Meme coins as a phenomenon have grown dramatically in the space this year, with 75% of all projects launched in 2024. Binance Research released an exclusive report analyzing this market trend.

The report takes a skeptical view on meme coins’ innovative capacity, but acknowledges their broad appeal and ability to foster community.

2024: Year of the Meme Coins

Binance Research has published a new report on the crypto industry, exclusively shared with BeInCrypto. Building on its existing track record of analyzing growth sectors in the space, the analysts conducted a comprehensive study on meme coins. Though meme coins have existed for a decade, beginning with Dogecoin, their popularity surged significantly in 2024.

Read more: What Are Meme Coins?

Essentially, in this report’s reckoning, meme coins are first and foremost the product of broader economic trends. Binance Research looked at several factors specific to the space, but kept returning to statistics like the global money supply and inflation rates. Above all, these assets exist in a climate of increasing precarity, and many users hope to cash out quickly.

“In many aspects, meme coins try to embody the fundamental principles of the cryptocurrency industry – fairness, transparency, decentralization. In other ways, they reveal a different side of the industry, demonstrating a distinct prioritization of financial profit and less focus on technological advancement,” the study claimed.

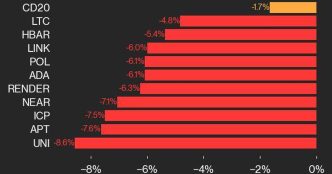

As a rule, meme coins have a reputation for high risk and huge short-term gains. Skilled blockchain developers have little incentive to join most projects; thus the majority of these coins do not meaningfully innovate. The rate of new tokens has risen astronomically, and 97% of them fail. What’s more, meme coins are a common vector for pump and dump schemes.

Nevertheless, these projects do have a unique appeal despite the downsides. Binance Research sums this appeal up in a word: community. Meme coins typically have a lower barrier to entry than other token projects, and grow quickly through word of mouth. Novice investors can join meme coin projects at their inception and feel a sense of participation and excitement.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Ultimately, though, the report falls on the side of meme coin skepticism. It wonders if their rise is caused by a sense of “financial nihilism” among younger generations, stating that meme coins will “inevitably lead to inefficiencies.” Still, in this industry of sophisticated technical ideas, it is important to offer narratives of belonging to inexperienced users.

“Valuable insights can be gleaned from the meme coin phenomenon, particularly in the areas of community building and fair token launches. The rise of meme coins is a compelling demonstration of blockchain technology’s capacity to unite individuals globally and foster organic communities around tokenized assets,” the report concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/meme-coins-binance-research-report/

2024-11-04 14:00:00