s price is likely to find support near the cloud, maintaining the uptrend. Furthermore, JUP’s Aroon Up Line is at 100%, confirming the strength of its current uptrend.

The Aroon indicator measures the direction and momentum of a trend, and a 100% reading on the Up Line suggests the asset has recently hit a new high. For JUP, this marks its highest price point in 30 days.

This 100% reading is a strong bullish signal, indicating solid upward momentum. Traders interpret it as confirmation that buyers dominate the market, making further price increases likely in the near future.

JUP Price Prediction: Buying Pressure Needed To Sustain Rally

As of this writing, JUP is trading at $1.01, approaching the key resistance level of $1.09. If buying pressure continues, JUP could break above this resistance and aim for the next critical barrier at $1.23. A successful breakout would set its sights on the six-month high of $1.38.

Read more: Solana ETF Explained: What It Is and How It Works

However, if profit-taking occurs, JUP may lose its recent gains, dropping toward the support levels within its Ichimoku Cloud at $0.90 and $0.86. A breach of these supports could send the altcoin tumbling to its July 5 low of $0.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/jup-price-climbs-to-monthly-high/

2024-10-24 07:30:00