On Tuesday, Pepe’s (PEPE) price rose by 11% following its listing on South Korea’s largest cryptocurrency exchange, Upbit. This rally caused its price to break above a descending channel it has traded within since August 6.

Exchanging hands at $0.0000078 at press time, some of PEPE’s technical indicators suggest that the meme coin is primed for more growth.

Pepe is Ready for More

Following the general market downturn of August 5, PEPE has been in a downtrend that led to the formation of a descending channel. This bearish pattern appears when an asset’s price consistently moves lower, creating a series of lower highs and lower lows.

The upper line of the channel acts as resistance, currently at $0.0000090 for PEPE. Conversely, the lower line, set at $0.0000065, serves as support.

After listing on Upbit on Tuesday, PEPE’s double-digit rally briefly pushed it above resistance. Although it has since witnessed a pullback, the meme coin is attempting to retest resistance.

When an asset’s price breaks above a descending channel, it confirms the reversal of any downtrend in the market. It indicates that selling pressure is weakening and that buyers are gaining control.

In addition to seeking to break above the upper line of its descending channel, PEPE is also trending towards its 20-day exponential moving average (EMA), which measures the meme coin’s average trading price over the past 20 trading days.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

When an asset’s price nears this key moving average in an uptrend, it indicates a shift toward a bullish trend. It suggests that the short-term price momentum is turning positive, with recent prices seeking to trade higher than the average price over the past 20 days.

PEPE’s Price Prediction: a Buying Opportunity Abounds

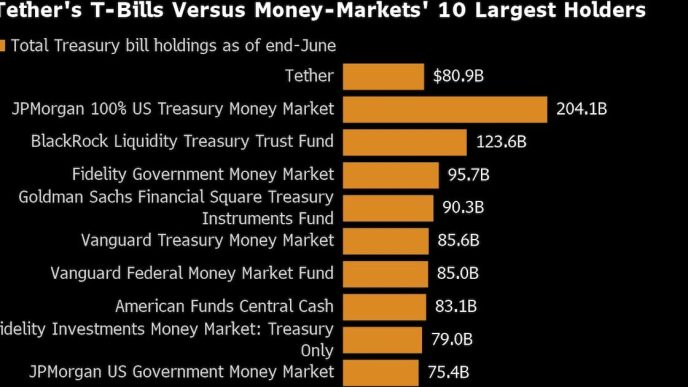

On-chain data suggests that PEPE remains undervalued and may be a good buy for those looking to gain from the potential rally. This is based on assessing the token’s market value to realized value (MVRV) ratio over different moving averages.

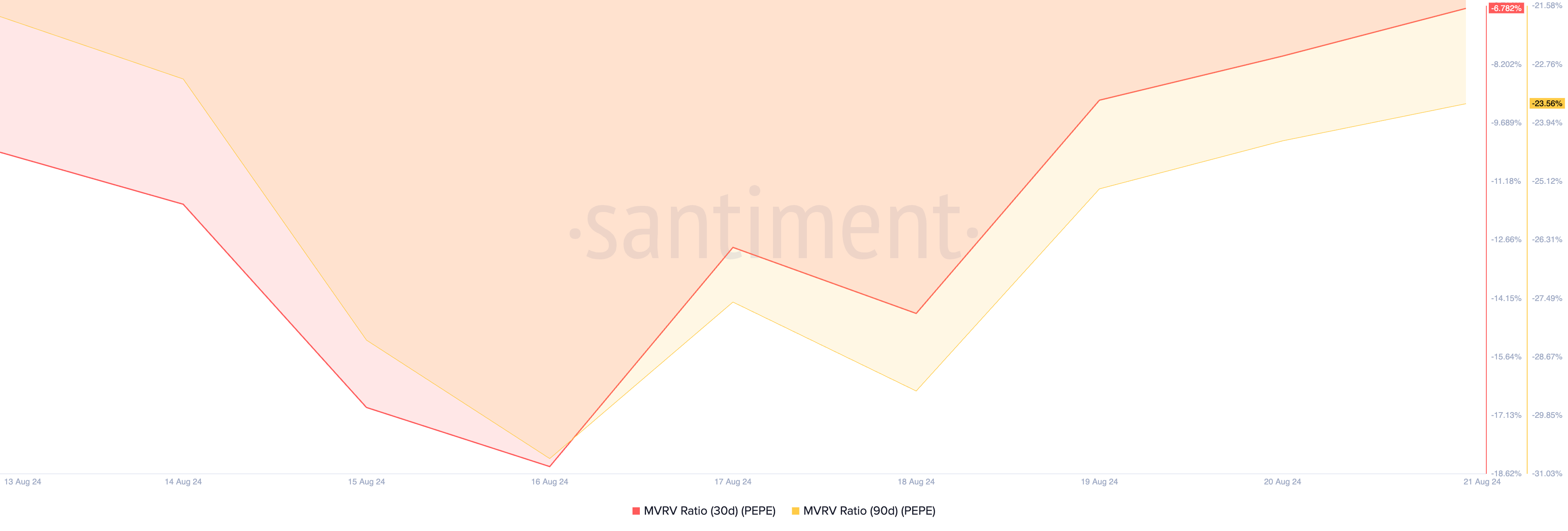

According to Santiment, the token’s 30-day and 90-day MVRV ratios are -6.94% and -23.71% respectively.

An asset’s MVRV measures the ratio between its current market price and the average price of its tokens in circulation. When its value is below zero, the asset is said to be undervalued.

An MVRV ratio below zero indicates the asset’s current price is lower than the acquisition cost of all its tokens in circulation. This presents an opportunity for buyers looking to “buy the dip.”

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

If PEPE continues its uptrend, its price could rally to $0.0000085, putting these new buyers in gains.

However, any uptick in profit-taking activity recorded at this point may send its price below support. If this happens, the meme coin may trade at $0.0000058.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pepe-breaks-above-descending-channel/

2024-08-21 13:00:00